Just a few months ago, mainstream analysts were calling gold a “barbaric relic.” Now all of a sudden, they are saying, “Buy gold!”

Last Friday, Deutsche Bank issued a note asserting that with emerging economic risks and market turmoil, signs point in gold’s favor:

There are rising stresses in the global financial system…Buying some gold as ‘insurance’ is warranted.”

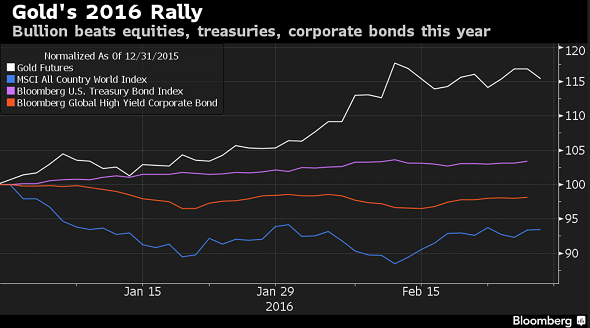

Deutsche Bank isn’t alone in singing gold’s praises. A Bloomberg report crowned gold “the biggest winner of 2016,” noting it’s posted 15% gains so far in 2016:

Turmoil across global equity and currency markets has sparked demand for a haven. Speculators raised their net-long position in gold to the highest in a year.”

The demand for gold and silver bullion coins surged in the last half of 2015, and it has not abated so far this year, despite a rally in the price of both metals.

Last year, demand was so strong the US Mint sold out of American Silver Eagles in July. Inventory was replenished in August, but the coins were on weekly allocations of roughly 1 million ounces for the rest of the year. The mint set a record for Silver Eagle sales in 2015, with the final total coming in at 47 million ounces.

The demand for American Gold Eagles was equally brisk in the last half of 2015. The US Mint announced it had sold out of one-ounce coins in late November and halted production for the year. It sold out of smaller sized Gold Eagles earlier that month.

After a tepid first half of 2015, demand for gold rallied during the last half of the year, despite a number of economic and external factors working against it.

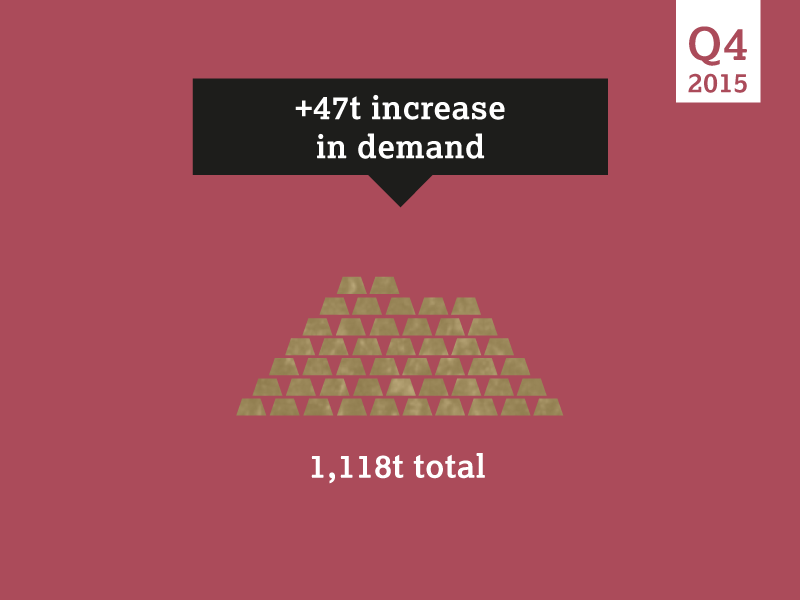

According to the World Gold Council’s Gold Demand Trends Full Year 2015 a surge in demand during the fourth quarter turned around what was looking to be a bad year for the yellow metal:

Gold demand in the fourth quarter increased 4% year-on-year to a 10-quarter high of 1,117.7 tons. Full year demand was virtually unchanged…Weakness in the first half of the year was cancelled out by strength in the second half. Fourth quarter growth was driven by central banks (+33 tons) and investment (+25 tons).”

Central bankers want you to think they have all the answers. They talk about their policy “tool kits” as if they can just reach in and find the proper solution for any possible economic scenario.

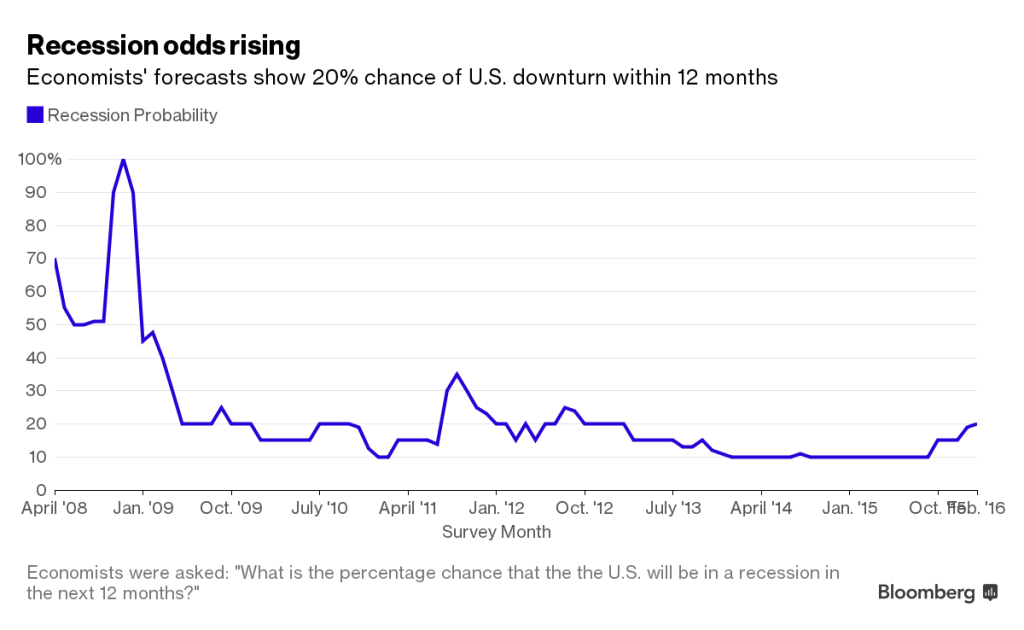

But if you peer behind the curtain, it becomes apparent they may not really know what they’re doing after all. In fact, with a recession looming on the horizon, there are some signs of desperation among economic central planners.

The conventional Keynesian wisdom that dominates today holds that central banks need to lower interest rates when the economy slumps in order to stimulate borrowing and spending. But rates in the US hover just barely above zero. In the Eurozone and Japan, they languish in negative territory. So, what is a central banker to do when the next recession hits?

With four states officially in recession, and economic data continuing to point toward a broader downturn, it’s getting increasingly difficult for officials to sell the illusion of a strong US economy.

Peter Schiff has been saying for weeks that the US may already be in a recession. Recently, Jim Grant appeared on CNBC’s Closing Bell and echoed Peter’s sentiments, saying the US likely went into recession in late December. And while officials at the Federal Reserve keep insisting the US economy remains strong, some mainstream analysts have started sounding recession warning bells as well. In fact, the number of mainstream economists predicting a recession within the next 12 months continues to rise.

So far, people have been able to blow off talk of a looming recession as mere chatter, but in some US states, it’s not just speculation; it’s reality. According to a Bloomberg report, four US states have officially gone into recession, with three more “at risk of prolonged declines.”

Could the student loan bubble be on the verge of popping?

If desperate government actions serve as any indication, it may well be.

Last week, seven US Marshals armed with automatic weapons came to Paul Aker’s home in Houston to arrest him for a $1,500 student loan debt dating back to 1987. According to the Guardian, Acker isn’t alone facing the barrel of a gun over outstanding student loans:

Aker is unlikely to be the only person to be surprised by marshals collecting on student loans. A source at the marshal’s office told Fox 26 that it is planning to serve warrants on 1,200 to 1,500 people over student loan debts.”

The war on cash heated up this week when a former Obama economic adviser/ex-Treasury secretary floated the idea of eliminating the $100 bill.

Lawrence Summers called for death to the Benjamins in a post on his Washington Post blog titled It’s Time to Kill the $100 Bill. The post announced the release of a paper by Harvard’s Mossavar Rahmani Center for Business and Government senior Fellow Peter Sands arguing that governments should stop issuing high-denomination currency such as 500 euro notes and $100 bills. The paper even proposed withdrawing such currency them from circulation.

Cash warriors always publicly center their arguments on the need to limit cash as a way to fight drug crime, terrorism, and tax fraud. This was exactly how Summers framed the argument in his blog post:

Kyle Bass, a well-known hedge fund manager who profitably shorted the subprime mortgage crisis, strongly believes gold investors should take physical possession of their precious metals. Speaking about his role as a fiduciary board member for the University of Texas Investment Management Company (UTIMCO), Bass explained last year why he advised UTIMCO to take physical possession of its nearly $1 billion worth of gold bars held in COMEX vaults.

Bass’ comments are particularly important given the newfound love for gold in the mainstream media that we’ve been reporting. Many investors assume that buying a gold Exchange-Traded Fund (ETF) on the COMEX is the same as investing in the physical metal, because such funds are “backed” by physical gold. Even Jim Cramer, who has recently come around to gold, actually advises buying paper gold instruments, rather than the real thing. But Bass shattered the illusion of the so-called “gold backing” of these funds:

Negative interest rates are becoming more and more in vogue and that could be good news for gold.

Last week, Sweden’s central bank plunged a key interest rate even deeper into negative territory. Riksbanken slashed the rate from negative 0.35% to negative 0.50%. Many analysts anticipated the rate reduction, but the magnitude of the cut caught most by surprise.

The Swedish central bank’s move followed on the heels of the Bank of Japan dropping a key interest rate to negative 0.1%. The Japanese bank indicated it was willing to go deeper into negative territory if necessary.

All of a sudden, everybody has gone bullish on gold, even Wall Street.

Within the last couple of days Jim Cramer, the CNBC Nightly Business Report, and Van Eck Global all sang gold’s praises. Cramer said, “There is a bull market in Gold,” and CNBC Nightly Business Report opened the show Monday proclaiming, “Hard assets – stocks slump, gold shines.”

CNBC even devoted a blog post to technical analysis on the gold bull market, saying “the rally in gold has the potential to develop into a breakout from the consolidation base and become a new uptrend.”

Wall Street has apparently caught on to what Peter Schiff was saying a month ago – 2016 looks like a big year for gold. This video compilation tells the story.