Have you heard the news? Greece has defaulted and is facing complete financial meltdown. European banks are exposed to Greek sovereign debt, and US banks are exposed to European banks. As we saw in 2008, it only takes one domino to fall (Lehman) to threaten the entire global financial system.

Don’t panic. SchiffGold has compiled new special report that explains why gold is the asset that will weather this storm. Why Buy Gold Now? lays out the case for why gold is now not just a source of future profit, but an essential insurance policy for every investor.

Why Buy Gold Now?

- Because right now is a superb cyclical buying opportunity

- Because of the madness of central bankers

- Because the next bust could be the mother of all busts

- Because the so-called “economic recovery” is a ticking time-bomb

- Because eventually gold owners will be unwilling to accept dollars for gold at any price

All of these factors are fully explained in Why Buy Gold Now?, with accompanying charts and graphs. This 13-page report has been carefully researched and crafted by SchiffGold’s team of Precious Metals Specialists for the benefit of everyday investors.

It is serious reading, but it is worth your time.

Why now? Because you can’t afford to wait.

In a popular referendum yesterday, Greeks voted to reject further European financial aid in exchange for more austerity. Despite promises to the contrary, Greek banks remain closed, allowing account holders to only withdraw a meager daily maximum of €60. Greek Finance Minister Yanis Varoufakis has resigned.

Greece will meet with its creditors tomorrow and try to negotiate for more debt relief and infusions of cash into its banks. Nobody is certain the course those negotiations may take, but one thing is for sure – Greek citizens are hurting as they remain cut off from their savings. Unfortunately, no matter which way those negotiations go, it appears inevitable that Greeks will continue to suffer financially.

Texas Wants Gold Back from Feds

CBS News – Texas wants its physical gold back. In mid-June, Gov. Greg Abbot signed a law creating a state gold bullion and precious metal depository. The Star-Telegram reported that the primary goal of the depository is to “bring home more than $1 billion in gold bars that are owned by the University of Texas Investment Management Co. and are now housed at the Hong Kong and Shanghai Bank in New York.” Under the new law, Texas gold will be beyond the purview or control of any “governmental or quasi-governmental authority” not directly administered by the state. Read Full Article >>

Bank of China to Help Set London Gold Price

The Telegraph – The Bank of China will become the first Asian firm in history to join a group of western institutions setting the price of gold in the London market with its entry to the London Bullion Market Association gold price auction. China is the world’s largest producer and consumer of bullion. Bank officials said its inclusion will allow the gold price to better reflect supply and demand in the People’s Republic. Read Full Article>>

Greece missed its International Monetary Fund (IMF) payment earlier this week – the first advanced economy in the world to do so. All of Europe is watching to see if Greece stays in the eurozone and what the ramifications could be for the relatively young euro currency. And while they wait, they’re buying gold.

European mints and gold sellers have reported a huge leap in gold sales since this weekend, when Greece announced bank closures. The Wall Street Journal reports that the British Royal Mint is experiencing twice the demand for gold sovereigns from Greek customers.

Meanwhile, the last time the European retailer CoinInvest.com saw sales like this was during the Cypriot banking crisis in 2013.

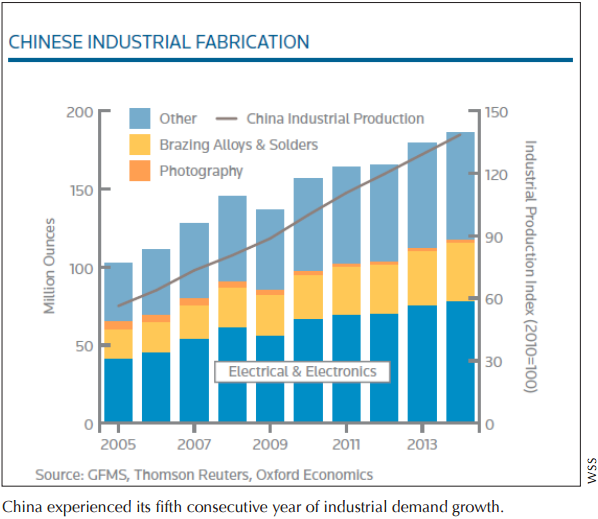

The Silver Institute has released its June newsletter. The publication features interesting and educational articles about the latest technology in the silver industry, as well as new silver investment products on the market. This edition notes that industrial demand for silver continues to grow in Asia and developing countries:

Industrial applications accounted for 56 percent of all silver demand in 2014. On a regional basis, a modest increase in industrial demand in developing countries, led by 4 percent growth in China and Taiwan, was offset by weaker demand in advanced countries in 2014. This marks the fifth consecutive year of Chinese industrial demand growth. Last year’s industrial demand total for Taiwan was 23 percent above their 2009 figure.”

Bank of International Settlements issued a blunt report on Sunday, warning that over-reliance on monetary policy has left central banks with little capacity to deal with the next global crisis.

As the Telegraph reports, BIS asserts that central banks have “backed themselves into a corner” by repeatedly cutting interest rates in order to stimulate flagging economies.

These low interest rates have in turn fueled economic booms, encouraging excessive risk taking. Booms have then turned to busts, which policymakers have responded to with even lower rates.”

China will reportedly create a yuan-denominated physical gold price setting mechanism through the Shanghai Gold Exchange (SGE) by the end of the year.

According to a Reuters report, the plan aims to give China more influence over gold pricing. The country already leads the world in production and consumption of gold bullion.

Greece has closed its banks and instituted capital controls. The measures will remain in effect until at least July 6th, the day after a popular referendum on European bailout aid is due to take place.

Rather than agree to further austerity measures in exchange for an extension of financial aid from its international creditors, Prime Minister Alexis Tsipras surprised markets by putting the decision to a popular vote. Greece’s current bailout program expires tomorrow, when a 1.6 billion euro payment to the International Monetary Fund also comes due.

Stock markets across the globe fell on the news, and gold rose about 0.7%.

Bloomberg reports that Greece’s capital controls include:

- Banks are closed up to and including July 6.

- International payments and transfers are banned.

- Daily ATM withdrawals are limited to 60 euros ($67; £42).

Mark Dice walked around downtown Encinitas, California and tried to sell a 10-ounce bar of silver for only $10. At today’s prices, that bar is worth about $160. He asked men and women, young and old, if they’d like to buy it. He even lowered the price to $1 while standing directly out front of a gold dealer. How many people do you think took him up on the offer?

This is a great video to show the naysayers who argue that precious metals are in a bubble. There are many people who think the prices of gold and silver are ready to plummet at any time. They predict gold could drop as low as $700 an ounce and silver could fall into the single digits.

However, bubbles are often associated with a certain amount mania. The asset or market in a bubble is often widely considered to be a valuable investment.

Did you know SchiffGold has a YouTube channel with exclusive videos from Peter Schiff? When you subscribe, you’ll be the first to see:

- Peter’s latest analysis of the gold market.

- Interviews with experts like Jim Rickards and Axel Merk.

- High-definition videos of our gold & silver products.

Watch Peter’s introduction to our channel below, then follow the links to subscribe.

Or click here to visit our YouTube channel right now and subscribe.