Foreign Banks Dumping US Debt at Record Pace

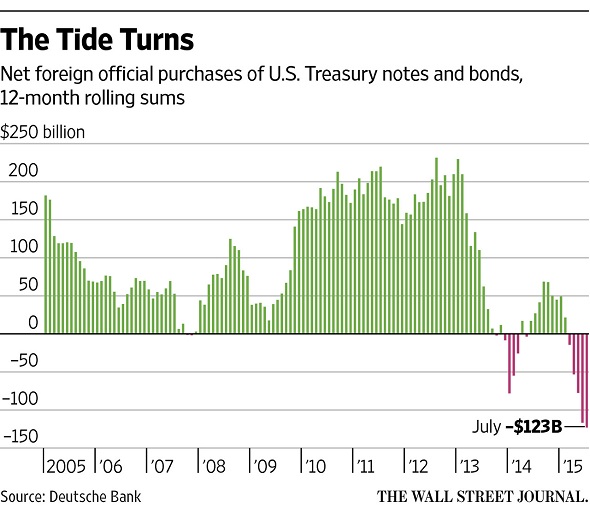

China, along with other central banks, are selling US government bonds at the fastest rate on record, according to the Wall Street Journal. WSJ calls it “a dramatic shift” in the bond market:

Foreign official net sales of U.S. Treasury debt maturing in at least a year hit $123 billion in the 12 months ended in July, said Torsten Slok, chief international economist at Deutsche Bank Securities, citing Treasury Department data. It was the biggest decline since data started to be collected in 1978. A year earlier, foreign central banks purchased $27 billion of U.S. notes and bonds.”

It’s not just China dumping US Treasury bonds:

China, the biggest foreign owner of Treasury securities, owned $1.241 trillion Treasury debt at the end of July, down from a record of $1.317 trillion in November 2013, according to the latest data available from the Treasury. China isn’t alone. Russia’s holdings of all U.S. Treasury debt fell by $32.8 billion in the year ended in July, according to the latest data available from the U.S. Treasury. Taiwan’s holdings dropped by $6.8 billion. Norway, a developed nation hit by the oil-price decline, reduced its Treasury holdings by $18.3 billion.”

So, who is buying up all of this debt?

According to the WSJ, central banks are finding ready buyers in US and foreign firms. This seems to indicate the private sector is not buying Washington’s positive spin about the US economy and is seeking the “security” traditionally offered by US government bonds. Casey Research recently analyzed the current dynamics in the bond market and reached a similar conclusion, reporting “looming warning signs” in the US “wonderland economy.”

As China sells off US debt, it continues to buy up gold. As we reported last week, China increased its stockpile of gold another 1% in August. Many analysts believe the Chinese hope to stabilize the yuan in the eyes of the international community as it pushes for inclusion in the International Monetary Fund’s Special Drawing Rights basket. It seems to be making headway. It recently overtook the Japanese yen to become the fourth most-used currency for global payments.

Russia has also been upping its gold reserves as it sells off US treasuries, buying 1 million ounces of gold in August alone.

The WSJ reports that to contain a selloff of its currency in the wake of the People’s Bank of China devaluation of the yuan in August, it has been buying yuan and selling dollars:

Data published Wednesday showed China’s foreign-exchange reserves dwindled further in September, a trend that likely will force the country’s central bank to step up monetary easing. The PBOC said currency reserves fell $43.3 billion last month to $3.51 trillion as more funds left the country, the fifth consecutive monthly drop but a less-sharp one than the record $93.9 billion plunge the previous month.”

Peter Schiff has argued that the mainstream media has missed the point of China’s moves entirely:

In the past, most of the action in the ‘currency wars’ had been focused on the efforts that many nations undertook to prevent their currencies from rising against the US dollar, which itself was being weakened by a perpetually easy Federal Reserve and persistently negative US trade and budget deficits. But with the dollar now strengthening significantly, the Chinese government has become concerned that the yuan, which has remained largely tethered to the dollar, had become too strong against other currencies, particularly its primary trading partners in Asia and the Pacific. To remain competitive locally, it decided to ease the tether to the dollar and instead let its currency float more freely. The purpose and implications of this significant pivot has largely escaped the US media. In reality, the move raises the likelihood that the yuan will rise significantly when the dollar resumes its long-term bear market, not that it will remain weak forever.”

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Leave a Reply