Mainstream Economists Agree with Peter Schiff: Rate Hike Can’t Stick

The Federal Reserve’s Federal Open Market Committee will kick off its December meeting Tuesday. Most pundits seem to think the Fed will raise the benchmark short-term interest rate from near zero to 0.25 on Wednesday. But many economists agree with Peter Schiff that even if the Fed ticks the rate up this week, it won’t stick.

Originally, conventional wisdom held the first rate hike would represent “liftoff.” It would signal the beginning of a series of hikes that would bring the rate back to “normalcy.” But as Peter Schiff pointed out last week, the Fed has walked back expectations. Instead of a liftoff, it is now signaling something that looks more like a hoverboard:

I believe that if the Fed raises rates by 25 basis points…as everyone expects it will, that the move will likely represent the END of the tightening cycle, not the beginning. (As I explained in my last commentary, the current tightening cycle actually started more than two years ago when the Fed began shortening its forward guidance on quantitative easing). The expected rate hike this month has long been referred to as ‘liftoff’ for the Fed, an image that suggests the very beginning of a process that eventually puts a spacecraft into orbit. But, in this case, liftoff will be far less dramatic. I believe the Fed’s rocket to nowhere will hover above the launch pad for a considerable period of time before ultimately falling back down to Earth.”

In the latest episode of The Peter Schiff Show, Peter expanded on this theme. He likened the Fed’s maneuverings to playing chicken with the stock market. He pointed out that all of the forward-looking economic signals point toward recession. But the Fed has backed itself into a corner. It almost has to raise rates slightly because it has created this expectation. Failing to nudge rates up would signal lack of confidence in an economy that the government has sold as recovered.

Peter argues that the Fed is now talking about raising rates only symbolically in order to create a false sense of confidence in the economy. People are saying, “If they don’t raise rates, they must be really afraid.”

“Well, they are afraid. And the only reason they might raise rates is to cover that fear up,” Peter said.

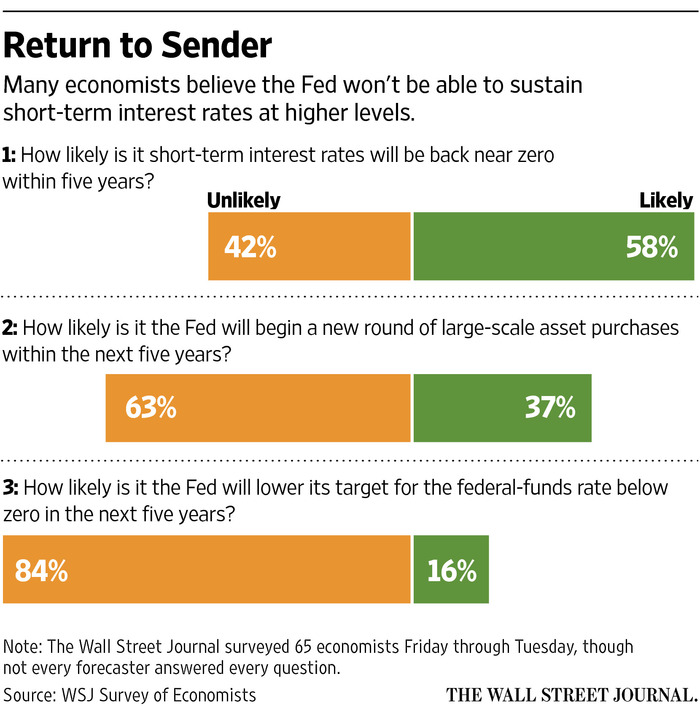

Peter isn’t alone in thinking that the Federal Reserve can’t maintain a rate hike. The Wall Street Journal polled 65 economists. A solid majority said they think interest rates will fall back to zero within five years. The Wall Street Journal touched on several factors that could push rates back down:

Any number of factors could force the Fed to reverse course and cut rates all over again: a shock to the U.S. economy from abroad, persistently low inflation, some new financial bubble bursting and slamming the economy, or lost momentum in a business cycle which, at 78 months, is already longer than 29 of the 33 expansions the U.S. economy has experienced since 1854.”

Peter mentions several of these same factors in his podcast.

Ten economists told the WSJ that they believe the Fed will ultimately follow the lead of the European Central Bank and push rates below zero.

The bottom line is the Federal Reserve has put itself in a damned if it does, damned if it doesn’t position. It has tried to sell its policy of intervention, low interest rates, and quantitative easing as a success. This rate hike is supposed to kick off the victory lap. But it appears that we are looking at a false start. As Peter points out, you can’t say you won until the game is over:

I’ve always said you can’t declare victory until you end the program. You can’t see the damage until you take away the stimulus. It’s like that’s when the hangover starts from all of your drunken partying the night before. So, what the Fed has to do in order to be vindicated and to say guys like me are wrong is you end your program [and] normalize interest rates. Not just raise them from zero to .25 – bring them back to normal. Shrink your balance sheet back down to where it was, and then if everything is still OK, if it hasn’t all fallen apart, if everything is good, then I’ll admit that [I was] wrong and you can take your bow.”

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Leave a Reply