Mainstream analysts have started seriously talking about the possibility of negative US interest rates in the near future.

On the heels of the Bank of Japan dropping a key interest rate to negative 0.1% late last month and indicating it is willing to go deeper into negative territory, Bloomberg reports that American analysts see an increasing likelihood that the Federal Reserve is willing to follow suit:

If the world’s biggest economy weakens enough that traditional policy measures don’t help, the Fed may consider pushing rates below zero, according to Bank of America Corp. and JPMorgan Chase & Co. That step would broaden the Fed’s toolkit beyond what was available during the financial crisis, when it slashed its overnight benchmark near zero and bought bonds to stimulate the economy.”

Debt is crushing the American economy.

Over the last month or so, the mainstream seems to have realized that the economy isn’t on nearly as solid ground as government officials and central planners were telling them throughout 2015, and all of a sudden, gold is in vogue. But as we pointed out last week, the signs of economic distress have been there all along.

One underlying fundamental that seems to get swept under the carpet is the staggering level of debt – both public and private.

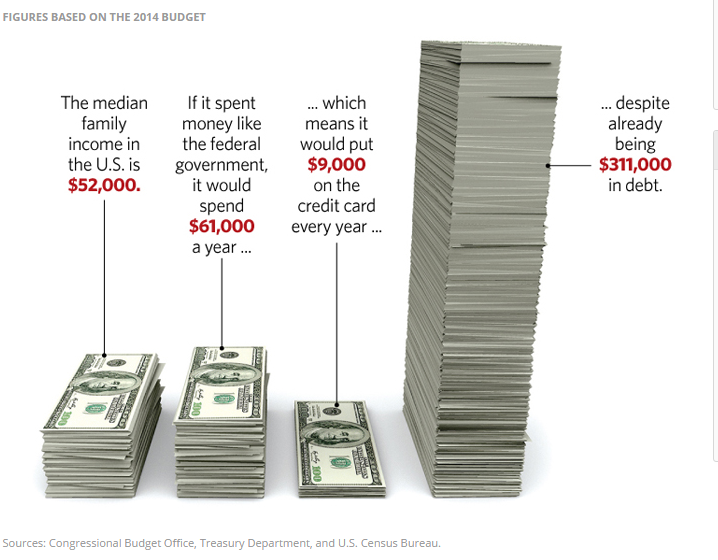

Last week, the US national debt crossed the $19 trillion threshold. Most of us can’t even grasp that number. The graphic above created by the Heritage Foundation puts it into vivid perspective, illustrating what this level of indebtedness and spending would mean to the average American household.

The mainstream world of economics and investment has the attention span of a 12-year-old hopped up on sugar.

A couple of months ago, it was all doom and gloom for gold. The Fed was talking interest rate hikes, government spokespersons were claiming victory over the recession, and mainstream analysts were hastily pounding nails in gold’s coffin.

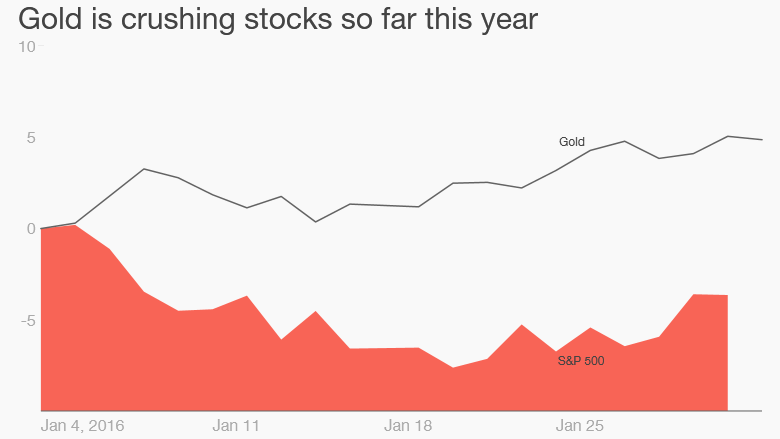

Cancel the wake, because today everybody has turned bullish on gold with the price up more than 9% since New Year’s Day.

A headline at CNN Money earlier this week boldly proclaimed, “Gold is 2016’s most beloved asset.” The story highlights the more than 10% gain in the price of gold since its low after the Fed hiked rates in mid-December, along with the dismal performance of stock markets, pointing out the Dow is down more than 1,000 points and the NASDAQ has lost 8% of its value:

We are always told to “be prepared” for a crisis. But what exactly does that mean?

We tend to think in terms of stockpiling supplies, or maybe having an evacuation plan. Of course, these are important steps. But there are other less obvious things we can do to prepare for upheavals, particularly when it comes to the prospect of an economic meltdown.

Brandon Smith founded the Alternative Market Project and he emphasizes the importance of developing local networks to facilitate barter. In the event of a systemic economic collapse, these networks will provide vital channels for the exchange of goods and services in the event traditional markets cease to function. The national network of barter markets he is facilitating are designed to insulate and protect local economies from what he calls the inevitable collapse of the current unsustainable fiat system.

Germany ramped up its gold repatriation project last year, joining other European nations bringing gold home. The trend underscores the importance of holding physical gold within easy access.

Germany’s Bundesbank transferred more than 210 tons of gold back into the country from vaults in Paris and New York last year. According to the Financial Times, with last year’s transfers, Frankfurt now ranks as the largest storage location for the country’s reserves after New York.

In early 2013, the Bundesbank announced a plan to repatriate massive amounts of its physical gold reserves back into Germany. The goal is to have half of its gold back in within the country’s borders by 2020. Germany’s gold reserves are currently the second-largest in the world, with nearly 3,400 metric tons.

Government regulations are no match for Indians’ love of gold.

Try as it might, the Indian government has been unable to stem the tide of costly gold imports, nor stop Indians from hiding billions of dollars in undeclared “black money” by investing in the yellow metal.

The latest attempt was a requirement that buyers of high value gold jewelry must provide their tax ID. But instead of denting demand, the move has apparently boosted unofficial trading.

We’ve focused a great deal on gold demand in China, India, and Eastern Bloc countries over the last several months, but people in these nations aren’t the only ones buying gold. Demand for the yellow metal is also robust in the Middle East due to what analysts call “safe haven buying.”

Despite general sluggishness in the retail sector, gold jewelry sales surged in the United Arab Emirates during January. According to Gulf News, retailers in Dubai sold upwards of 8 tons of gold jewelry last month. This rivals sales rates from January 2015, despite a much more difficult environment for retailers this year. Abdul Salam K.P., a member of the board at Dubai Gold & Jewellery Group, pointed to gold sales as one of the few bright spots for UAE retailers:

Ever since the Federal Reserve raised interest rates in December, Peter Schiff has insisted that the state of the US economy didn’t justify the move. In fact, on numerous occasions, Peter has said the US may already be in a recession. If not, we are on the verge of entering one. Earlier this week, Peter reiterated this message during an interview on Newsmax:

I think the US economy has already reentered recession. I think the current recession we are in is going to be worse than the one we left in 2009, and I think the Fed is going to be back to its old tricks of 0% interest rates and another round of quantitative easing.”

Now it seems mainstream analysts are staring to see the writing on the wall. A recent video featuring Bloomberg’s Scarlet Fu highlighted three charts that show the US may be entering a recession.

Gold supplies took a nosedive as demand increased in the final quarter of 2015, according to the latest GFMS Gold Survey by Thompson Reuters.

Total gold supply dropped 7% in Q4 of 2015, driven down by a 4% decline in mining production. It was the largest decline in mine output since 2008, according to the report:

We expect this trend to continue in 2016, due to lower production at more mature operations and a lack of new mines coming on stream. We currently forecast global mine output to shrink in 2016, marking the first annual decline since 2008 and the largest in percentage terms since 2004.”

SchiffGold is giving away more than $4,500 worth of prizes, including gold coins, silver bars, and books signed by Peter Schiff. Anyone can enter to win before March 22, 2016 – no purchase necessary! Click the link below to learn more or scroll down to enter immediately.

Click here to learn more about Peter Schiff’s Gold Giveaway.

Or enter to win today: