Bloomberg recently published an article about how world political leaders don’t have too much to say about the current sell off in equities – the worst of its kind since 2008. It states:

It’s wiped out more than $8 trillion in the value of global equities, leaving virtually no market unaffected, yet reaction from world leaders so far has ranged from muted to dismissive.”

Essentially, the message is that despite people’s portfolios hemorrhaging value and the world economy clearly starting to slow down, this is no big deal. There is no reason to panic and get out of the stock market. Oh – and it’s also China’s fault.

Stories about plummeting stock markets, a sputtering Chinese economy, and the yuan versus the dollar have dominated financial news over the past few weeks. Lost in the din: the economic disaster continuing to unfold in Venezuela.

Venezuelans face crippling shortages of basic staples as their currency, the bolivar, continues to inflate at breakneck speed.

Hyperinflation has rendered the bolivar practically worthless. A photo uploaded to Reddit of a man using a 2 bolivar note as a napkin went viral last week. Business Insider reported that based on the official exchange rate, the makeshift napkin was worth about 32 cents. But in reality, the man didn’t waste nearly that much.

In an attempt to stem stock market losses and stimulate a sagging economy, the Chinese central bank slashed its interest rate on Tuesday.

As Bloomberg reported, it was the fifth Chinese interest rate cut since last November.

The one-year lending rate will drop by 25 basis points to 4.6 percent effective Wednesday, the Beijing-based People’s Bank of China said on its website Tuesday, while the one-year deposit rate will fall a quarter of a percentage point to 1.75 percent. The required reserve ratio will be lowered by 50 basis points for all banks to cover funding gaps, it said.”

Of course, the United States stock market also plummeted Monday, shedding more than 1,000 points in early trading. With signs the American economic recovery might not be as robust as the government wants you to believe, what steps might the Federal Reserve take to shore things up in the near future?

Former Federal Reserve Chairman Alan Greenspan appeared on Fox Business this week with two strong messages for investors:

1. The United States economy is “extraordinarily sluggish,” and part of this problem is the massive amount of government entitlements. He pointed out that entitlements have grown nearly 10% a year for the past 50 years, no matter which political party is in office. This adversely affects savings, which is the foundation for economic growth – a message Peter Schiff has been sharing for years.

2. Interest rates have never been kept this low for this long, so a huge bubble in bonds is forming. While this could correct itself slowly, history tells us that it will likely pop quickly, with devastating effects for the financial markets.

Most people who buy physical gold and silver these days tend to be those who are worried about our financial system.

They see unbacked, untrustworthy fiat currencies as an intrinsically flawed foundation for an economy. They see skyrocketing debt that doesn’t stop rising. They see an overvalued stock market, inflated by repeated rounds of quantitative easing. And they see world governments that cannot be trusted to act economically responsible – especially in light of how things have played out recently in Cyprus and in Greece. These are all good reasons to distrust and opt-out of the banking system and put one’s wealth in physical gold and silver instead.

Of course, not everyone is onboard with these ideas. Many do not see the sky falling so quickly and are still hopeful that our financial system is going to pull through okay.

Regardless of whether you are a gold bug or maintain faith in the “system,” there is still a very strong argument for holding up to 5-10% of your portfolio in precious metals — something that Peter Schiff has always recommended. And that is simply the argument of diversification.

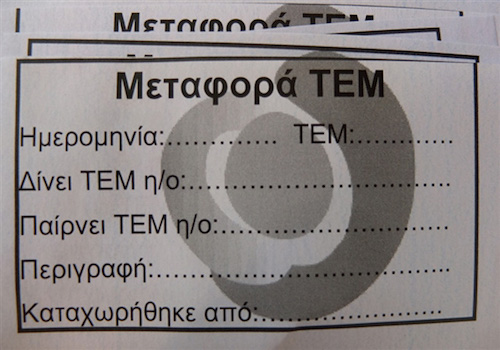

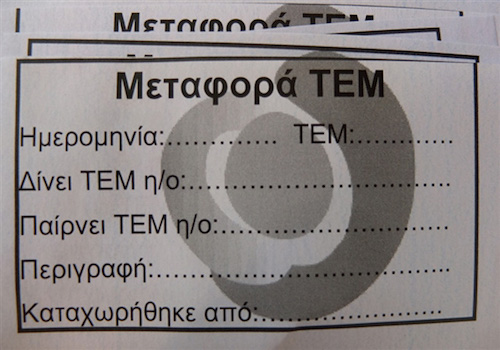

The other week, we wrote about the growing barter economy in Greece. With cash withdrawal limits still in place, Greek citizens are finding it difficult to conduct daily business using traditional methods. Now, the Wall Street Journal reports on the flourishing of a variety of alternative currencies, particularly one named TEM:

TEM—a sophisticated form of barter whose name is the Greek acronym for Local Alternative Unit—was founded in 2010 in the early months of Greece’s debt crisis with less than a dozen members. Now it includes dozens of participating local businesses that use the system to sell goods and services, including prepared food, haircuts, doctor visits, or even for renting an apartment.

“One of the larger and more established alternative payment systems in Greece, TEM has given Greeks living under the strain of wage cuts and tax increases a supplementary way to trade. Instead of dealing with a physical currency, members have an online account that starts at zero when they join. They can opt to take payment for goods and services in TEM, and then use those to buy products from others.”

So the People’s Bank of China (PBOC) just weakened the yuan fix to the United States dollar by the most on record – 1.9%. A central bank has devalued its currency, you say? Well, duh! With apologies to GEICO, it’s what central banks do. Apparently with exports suffering and their economy struggling to grow, something had to give. Devaluing the yuan immediately gives its export sector a boost. The hope is that this boost offsets whatever capital outflows result from a now weakened currency.

The move recalls another recent currency devaluation on the other side of the world. This time last year, the Swiss National Bank still wholeheartedly protested that it would never let its currency fix of the franc to the euro revalue. It continued declare as much right up until the week that it dropped that very peg. Me thinks it doth protested too much.

Mainstream pundits regularly scoff at Peter Schiff when he insists that real inflation is higher than the official Consumer Price Index (CPI), but an AP report this week vindicates his position.

During a recent interview on MSNBC, Schiff insisted that money printing by the Federal Reserve has already created a lot of inflation. He also believes the Fed must continue its inflationary policies. But the host scoffed, disputing the notion that the introduction of all these new dollars is necessarily inflationary.

I feel this is the refrain we’ve been hearing from gold advocates for a long time, especially since 2008 – that inflation has to go up. But when we look at actual consumer prices, they’ve been very muted…”

“Let’s say you want to start a business. Just start it in Puerto Rico. Why would you start it anywhere else?” This is what Peter Schiff told CNN Money in an article published yesterday. Peter and John Paulson are two of many successful investors CNN mentions as moving their businesses – and eventually themselves – to Puerto Rico.

CNN floated the idea that Puerto Rico could become the next Singapore by continuing to attract businesses with the tax advantages. Peter was the focus of their article:

Peter Schiff moved his asset management firm from Newport Beach, Calif., to San Juan in 2013. Schiff has bought a house in the Ritz Carlton compound just outside San Juan and water is not a problem for him. He plans to move there once his son graduates from high school. Individuals must live in Puerto Rico for 183 days a year to qualify for tax breaks.

“But his company is already enjoying financial benefits, paying a low corporate tax rate of 4%. In California, Schiff’s firm had to pay the U.S. corporate tax rate, which is about 35%. He says tax breaks like those encourage him to create more jobs, which Puerto Rico badly wants.

“‘I’m saving a lot of money,’ says Schiff, CEO of Euro Pacific Capital. ‘It’s the closest thing to renouncing your U.S. citizenship without actually doing it…You’re still an American, you’re just out from under the IRS.’

With gold’s recent volatility and price drop, we’ve heard a lot of noise from pundits and analysts. Consequently, this seems like a great time to ask certain basic questions about this oft misunderstood market. For example, just how big is the gold market? Where does gold fit into the modern financial landscape? Why does gold still matter today?

To start, let’s consider the size of the global market for gold.