As the Wall Street Journal put it, the debt crisis in Puerto Rico entered a “more perilous phase” after the Government Development Bank defaulted on a $422 million payment Monday:

The missed principal payment, the largest so far by the island, is widely viewed on Wall Street as foreshadowing additional defaults this summer, when more than $2 billion in bills are due.”

Download SchiffGold’s Free White Paper: Why Buy Gold Now?

Congress is debating legislation to grant the territory new power to restructure its more than $70 billion in debt. If Congress fails to act, the US taxpayer could ultimately end up footing the bill for Puerto Rico’s debacle:

In a letter to Congress, Treasury Secretary Jacob Lew warned on Monday that a US ‘taxpayer-funded bailout may become the only legislative course available’ if the proposed restructuring legislation isn’t approved.”

So much for that socialist paradise.

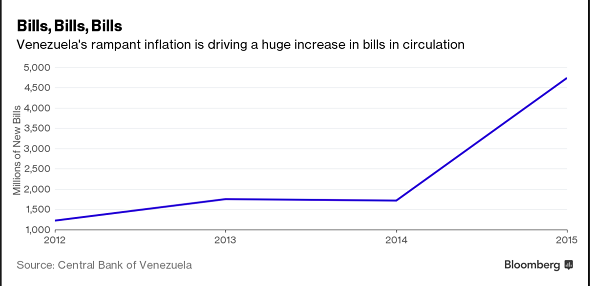

Last summer we reported that hyperinflation had devalued the Venezuelan bolivar to the point that people were using 2-bolivar notes as napkins. In order to keep up with the rate of devaluation, the Venezuelan government literally flew in 747s full of cash. Now we’ve learned that the Venezuelan government is so broke, it can’t even pay to print more money.

So, what is a benevolent socialist government to do?

Naturally, raise the minimum wage.

As we’ve been reporting for months, China is quietly becoming a dominant player in the world gold market, as the yellow metal shifts from the West to the East. Now the mainstream media is starting to take notice.

Not only is China the top consumer of gold in the world, ahead of fellow Asian nation India, it is also gaining stature as a player in the global market. Just last week, China launched twice daily gold fixing to establish a regional benchmark that will further bolster the country’s influence.

Earlier this week, NewsMax Finance published an article highlighting five trends in China it says will change the gold market forever. The piece nicely summarizes the trends we’ve been pointing out for more than a year. Based on these trends, NewsMax predicts China will become a dominant force on the world stage:

The gold market will soon be very different than from what we see today—largely due to the current developments in China. China’s influence will impact not just gold investors but everyone who has a vested interest in the global economy, stock markets, and the US dollar. After all, China will be a dominant force in all, as most analysts project.”

As the push for a $15 per hour minimum wage continues in earnest across America, policymakers had better consider the warning signs flashing from beleaguered Puerto Rico. Minimum wage policy was a major factor leading to the current crisis there.

The Government Development Bank in the US territory is operating under a state of emergency imposed to halt the erosion of its dwindling cash. Governor Alejandro Garcia Padilla declared the emergency earlier this month. The executive order suspends the bank’s lending power and freezes most withdrawals, except for those to fund public safety, health, and education services.

The GDB serves as the US territory’s primary financial agent. According to Bloomberg, the bank has $562 million in liquidity. It is currently negotiating with creditors, trying to avoid default on $422 million payment due May 1. According to a report at Fortune.com, Garcia Padilla says the bank can’t afford to repay the loan.

As Peter Schiff put it in his recent podcast, “Hi ho silver seems to be the rallying cry for the day.” (Scroll down to watch the full podcast.)

Last month, we reported silver could be poised to come out of the shadows. It certainly has – in a big way. Silver cracked $17 per ounce Tuesday, hitting its highest level in more than 10 months. On Monday, Bloomberg declared it a bull market:

Silver entered a bull market after climbing to a 10-month high amid positive signs for Chinese industrial demand and decreasing bets the Federal Reserve will raise US interest rates.”

The silver price has increased more than 23% since the first of the year, outperforming gold.

In another sign that it is becoming a major player in the world gold market, China launched twice-daily price fixing on Tuesday. According to a Bloomberg report, the move is an attempt to establish a regional benchmark that will bolster its influence in the global gold market:

The Shanghai Gold Exchange set the price at 256.92 yuan a gram ($1,233.85 an ounce) at the 10:30 a.m. session after members of the exchange submitted buy and sell orders for metal of 99.99 percent purity. Members include Chinese banks, jewelers, miners and the local units of Standard Chartered Plc and Australia & New Zealand Banking Group Ltd., according to the bourse.”

Gold has shifted from the West to the East over the past several years. China ranks first in the world in gold consumption, ahead of India at number two. China’s central bank aggressively added to its stock of gold during the last half of 2015, and that trend is expected to continue this year. The country is also making an impact on the worldwide gold market. Earlier this year, ICBC Standard Bank bought a huge gold vault in London, expanding China’s largest bank’s footprint in the city’s bullion market.

Here’s some free advice for the Federal Reserve.

It’s OK. You can tell them. They already know.

The economy is not good.

As Peter Schiff pointed out on CNBC yesterday, the Fed doesn’t really want to raise interest rates. We just witnessed what even a small nudge upward did to the stock markets after years of low rates and monetary policy artificially pumped them up. But on the other hand, the Fed doesn’t want to admit the US economy really isn’t in great shape:

The Fed is trying to walk a fine line, because they don’t want to admit how weak the economy is when President Obama is trying to elect Hillary Clinton based on the strength of the economy.”

Recognizing that large investments require tailored, individualized service, SchiffGold has developed a special desk for its institutional and high net-worth investors.

The SchiffGold Institutional and High Net-Worth Desk provides discreet, personalized, one-on-one service for clients investing $250,000 or more. It also offers the type of heavily discounted pricing that high net worth and institutional investors are entitled to receive. Click here to learn more.

SchiffGold offers several exclusive features through the Institutional and High Net-Worth Desk:

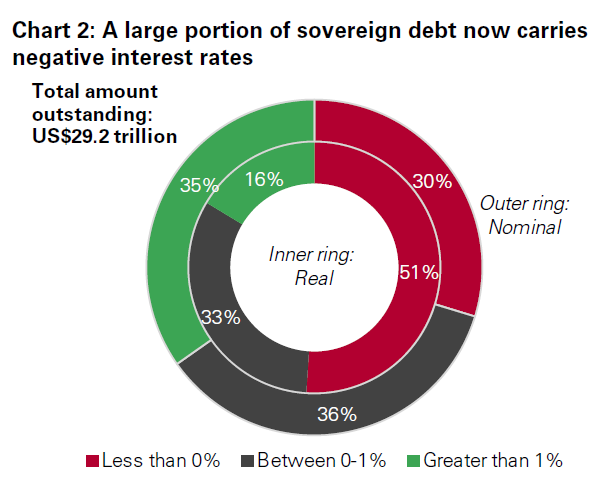

More than half the world’s sovereign debt now carries negative interest rates, and data keeps coming in confirming that it is driving demand for gold.

A couple of weeks ago, CNBC reported central bank action appears to be rejuvenating gold in Europe, as the entrenchment of negative interest rates makes depositing cash in banks less and less rewarding. Now we have hard data reported by Bloomberg confirming a similar spike in Japanese gold demand since that country’s central bank plunged interest rates into negative territory earlier this year:

Gold sales surged in Japan through March after the country’s move to set negative interest rates sent investors scurrying for a shelter, a further sign that global central bank policy of keeping borrowing costs low or below zero is stoking demand for bullion. Bar sales climbed by 35% to 8,192 kilograms in the three months ended March 31 from a year earlier, Tanaka Kikinzoku Kogyo K.K., the country’s biggest bullion retailer, said in a statement Thursday.

The surge in gold purchases since the Bank of Japan’s interest rate move comes on top of a significant increase in demand last year. Consumer demand for the yellow metal almost doubled to 32.8 tons in 2015, up from 17.9 tons a year earlier.

More than half of the world’s sovereign debt now carries negative interest rates. The European Central Bank, Denmark, Switzerland, and Sweden, along with Japan, all currently have negative interest rates, and there is no sign that they will rise any time soon. Janet Yellen has even said that the US Federal Reserve will consider negative rates if economic conditions dictate:

The World Gold Council’s first quarter report is a bunch of bull. Or perhaps it would be more accurate to say it projects a very bullish outlook for gold.

The report confirms what we already knew – gold got off to a glittering start in 2016 – and it predicts the rally will likely continue and evolve into a genuine, long-term bull market.

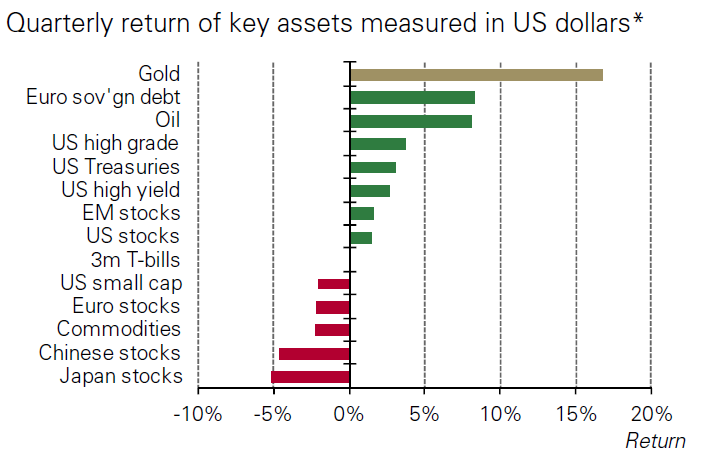

Gold rose nearly 17% in US dollar terms through the first three months of 2016, and the return on the yellow metal significantly outperformed most other major stock, bond, and commodity indices. Analysts at the World Gold Council say they don’t think it was just a flash in the pan. They say market dynamics indicate the rally will continue: