Drop in Gold Output Expected as Mining Companies Lose Money

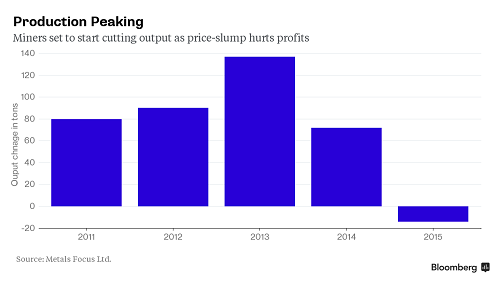

With many mining companies in the red, analysts expect gold production to drop for the first time since 2008.

According to a Bloomberg report, the anticipated drop in production follows a global surge. Gold output jumped 24% in a decade to a record 3,114 metric tons in 2014, according to data from industry researcher GFMS.

About 10 percent of the world’s mines are losing money, according to London-based researcher Metals Focus Ltd. Output will start declining as soon as next year, said the chief executive officers at Randgold Resources Ltd. and Polymetal International Plc. Gold Fields Ltd.’s CEO expects a ‘big dip’ from about 2018, while HSBC Holdings Plc predicted the drop will be 25 tons this year.”

Approximately 65% of mined and recycled bullion is used in jewelry and industrial items. Investors buy the rest.

According to James Sutton, a portfolio manager at JPMorgan Chase & Co.’s $2 billion Natural Resources Fund, on average, the industry needs about $1,200 per ounce to break even, taking into account all costs.

Profit margins for the 15 largest producers have dropped as much as 45% since 2011, while their debt has doubled to about $34.7 billion, according to an analysis by Bloomberg Intelligence.

Barrick Gold Corp. ranks as the world’s largest gold producer. In August, Moody’s Investors Service cut the company’s credit rating to one level above junk status. Moody analysts say they expect Barrick to restrict output in the next two years.

The drop in output will likely shrink the implied gold surplus, a measure of mine output and recycling against demand from jewelers, manufacturers and investors. According to Barclays Plc., the implied surplus will drop to 999 tons in 2016, the lowest level since 2012, after reaching 1,476 tons in 2013.

Johannesburg-based Gold Fields CEO didn’t mince words when discussing the future gold supply.

Exploration has been slashed; projects have been put on the back burner. The gold industry supply side is going to drop.”

The likely drop in gold output is just one of many reasons now is the time to consider buying gold. For more information and in-depth analysis on the gold market, get Peter Schiff’s report Why Buy Gold Now? You can download it for free HERE.

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

America’s trust in its institutions has rapidly eroded over the past 20 years. We have a lower level of trust in our judicial system and elections than most European countries. Some of this is natural, as Americans are uniquely individualistic, but much of it arises from repeated government failures.

America’s trust in its institutions has rapidly eroded over the past 20 years. We have a lower level of trust in our judicial system and elections than most European countries. Some of this is natural, as Americans are uniquely individualistic, but much of it arises from repeated government failures. Decades of negative interest rate policy in Japan have ended. That could mean the end of the $20 trillion “yen carry trade,” once one of the most popular trades on foreign exchange markets, and a chain reaction in the global economy. The yen carry trade is when investors borrow yen to buy assets denominated in […]

Decades of negative interest rate policy in Japan have ended. That could mean the end of the $20 trillion “yen carry trade,” once one of the most popular trades on foreign exchange markets, and a chain reaction in the global economy. The yen carry trade is when investors borrow yen to buy assets denominated in […] With a hot CPI report casting a shadow of doubt on the likelihood of a June interest rate cut, all eyes are on the Fed. But they’ve caught themselves in a “damned if they do, damned if they don’t” moment for the economy — and the news for gold is good regardless.

With a hot CPI report casting a shadow of doubt on the likelihood of a June interest rate cut, all eyes are on the Fed. But they’ve caught themselves in a “damned if they do, damned if they don’t” moment for the economy — and the news for gold is good regardless.  It’s no secret that the American public is wildly ignorant of many issues that are central to the success of our nation. Just a generation ago it would have been unthinkable that less than half of the American population could recognize all three branches of government. America is in most cases far less educated about its government […]

It’s no secret that the American public is wildly ignorant of many issues that are central to the success of our nation. Just a generation ago it would have been unthinkable that less than half of the American population could recognize all three branches of government. America is in most cases far less educated about its government […] In investing, “Buy low, sell high” is among the most well-known sayings, and generally, it’s good advice. But with gold still holding near its historic all-time highs, central banks led by China are bucking the classic adage and smash-buying more, buying the top to fortify themselves against a global monetary and financial blow-up.

In investing, “Buy low, sell high” is among the most well-known sayings, and generally, it’s good advice. But with gold still holding near its historic all-time highs, central banks led by China are bucking the classic adage and smash-buying more, buying the top to fortify themselves against a global monetary and financial blow-up.

Leave a Reply