JP Morgan Chase Bank just fired another salvo in the “war on cash.”

The bank recently capped ATM withdrawals for non-Chase customers at $1,000 per day. The move came after the bank began installing new ATMs that dispense $100 bills. Some people were reportedly pulling tens of thousands of dollars out at one time, according to a report in the Wall Street Journal. A spokeswoman said the bank “felt it was prudent to set withdrawal limits on all of our ATMs.”

Chase claimed the move was primarily to fight fraud. This is always the justification used when banks and government agencies slap limits on access to cash. But according to the WSJ report, there haven’t been signs of criminal activity in the recent big-dollar cash withdrawals from Chase ATMs:

The bank said there doesn’t appear to be fraud involved. But partly due to heightened regulatory scrutiny, banks are paying more attention to large cash transfers that could be a sign of money laundering or other types of shady activity. Typically, the card-issuing bank sets withdrawal limits, not the bank owning the ATM.”

The market for silver jewelry grew in 2015, mirroring an overall surge in demand for the white metal, according to a survey report released yesterday by the Silver Institute:

Silver jewelry sales in the United States were solid in 2015 with 60% of jewelry retailers reporting increased sales, according to a survey conducted on behalf of the Silver Institute’s Silver Promotion Service (SPS). This marked the seventh consecutive year of growth for silver jewelry sales and confirmed that silver jewelry is an increasingly important category for many retailers.”

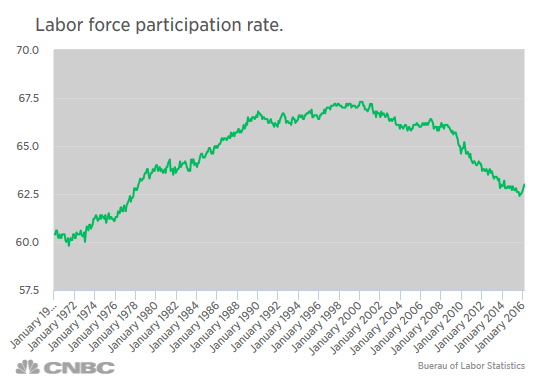

Donald Trump managed to shove his way into the spotlight again last week, claiming the US is heading for “a massive recession.” Unsurprisingly, the mainstream media scoffed at Trump’s assertion, pointing to the “great jobs report” that came out Friday.

The report did show the US economy added some 215,000 jobs, slightly more than expected. But once again, the headlines only tell a little piece of the story. And once again, most mainstream media and financial analysts are ignoring the bigger picture. In fact, all of the positive spin about a great employment outlook is nothing more than an April snow job. As Peter Schiff succinctly put it in his recent podcast, this was not a good jobs report:

We added the jobs we don’t want; we lost the jobs we do want. That is the real story. It’s the story nobody wants to tell. Everybody wants to talk about the number as if this is some kind of economic miracle.”

This is not an April Fools’ Day joke!

These are the winners in Peter Schiff’s Gold Giveaway.

Winners collected more than $4,500 worth of prizes, including gold coins, silver bars, and books signed by Peter Schiff.

These lucky people were drawn at random from all of the entries submitted.

The Russians have launched into a gold buying spree.

Based on recently released International Monetary Fund numbers reported at Mining.com., the Russian central bank ranked as the world’s leading gold buyer in February, adding 356,000 ounces to its reserves:

Last December, Russia announced plans to increase its gold reserves to $500 billion within the next five years. As a Russian publication put it, “Gold is considered to be a buffer against external economic risks and is currently in favor in Russia.”

When we talk about increasing gold demand, the focus tends to fall on Asia. Earlier this week, we reported surging investor demand for the yellow metal in China. The Japanese have also gone on a gold buying spree since that country’s central bank plunged interest rates into negative territory. But it isn’t just Asians who are bullish on gold. Analysts say they see signs of growing demand for the metal in Europe as well.

According to an article published at CNBC, central bank action appears to be rejuvenating gold in Europe, as the entrenchment of negative interest rates makes depositing cash in banks less and less rewarding. UBS strategist Joni Teves said European central bank policy could become increasingly influential on the gold market:

Although gold is very much driven by US Federal Reserve policy, the impact of European Central Bank (ECB) policy decisions may become increasingly relevant for gold price action, as concerns about negative interest rates gain traction among investors.”

You may have heard that you can’t purchase more than $10,000 worth of gold without it being reported to the IRS.

This is a myth.

You can avoid IRS reporting requirements, even on large-scale purchases. You just have to know the rules. Our brand new Guide to Tax-Free Gold and Silver Buying provides the information you need to navigate the complex world of IRS reporting. You’ll learn:

- The truth about $10K reporting requirements.

- What kind of sales transactions trigger IRS reporting.

- How to buy and sell gold and silver in complete privacy.

Download The Free Tax-Free Gold and Silver Buying Guide Here

Generally speaking, rising prices tend to temper demand, but when it comes to gold in China, the recent price rally has created the opposite effect. As the Wall Street Journal put it, “Chinese investors see a golden opportunity.”

Demand for gold has surged in China over the last several weeks, during a period generally considered out of season. And it’s not typical Chinese jewelry purchases driving the demand. Chinese investors are buying gold coins and bars.

Typically, gold purchases in China are strongly associated with jewelry buying around the Lunar New Year holiday, which this fell in early February. But the uncertainty confronting global economies has driven up demand from a different sort of buyer—the hard-nosed investor.”

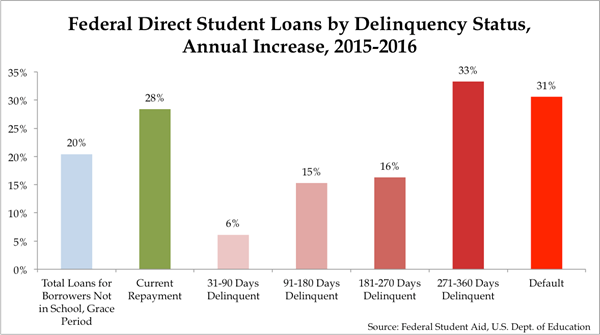

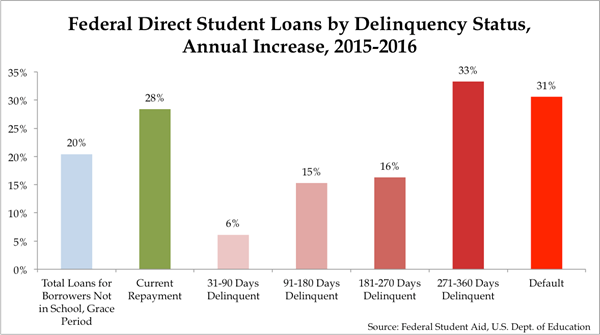

The feds recently released new data on student loan debt. The Department of Education press release claimed it showed “promising repayment trends.”

If these latest numbers are good news, I’d hate to see the bad.

As the Foundation for Economic Education (FEE) pointed out in its blog, total student loan debt increased at a healthy clip last year:

The total amount of outstanding direct student loans stood at $855 billion at the beginning of the first quarter of 2016, distributed among over 30 million recipients. (This total does not include loans still outstanding under the now-discontinued FFEL program, which guaranteed private-sector student loans.) The total direct loan amount outstanding is up roughly 15% over a year ago, doubtlessly the result of relentless tuition increases.”

The numbers also reveal that 46% of student loans are not currently being repaid. That doesn’t include debt held by students still in school or within the six-month grace period after graduation. Here’s a breakdown by the FEE:

Peter Schiff’s Gold Giveaway ended at midnight last night. Winners will be drawn at random from all of the entries that were submitted. We will be announcing them soon.

Lucky winners will collect more than $4,500 worth of prizes, including gold coins, silver bars, and books signed by Peter Schiff.