Goldman Sachs officials are ready to push back their rate hike forecast to late 2016. As Bloomberg reported, they are hedging their bets on a December rate hike (probably to save face):

Goldman Sachs Group Inc. said there’s a chance U.S. policy makers will delay raising interest rates well into next year. While Goldman Sachs’s central forecast is still for a December liftoff, a slowdown in output and employment may justify the Fed keeping rates near zero for ‘much longer,’ the bank said in a report.”

Peter has been saying the Federal Reserve won’t raise rates all year. Now, as the year winds down and bad economic data continue to leak out, the mainstream appears to be catching up. Peter said it will eventually wake up completely.

The pretense that the Fed is about to raise rates, that a rate hike is just around the corner is going to end. It cannot withstand all of this negative economic news.”

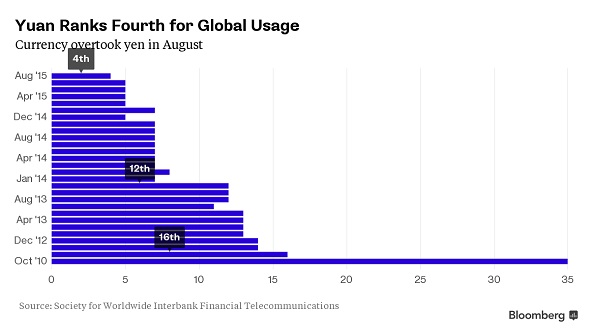

The Chinese yuan continues to gain stature on the world financial stage, overtaking the Japanese yen to become the fourth most-used currency for global payments.

Bloomberg reports the yuan rose to its highest ranking ever in August, boosting its claim for reserve status.

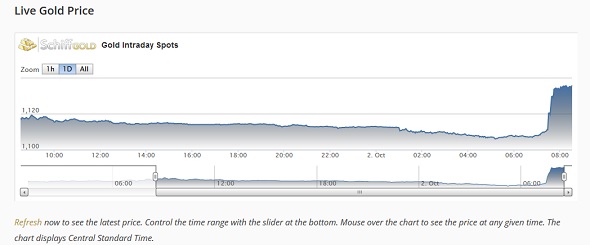

Barter with gold or silver provides a means of conducting business using real money with real value. SchiffGold has created an innovative tool to help you get started today.

The ability to barter can be a lifesaver during a currency or banking crisis, as the situation in Greece vividly demonstrates. But you shouldn’t wait for a crisis to establish barter relationships. You can begin to cut the government’s inflationary paper dollars out of your economic life today. In doing so, you’ll develop an invaluable hard money trading network.

One thing holds many people back from jumping into barter with gold or silver. Precious metal transactions get tricky when it comes to determining the value of the coins. While the spot price is readily available, it is not meant for everyday, person-to-person transactions.

SchiffGold has come up with an innovative solution to that problem – an easily accessible widget showing the current trade price of gold and silver in real time:

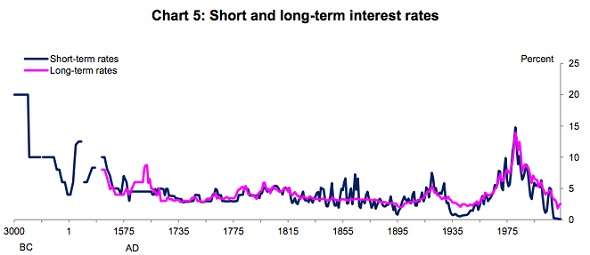

Bank of England chief economist Andy Haldane dug through thousands of years of historical data and found interest rates now sit at the lowest levels in some 3,000 years.

Wonkblog economic affairs reporter Matt O’Brien places the historic state of interest rates in vivid perspective in a Washington Post op-ed:

This is the best time to borrow money in recorded history…Now, it is true that rates almost got all the way down to zero during the Great Depression, but they have gotten all the way down there today. Indeed, interest rates are all-but-zero in the United States, the United Kingdom, the euro zone and, for the past 16 years now, Japan. Those are economies that, in nominal terms, make up more than half of the global economy.”

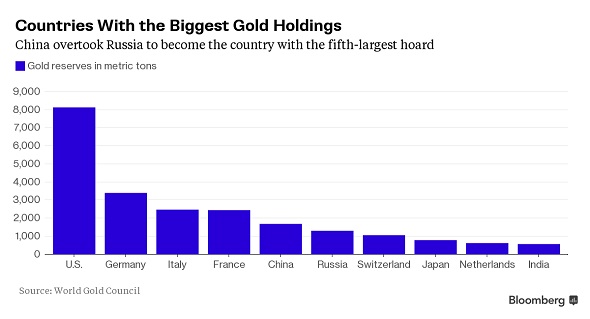

China continues to increase its central bank gold holdings, and other countries are following suit.

The world’s largest bullion consumer upped its stash of the precious metal another 1% in August. Bloomberg reports the hoard rose to 54.45 million troy ounces in August from 53.93 million ounces a month earlier, according to data released by the People’s Bank of China (PBOC).

It was the third straight month Chinese officials have release information on the amount of gold it owns. In July, the Chinese central bank announced its gold holdings had grown by 57% to about 1,658 tons. It was the first official update to China’s gold reserves since 2009. That lifted the nation above Russia to become the fifth largest holder of gold in the world.

As we reported a couple of weeks ago, mining companies worldwide face increasing obsticals, and analysts expect gold production to drop for the first time since 2008.

Now Bloomberg provides us with a concrete example of the struggles facing many gold mining operations.

According to the largest industry lobby group in the country, gold producers in Zimbabwe recently asked the government to lower royalties and electricity tariffs to stave off mine closures.

SchiffGold has a new tool to help you analyze the price of gold, silver, and platinum in real time. It also provides you with the detailed information you need for in-depth historical research.

The new SchiffGold Price Charts page features an easy to read, live table with up-to-the-minute precious metals pricing. But the tools on the page allow you to do far more than simply see current prices. Graphical charts allow you to study how the price has moved hour-by-hour, month-by-month or year-by-year, over time. Bookmark this page in your web browser so you always know exactly where to find the current price of all the precious metals.

The Federal Reserve Bank of Atlanta’s GDPNow estimate released today reveals a terrible early forecast for third quarter gross domestic product (GDP) growth. It’s especially bad when compared to Wall Street expectations.

The GDPNow model puts Q3 2015 GDP growth at 0.9% – that’s a 50% drop from just three days ago. The Atlanta Fed explains:

The model’s nowcast for the contribution of net exports to third-quarter real GDP growth fell 0.7 percentage points to -0.9 percentage points on September 29 following the advance report on U.S. international trade in goods from the U.S. Census Bureau.”

What’s most telling about this report is how different the GDPNow forecast is from the “Blue Chip consensus,” which is the expectations of mainstream business economists followed by Wall Street. Check out this chart:

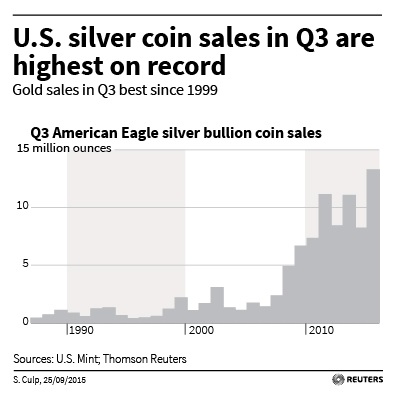

The demand for physical silver is absolutely through the roof.

The mainstream media has finally caught up with a story we began reporting on back in July. Yesterday, Reuters reported booming worldwide demand for silver coins:

The global silver-coin market is in the grips of an unprecedented supply squeeze, forcing some mints to ration sales and step up overtime while sending U.S. buyers racing abroad to fulfill a sudden surge in demand. The U.S. Mint began setting weekly sales quotas for its flagship American Eagle silver coins in July because it can’t meet demand, and the Canadian mint followed suit after record monthly sales in July. In Australia, the Perth Mint sold a record of more than 2.5 million ounces of silver this month, nearly four times more than in August, and has begun rationing supply of a new line of coins this month, a mint official said.”

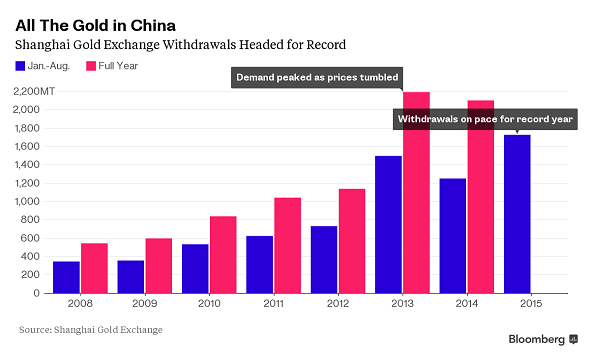

Investors have withdrawn a record amount of gold from the Shanghai Gold Exchange over the past year, signaling a steady increase in demand in the world’s largest gold consuming country.

Bloomberg reported the most recent numbers:

Withdrawals jumped 37% to 1,891.9 metric tons through Sept. 18 from 1,380.9 tons a year earlier, according to data on the bourse website. Trading increased 150% in the first eight months, said Liu Liang, a spokesman for the exchange, the world’s largest spot bullion market.”