The mainstream media trumpeted the latest data on housing starts as good news for the economy, but there is a dark side they aren’t talking much about.

Reuters reports housing starts rose more than expected in September, driven by high demand for rental units.

Groundbreaking increased 6.5% to a seasonally adjusted annual pace of 1.21 million units, the Commerce Department said on Tuesday. It was the sixth straight month that starts remained above 1 million units, pointing to a sustainable housing recovery. Starts increased to a 1.13 million-unit rate in August. Economists polled by Reuters had forecast groundbreaking on new homes rising to a 1.15 million-unit pace last month.”

A Chinese bank will soon join the London Bullion Market Associations (LBMA) silver price-setting process.

According to a Reuters report, China Construction Bank signed a memorandum of understanding with CME Group. It will join HSBC, JPMorgan Chase, Mitsui & Co Precious Metals, Bank of Nova Scotia – ScotiaMocatta, Toronto Dominion Bank, and UBS in taking part in the daily auction process hosted by CME and Thomson Reuters.

The Chinese central bank continues to increase its gold holdings at a steady pace.

Figures released by the People’s Bank of China indicate its gold stash went up another 1% in September, according to a Reuters report:

Gold reserves rose by 480,000 fine troy ounces, or 14.9 tons, to 54.93 million ounces, or 1,708.5 tons at the end of September, the People’s Bank of China (PBOC) said.”

This follows a trend we’ve seen ever since China announced its gold holdings for the first time in nearly six years last summer. The central bank added 16.2 tons in August and nearly 19 tons in July, a steady 1% increase each month.

Wal-Mart’s problems may well reflect deeper issues in the US economy.

The giant retailer announced Wednesday that profits could drop as much a 12% in the next year. It’s stock plummeted 10% on the news. Company officials also warned they now expect sales growth for the current fiscal year to be flat. In February, the company predicted 1 to 2% growth.

According to the Wall Street Journal, the cost of recent wage increases is weighting heavily on the company’s profit margin:

The price of gold is rallying on growing uncertainly about a Federal Reserve interest rate hike and fears companies may disappoint already low expectations with third quarter earnings reports. No wonder billionaire Paul Singer said every investor should buy gold.

According to a Bloomberg report, Singer criticized monetary policy makers for a “staggered economic recovery” and slammed “the cult of central banking” in which investors turn to regulators such as Janet Yellen and Mario Draghi to solve the ills of the global financial system.

Investors are well-aware of the numerous industrial applications for silver, and it often factors into analysis of the white metal’s demand. But gold also has industrial applications. And while investment and jewelry primarily drive the demand for gold, its use in industrial applications continues to expand, representing a growing market for the precious metal.

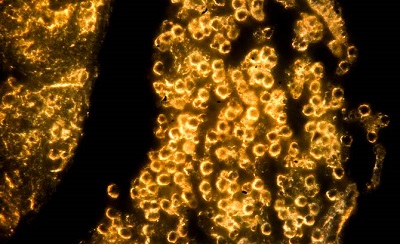

Gold nanoparticles are increasingly used in medical applications and electronics, and according to recently released market analysis by research firm Radiant Insights, the demand for gold nanoparticles is expected to grow to $4.99 billion by 2020.

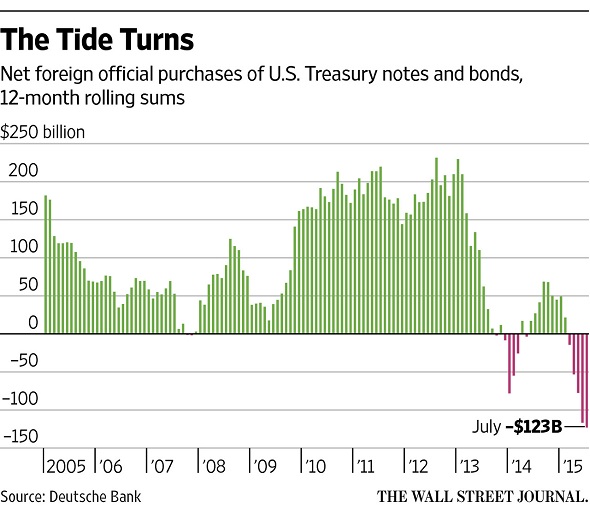

China, along with other central banks, are selling US government bonds at the fastest rate on record, according to the Wall Street Journal. WSJ calls it “a dramatic shift” in the bond market:

Foreign official net sales of U.S. Treasury debt maturing in at least a year hit $123 billion in the 12 months ended in July, said Torsten Slok, chief international economist at Deutsche Bank Securities, citing Treasury Department data. It was the biggest decline since data started to be collected in 1978. A year earlier, foreign central banks purchased $27 billion of U.S. notes and bonds.”

It’s not just China dumping US Treasury bonds:

Walk into the small restaurant near the shore of Lake Michigan in Manitowoc, Wisconsin, and the smell of burgers and deep-fried cheese curds will assault your senses. According to the Blaze, locals will tell you Late’s has the best burger in town. It’s a throwback kind of restaurant, complete with a long, winding dining counter and spinning stools.

Late’s also features some throwback pricing for customers willing to pay with silver coins minted before 1965.

High on the south wall, up near the ceiling, hangs a sign featuring the special prices. In big bold letters it reads, “Late’s prices, if you pay in US silver coins dated 1964 or earlier.”

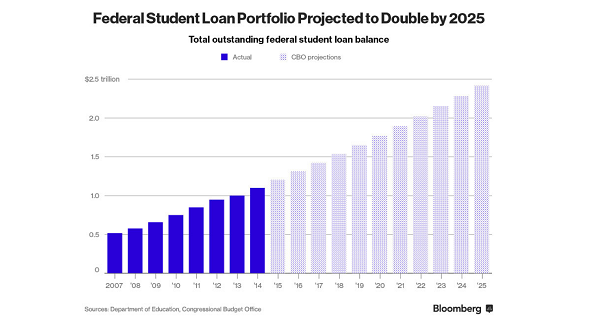

A federal case now under consideration in the First Circuit Court of Appeals could have huge ramifications for millions of Americans buried under student loan debt, as well as lenders and US taxpayers.

Bloomberg reports Robert Murphy is closer than ever to victory:

After record-breaking world-wide silver demand in the third quarter of 2015, the surge continued in September, with Bloomberg reporting sales at the Perth Mint in Australia hit the highest level in at least three years last month.

Sales of silver coins and minted bars jumped to 3.35 million ounces in September from 707,656 ounces the previous month, the mint said on its website on Friday. That’s the highest on record according to mint data compiled by Bloomberg dating back to 2012. Gold sales rose to 63,791 ounces, the highest in a year, from 33,390 ounces in August.”