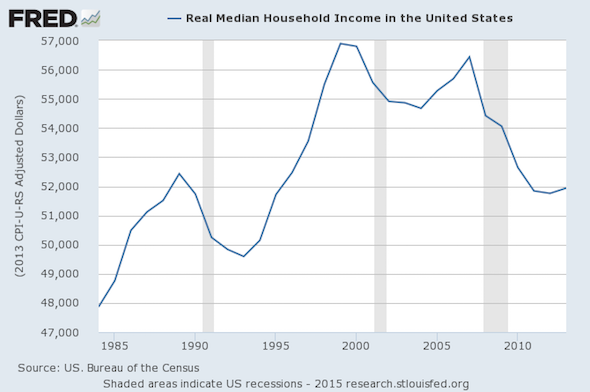

Thus far, the so-called economic recovery has done little to improve the lives of everyday Americans.

In yet another sign that the recovery is an illusion, figures released last week and reported by Reuters show American’s household income lost ground last year.

The data released by the U.S. Census Bureau on Wednesday, which showed the inflation-adjusted median income slipping to $53,657 last year from $54,462 in 2013, offered a reminder of the tepid nature of the economy’s recovery.”

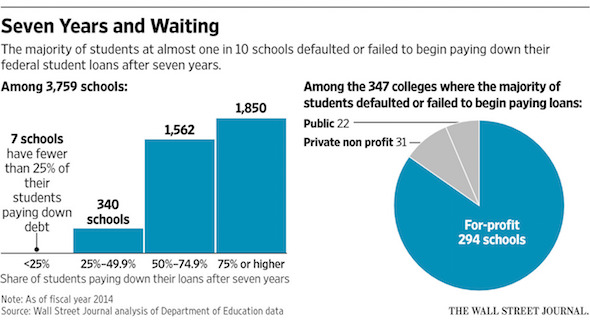

At the end of 2014, the New York Fed reported a surprisingly high delinquency rate for student loans – 11.3%. Now the latest data released by the White House reveals that number may in fact be dramatically higher. As the Wall Street Journal reports:

New figures covering more than 3,700 schools were released as part of the White House’s College Scorecard, which allows consumers to explore data about debt and degrees. The average repayment rate among almost 1,200 for-profit schools—meaning these students were actively paying off loans—was 61%, the lowest of any sector. The average repayment rate among all colleges was 73%.”

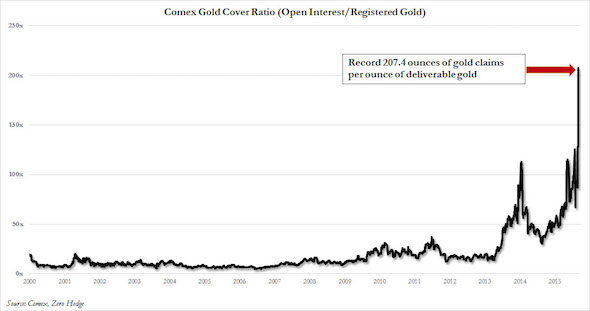

An apparent gold scam recently uncovered in Austin, Texas, serves as reminder for investors to use caution when dealing with small, unknown companies.

According to the Austin American-Statesman, the vaults belonging to an Austin company claiming to store millions of dollars in precious metals for its customers turned up virtually empty.

The latest update from CME Group shows a huge outflow of gold held for delivery by Comex. There are now less than 6 tons of registered physical gold available for delivery. For every 207 ounces of gold claimed by paper contracts on the Comex market, there is only one ounce of physical gold in Comex vaults. This is the lowest “coverage” ratio in the history of the Comex.

The world’s two leading consumers of gold continue to demand more. Gold imports spiked in India in August, building on a year-long trend, as gold also continued to flow into China.

According to the Times of India, 15.78 metric tons of gold were imported into India last month. That compares to 7.2 tons of gold imported in the same period in 2014, an increase of 119%.

This wasn’t a one-month anomaly, but continued a year-long trend of increased gold imports into the country. According to Business Standard, gold imports in the first eight months of this year are estimated to be 40% higher than last year. Analysts predicted, “By December 2015, the total imports will touch 1000 tons.”

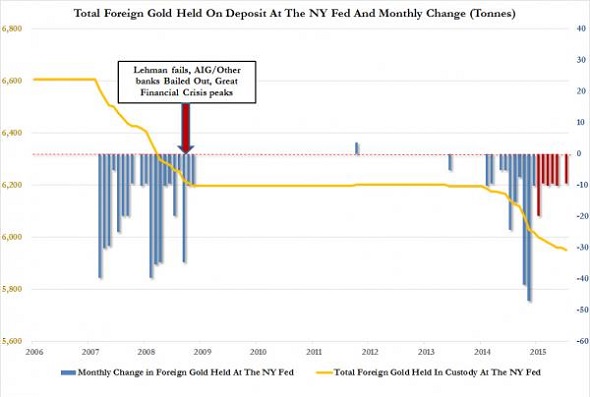

Foreign central banks want their gold back and they are pulling it out of Federal Reserve bank vaults.

According to a recent Federal Reserve report on its foreign official assets, physical gold holdings fell 9.6 tons last month to 5,950 tons. Total foreign physical gold held by the Fed now sits at just over $8 billion, down more than $67 million since January. If that figure sounds low to you, it is. Since 1973, the Fed has valued its gold based upon a statutory $42.22 price per ounce.

Federal Reserve foreign gold holdings dropped every month this year except June, when they held steady. Put in broader perspective, foreign central banks have withdrawn 192 tons of gold over the past year, and 246 tons since the January 2014.

This reflects a continuing trend of foreign gold repatriation.

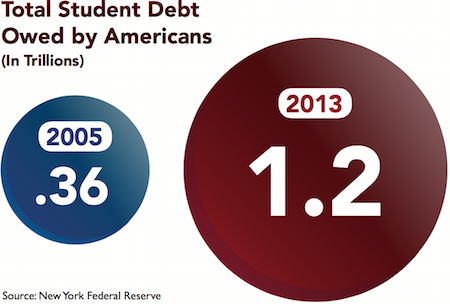

This article accompanies SchiffGold’s newly released white paper, The Student Loan Bubble: Gambling with America’s Future. To learn more about the shocking student debt bubble, click here for a free download.

“You need a college degree to succeed in America.” This idea has become so commonplace that the right to higher education is now a core issue in most political platforms. What if a young person cannot afford a college degree? The “obvious” answer from politicians on both sides of the aisle is that the government should subsidize them. Very few are brave enough to ask the far more important question: “At what cost?”

The answer is simple: as of today, the cost is $1.2 trillion. That is the current level of student loan debt in the United States, which represents the second largest category of consumer debt after home mortgages. It has grown by leaps and bounds since the financial crisis of 2008 and now surpasses even car loans and credit card debt.

The American Dream used to be simple: the ability to shape one’s own destiny and wealth without interference from the king, the government, or other powerful interests – the right to “life, liberty, and property.” Over generations, this dream has been coopted by politicians and bankers to gather votes and riches. In the 20th century, the idea of owning a home became an integral part of the Dream, which led to the disastrous idea that even unqualified borrowers deserve the opportunity to buy a house. We are all familiar with the fallout – the subprime mortgage crisis and ultimately the Great Recession.

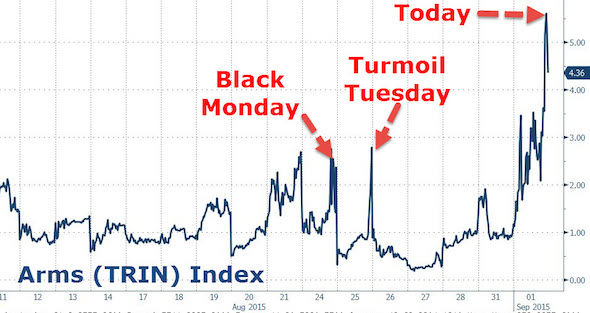

Yesterday, the Arms Index (TRIN) spiked dramatically to levels not seen since 2011 and nearly twice as high as last week’s “Black Monday.” The Arms Index is a way of measuring how balanced the stock market is, with higher values suggesting the market might head in a bearish direction sooner than later. As ZeroHedge describes it:

A sudden surge in the TRIN indicates a jump in trader lack of confidence, as everyone scrambles to either go long the 2-3 rising stocks, or to sell or short the biggest decliners, ignoring the bulk of the market.

Of course, the Arms Index is a purely technical indicator that stock speculators watch closely, but it coincides with a growing mountain of data pointing to frightening volatility in American stocks and major cracks in the rosy mainstream narrative of an economic recovery in the United States. International banks, investment firms, big-name fund managers, and everyday technical analysts have all been sharing insights into terrible data and trends the financial media has largely ignored.

South Korea, China Buying Up Gold

Reuters, Bloomberg – South Korea and China both reported an increase in gold purchases last month. Based on first-half sales through the country’s largest gold merchant, South Koreans are on pace to purchase $860 million in bullion – a yearly record. Analysts estimate South Koreans hold around 800 metric tons of gold in households and private vaults. China upped its gold reserves by 1.1% in July, an increase of about 19 tons. In an unexpected update, Chinese officials said the country owns about 1,677.4 tons of gold. The previous update came in July, after China had been silent on the size of its reserves for six years. Read full South Korea Article>> Read full China Article>>

Perth Mint Gold Sales Hit 9-Month High

Reuters – Gold sales at the Perth Mint climbed to a nine-month high in July. The spike followed a similar rise in US Mint sales of gold coins, which hit a two-year high last month. Perth Mint sales of gold coins and minted bars rose to 51,088 ounces in July, from 31,019 ounces in June. That was the highest increase since October 2014. The Perth Mint runs the only gold refinery in Australia, which is the world’s second-biggest gold producer after China. Read Full Article >>

In mid-July, Scott Nations of CNBC as much as laughed in Peter Schiff’s face when Peter predicted the Federal Reserve may raise interest rates a very small amount before launching a fourth round of quantitative easing in 2016. Nations said:

It seems that you’re a little bifurcated here. You say that you think the Fed may raise rates a little bit by the end of the year, but that they’re also going to implement QE4. Which is it? Because those are absolutely binary. Those are completely polar opposites… How in the world do they raise rates and institute QE4?”

Peter clarified: “No, no, no, they would reverse that. Let’s say they raise rates to 25 basis points. Then by 2016, they lower them back to zero and do QE4.”

Jackie DeAngelis jumped in, reproaching Peter with the stern voice of a mother chiding a foolish child: “They cannot raise rates, then lower them back to zero, Peter.” (Watch the full interview for yourself here.)

Do you think CNBC would have reacted the same if Peter’s forecast came from one of the largest hedge funds in the world? Because now it has.