On Kitco News yesterday, Peter Schiff put the past three years of falling gold prices in perspective. He emphasized that gold’s recent performance should be considered in the larger picture of a gold bull market that began in 1999. It has simply been investor assumptions and speculation about an improving economy that allowed gold’s correction to drag on this long. When investors realize in the coming year that the Federal Reserve is going to have to stimulate the economy again, then gold will begin the most dramatic up-leg of this long-term bull market. Click here to view Peter’s 5-year gold price forecast.

Rather than delivering the rate hikes that everybody expects, I think we’re going to get rate cuts and another round of quantitative easing that will be even bigger than the prior three. I think gold is set up for another spectacular rally. I think it’s going to see new highs. I think the biggest leg of this gold bull market – which really began in 1999 with gold below $300 – I think the next leg is going to be the biggest leg…”

The Silver Institute has released its December issue of Silver News. This edition spotlights falling silver supply and soaring silver bullion coin demand.

Total silver supply is forecast to fall to 1,014.4 million ounces in 2015, down 3% from the previous year. At the same time, silver bullion coin sales reached a fresh record high in the third quarter of this year, totaling 32.9 million ounces, and were up 95% year-on-year for the quarter, according to the recent press release Interim Silver Market Review, which included provisional supply and demand forecasts for 2015.”

Flat mine production and a 5% dip in scrap silver returns are driving the declining silver supply, according to the report.

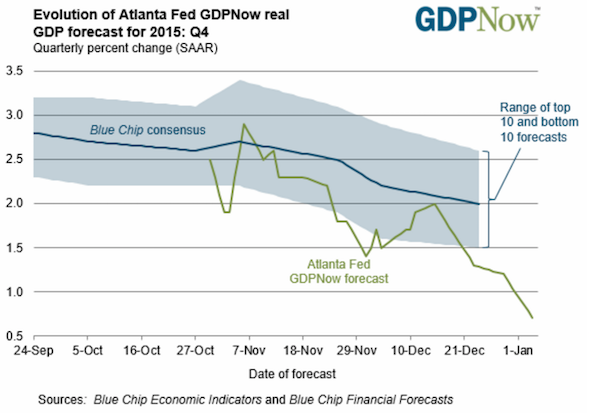

The Federal Reserve Bank of Atlanta’s GDPNow estimate released today forecast a dismal 4th quarter GDP number. The forecast was nearly cut in half from 1.3% on December 23rd to 0.7% today. It remains much worse than the mainstream consensus estimates:

Here’s what the Atlanta Fed had to say, citing the same manufacturing numbers Peter Schiff shared this morning:

A recent New York Times feature went to great lengths to promote the idea of a cashless society, focusing on the war on cash in Sweden.

The Nordic country sits on the cutting edge of the movement away from cash. As the Times put it, cash is so “last century”:

Few places are tilting toward a cashless future as quickly as Sweden, which has become hooked on the convenience of paying by app and plastic. This tech-forward country, home to the music streaming service Spotify and the maker of the Candy Crush mobile games, has been lured by the innovations that make digital payments easier. It is also a practical matter, as many of the country’s banks no longer accept or dispense cash.”

Peter Schiff has been saying that the December Federal Reserve interest rate hike is likely a one-and-done deal, with rates going back to zero or lower, and another round of quantitative easing in the cards for 2016. Peter insists that the US economy isn’t in good shape, and it can’t even sustain the recent small rate hike, much less the series of increases promised by the Fed.

Another bit of news came out this week that seems to further reinforce Peter’s position.

If you want to see the value of gold in a currency crisis, just look north.

When people tell you “gold is down,” you should always ask an important question: compared to what? If you bought gold in Canadian dollars (CAD) last year, you’re probably pretty happy. Gold is up 7.9% in the Great White North, and 17% over two years. Even if you bought gold in Canadian dollars five years ago, things still look pretty good. The price is up a healthy 5.8%.

We tend to talk about everything in terms of dollars, but the USD is not the only game in town. And the bullish market for gold when looking at it in Canadian dollars reveals the yellow metals intrinsic value. It historically protects wealth during a currency crisis.

The recent Federal Reserve rate hike was supposed to assure us that the US economy is improving. But as we’ve shown, the actual economic data just doesn’t back up the optimism. At best, the economy remains tepid, and Peter Schiff has argued that it is likely heading toward another recession. As a result, Peter doesn’t believe the rate hike will stick, and a lot of mainstream economists agree.

Now we have fresh evidence of another millstone hanging around the economy’s neck that doesn’t bode well for Fed policymakers – Obamacare.

According to a new study, the national health insurance program is taking a big bite out of customers’ wallets. It appears the so-called Affordable Care Act is anything but affordable. CNBC summarized the study’s findings this way:

In the past week, Peter Schiff released two podcasts, and appeared on CNBC, Fox Business, InfoWars and The Hard Line. The Federal Reserve’s decision to nudge interest rates up and the possible ramifications dominated discussions.

Follow these links to jump to the video or article you’d like to see:

1. Schiff Radio Podcast: CNBC Calls Me Out On Gold, Dec. 21

2. Commentary: Mission Accomplished, Dec. 18

3. InfoWars: All Fed Decisions Are Made for Political Reasons, Dec. 18

4. CNBC: The Battle Continues: Schiff vs. Nations on Gold & Fed Rate Hike, Dec. 17

5. Schiff Radio Podcast: Janet Yellen Gets Nuts, Dec. 17

6. Fox Business: If the Market Believes in the Fed, the Market has a Problem, Dec. 16

7. The Hard Line: Rate Hikes Are Over; Fed Will Ease Next, Dec. 16

Russia and Kazakhstan continued their gold buying spree in November, and Turkey added to its reserves as well. Meanwhile, India is on pace for a healthy increase in gold imports this year.

A paper recently published by the National Bureau of Economic Research found that a large percentage of the increase in college tuition can be explained by increases in the amount of available financial aid.

Peter Schiff was saying this as far back as 2012. That summer, Peter appeared on CNBC and debated an economist with the Progressive Policy Institute. Peter insisted that colleges are “basing their prices on the fact that students can borrow money with government guarantees.”

Economists Grey Gordon and Aaron Hedlund wrote their paper for the NBER after creating a sophisticated model of the college market. When they crunched the numbers, it confirmed exactly what Peter said in 2012. The demand shock of ever-increasing financial aid accounted for almost all of the tuition increase: