South Koreans have embarked on a gold buying spree.

Residents of the Asian country are on pace to purchase a record amount of gold in 2015. By year’s end, total sales will likely top 1 trillion won ($860 million) based on first-half sales through Korea Gold Exchange 3M Co Ltd, the country’s largest gold merchant.

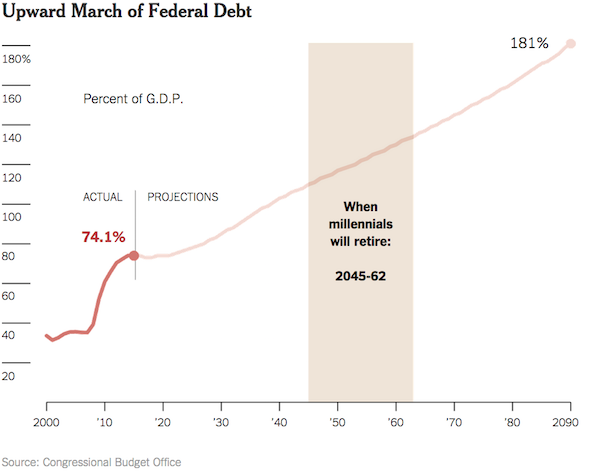

The New York Times ran a surprising op-ed on Sunday highlighting some structural problems in the US economy.

The issues raised in the column titled “We’re Making Life Too Hard for Millennials” by Wall Street executive and NYT contributing opinion writer Steven Rattner won’t surprise our regular readers. In fact, you will find the analysis rather familiar. But the fact that it appeared on the pages of the New York Times comes as quite a shock. Apparently, the mainstream is becoming aware of what we’ve been saying for years.

Rattner contends we should worry about future prospects for the millennial generation.

Coin Sales Soar, Driven by Greek Crisis and Low Prices

Reuters – The sale of gold and silver coins soared in July, with the Greek financial crisis and low prices pushing demand. With more than a week left until the end of the month, sales of US Mint American Eagle gold coins had already vaulted above 110,000 ounces, the highest monthly total since April 2013. July sales eclipsed the total of 76,000 ounces sold in June, and 21,500 ounces sold in May. On July 7, the US Mint temporarily sold out of its 2015 American Eagle silver bullion coins due to a “significant” increase in demand. Sales did not resume until July 27.

Read Full Articles Here, Here, and Here >>

China Discloses Gold Holdings

The Wall Street Journal – China released an update on its gold reserves for the first time in six years. At the end of June, China’s gold holdings totaled 53.32 million troy ounces, up 57% from the end of April 2009 when the People’s Bank of China last reported reserves. China’s official holdings are now the fifth largest in the world, behind the US, Germany, Italy, and France. China’s holdings now eclipse those of Russia and Switzerland. Despite the increase, China’s holdings were less than many analysts anticipated.

Read Full Article >>

You go to the bank, deposit your paycheck and walk away thinking your money will remain safe and secure, ready for you to withdraw whenever the need arises.

But as Greeks have discovered, that’s not necessarily the case. In the event of a crisis, you may not be able to access your money.

According to a Guardian article, some officials in the Greek government were prepared to take a page out of the Cypriot playbook and confiscate funds from banks.

The Chinese yuan continues to gain stature in the world financial system.

Earlier this week, the London Metal Exchange announced it will begin accepting yuan as collateral for banks and brokers trading on its platform.

The LME is the largest metal trading venue in the world. It facilitated some $15 trillion in metal trades last year. The yuan joins the United States dollar, the euro, the British pound and the Japanese yen as allowable collateral.

The Wall Street Journal called the LME move “another milestone for China’s currency.”

This article was written by Dickson Buchanan, SchiffGold Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

This article was written by Dickson Buchanan, SchiffGold Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

The month of July has seen the most intense demand for physical gold and silver since April of 2013, setting numerous records for the year. On the heels of the spectacular drop in spot prices, buyers of physical metal have come out in droves. In fact, available supply is hardly able to keep up with the demand for immediate delivery of metals.

This betrays a fundamental reality about the market for physical gold and silver bullion that many investors – even regular buyers of bullion – are not aware of. There simply is not much supply available at any given time. In other words, gold and silver products spend very little time sitting on the shelf waiting to get bought, making inventory very tight. As such, in times of intense demand, the entire available supply can be bought up in a matter of weeks, or even days. This results in higher product premiums and extended shipping times.

This is exactly where the market is for physical metals is right now. Consider what has happened in just the last couple of weeks.

Banks in Greece reopened on Monday, and even with strict withdrawal limits in effect, it at least gave the appearance of a return to normalcy. But Greeks also woke up Monday to a painful new reality that should serve as a warning to Americans.

Massive tax hikes went into effect, part of the austerity measures demanded by creditors in the latest bailout deal. As the AP reported, the increased taxes are another blow to Greeks already battered by years of economic crisis.

There are few parts of the Greek economy left untouched by the steep increase in the sales tax from 13 to 23 percent. The new rates have been imposed on basic goods, from cooking oil to condoms, as well as to popular services, such as taxi rides, eating out at restaurants and ferry transport to the Greek islands.

“The tax hikes are part of a package of austerity measures that also include pension cuts and other reforms that the Greek government had to introduce for negotiations to begin on a crucial third bailout.”

Gold is power.

We know that gold historically holds its value over time and serves to preserve wealth, especially in times of economic chaos. But gold also offers its holder political power.

Countries that stockpile gold create a foundation of stability for their monetary systems. This is precisely why China is increasing its gold holdings. As we reported last week, China now boasts the fifth largest story of physical gold in the world. The country continues to buy up the precious metal as it eyes a more dominant role in the world’s monetary system.

But it’s not just countries looking to gold to provide political clout and economic power. Texas recently laid the groundwork for its own gold depository. The reason? To wrest some economic power from the Federal Reserve by bringing some monetary autonomy to the Lone Star State.

In his podcast released yesterday evening, Peter Schiff explains why the price of gold plunged on Sunday night. More importantly, he reminds investors why gold is not a faith-based asset, like fiat money. He also reviews China’s relationship to gold, and compares the current market to the last time a bear market in gold ended.

I am convinced, when his market turns, it’s going to be vicious. When the people who have been selling their gold try to buy it back, it isn’t going to be there. Because the people who have been buying into the selling… they’re not going to turn around and sell it. When the speculative sellers are gone, there are no sellers left… I think the market is going to go up even faster than it has come down…

Gold fell to about $1,090 an ounce last night after the biggest single-day decline in its price in two years. It is now hovering around $1,110 an ounce.

Market consensus is that the sharp drop in price was triggered by major selling in the Shanghai gold market by gold speculators. The drop in price is not a product of fundamentals.

In fact, analyst Todd Horowitz told Bloomberg that he believes many investors see this as a major buying opportunity. He points out that from a technical perspective, gold is in very unusual territory when compared to the S&P 500:

It is a hard asset, a commodity, that I think everybody should own in part of their portfolio… I think gold is a hard asset that typically appreciates in value like everything else. If you compare it to the S&P, the S&P is twice as much as gold is now, which is one of the largest discrepancies in history, which means we should see a divergence back into that. Fundamentally, we have seen probably a low point here.”