The silver market will likely face its third consecutive annual physical deficit in 2015, according to the recently released Interim Silver Market Review by Thomson Reuters.

A drop in supply due to flat mine production and a spike in demand for silver coins are among the factors figuring prominently in the predicted physical deficit.

Silver bullion coin sales hit record highs in the third quarter of 2015, totaling 32.9 million ounces. That represents a 95% year-on-year increase. A summary of the market review notes North American sales jumped an even more robust 103%:

Gold rallied in the wake of the tragic ISIS terror attack in Paris on Friday.

Multiple media reports framed the rise in the price of gold as “safe haven demand.” The Wall Street Journal put it succinctly:

The precious metal has long acted as a safe store of value during periods of heightened global uncertainty.”

As the WSJ explained, the focus on safe-haven investing has been largely overshadowed by speculation on what the Federal Reserve will do with interest rates in the coming months. The events in Paris jolted the market out of its Fed induced revelry, if only temporarily.

After the last Republican presidential debate, candidate Ben Carson told Fox Business host Neil Cavuto he wouldn’t necessarily remove Janet Yellen as head of the Federal Reserve. His reasoning was astonishingly shallow.

Did he articulate some in-depth policy insights to bolster his comments? Did he cite some kind of Yellen policy success? Did he appeal to her breadth of economic wisdom?

Nope.

He had a much deeper reason for keeping Yellen on:

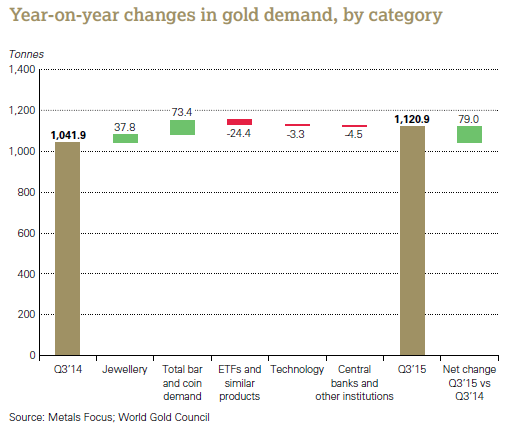

Gold demand showed a healthy increase in the third quarter according to a report released by the World Gold Council.

Total gold demand in Q3 stood at 1, 121 tons, an increase of 8% compared to the third quarter of 2014.

Global investment demand helped drive the overall increase. It surged 27% to 230 tons, primarily on the strength of gold bar and gold coin purchases. In the US, bar and coin demand hit the highest total in five years, up a whopping 207% to 33 tons. Gold Eagle coin sales are at the highest level since the financial crisis.

The Silver Institute has released its October issue of Silver News. This edition spotlights the continuing demand for silver bullion coins, highlighting the fact that the US Mint, the Royal Canadian Mint, Australia’s Perth Mint, the Austrian Mint, and the British Royal Mint recently all put their silver bullion coins on allocation at the same time.

Although individual mints, especially the US Mint, have gone to allocations in past years, most recently when American Eagle Silver Bullion Coins sold out in July of this year, restriction from multiple mints at the same time is unprecedented and illustrates considerable tightness in the current global silver coin business.”

After a year of anticipating a Federal Reserve interest rate hike, all eyes are on the Fed’s December meeting. There are two obvious outcomes: the Fed does raise interest rates or it does not. In his November Gold Videocast, Peter Schiff explains why both scenarios are bullish for gold. Peter points to the behavior of gold under both Alan Greenspan and Paul Volcker as proof that a rising interest rate environment isn’t automatically bearish for the yellow metal. On the other hand, if the Fed continues to delay raising interest rates, investors will begin to realize their expectations were ill-founded and reconsider their positions in gold and silver.

Either way, investors who have been waiting to buy should thank the Fed for extending the opportunity to buy gold for less than $1,100 an ounce.

Rob McEwen provided Kitco with an insider’s view on the mining industry and physical gold investment. McEwen was the founder and former CEO of Goldcorp, the world’s fourth largest mining company, so his insights into precious metals should not be taken lightly.

McEwen had 3 very important observations for investors:

1. If prices remain this low, there’s a possibility of gold and silver supply shortages as miners produce less.

While the government and mainstream media keep telling us, “The economy is improving, the economy is improving!” we keep getting news like this from the New York Times:

With a hint at what may be in store for shoppers this holiday season, Macy’s cut its profit outlook and CEO Terry Lundgren said markdowns are likely as a convergence of factors lead to a high inventory of goods for retailers. Macy’s third-quarter sales fell 3.6% at established locations.”

Macy’s Q3 revenue dropped to $5.87 billion, falling short of the $6.15 billion forecast by Wall Street analysts. The company dropped its full-year earnings forecast a full 50 cents, from $4.70 to $4.80 per share down to $4.20 to $4.30 per share.

Peter Schiff has been saying that it’s only a matter of time before the student loan bubble pops.

Now you can watch the clock tick thanks to the new National Student Loan Debt Clock developed for MarketWatch by StartClass, an education data site.

According to MarketWatch calculations, student loan debt increases in America by an estimated $2,726.27 every single second:

China announced it will start direct trading with the Swiss franc. This is another step in China’s relentless march toward becoming a major player on the world financial stage and away from dependence on the US dollar.

According to a Bloomberg report, the link between the currencies will begin Tuesday. The move by the China Foreign Exchange Trade System makes the Swiss franc the seventh major currency that can bypass conversion into the US dollar and be directly exchanged for yuan.

The People’s Bank of China said it welcomed the move in a statement on its website: