China continued adding to its gold reserves and accelerated its pace in November.

According to Bloomberg, the Chinese upped their stash of of gold an estimated 21 tons last month, the largest increase in at least five months.

The value of gold assets was $59.52 billion at the end of last month from $63.26 billion at end-October, according to data on the People’s Bank of China website released Monday. That works out to 56.05 million troy ounces or about 1,743 tons, based on the London Bullion Market Association afternoon price auction on Nov. 30, Bloomberg calculations show. The stash was 55.38 million ounces a month earlier.”

After months of speculation, the Chinese yuan is now officially part of the International Monetary Fund’s benchmark currency basket, elevating it to reserve currency status.

Chinese monetary policy has focused on gaining entry into this elite club for the last year or so. With its membership safely secure, it raises an interesting question.

What’s next?

The IMF announced the yuan’s inclusion in the Special Drawing Rights (SDR) basket Monday. The New York Times called it a “milestone decision,” underscoring the significance of the move in terms China’s growing power on the world economic stage:

You probably think of eBay as a good place to snag a deal on electronic gadgets, musical instruments, or sporting goods. But increasingly people are logging onto the auction site to buy gold and silver.

EBay officials told CNBC the company is touting its global user base of 150 million people to reach non-traditional buyers. With so many people entering the market for precious metals, buyers should beware. The strong demand creates a breeding ground for scammers. In fact, eBay is apparently using the demand for gold and silver bullion to peddle collectibles.

Black Friday has become an infamous holiday of American consumerism. We seem equally amused and disgusted by the inevitable news of crowds waiting through freezing nights only to trample each other on the way to a discount toaster. Many people watch a video of Black Friday fights like the one below and shake their heads at the blatant materialism. We ask ourselves, “Where has the good, old-fashioned holiday spirit gone?”

Perhaps we should be asking a different question. These fights seem almost like an ominous foreshadowing of just how desperate people could become when faced with a real economic crisis. When Peter Schiff points to goods shortages, hyperinflation, and drastic bank emergencies in countries like Greece, Cyprus, or Argentina, most people shrug it off. “That could never happen here. America is different.” But if suburban house moms are willing to get into hair-pulling fistfights over electronics discounts, what do you think they’d be willing to do when their life savings disappears overnight thanks to inflation or a banking crisis?

On Tuesday, the US Mint announced it has sold out of one-ounce 2015 American Gold Eagles. Mint officials say they don’t plan to produce any more at this time.

Earlier this month, the mint announced it had run out of one-tenth and one-fourth ounce Gold Eagles.

The tremendous demand for gold bullion coins we’ve seen over the last several months continues unabated in November. Buyers have already snatched up 80,500 1-ounce Gold Eagles this month. Combining all coin sizes, total Gold Eagle sales stand at 199,500 in November.

A federal program that will soon forgive billions of dollars in student loans illustrates the ineptitude of government planning and foreshadows bigger problems down the road.

The Public Service Loan Forgiveness (PSLF) Program erases the balance on student loans after the debtor makes 120 monthly payments while working full-time for a qualifying employer. The program was designed to incentivize graduates to go into relatively low-paying public service jobs such as public defender, social worker, and public health provider.

But as the Wall Street Journal reports, a loophole will allow thousands of high-paid workers to dump their student loan debt:

Increased demand for solar power is forecast to put significant upward pressure on silver prices in the years to come.

CNBC recently reported on the strong potential in the solar industry as governments continue a concerted drive to reduce global carbon dioxide emissions:

While the solar industry just accounts for just 6% of overall physical silver demand now, global solar capacity is growing at an average rate of 53% a year in the last decade, underscoring future growth potential, said London-based Capital Economics’s Simona Gambarini in a note Tuesday. About 2.8 million ounces of silver are needed to generate one gigawatt of electrical capacity from solar energy.”

The headline on the Pittsburgh Tribune-Review website says it all – “Collectors willing to overpay for silver.”

The article highlights an ongoing silver scam in Pennsylvania and other states featuring “US State Silver Bars.”

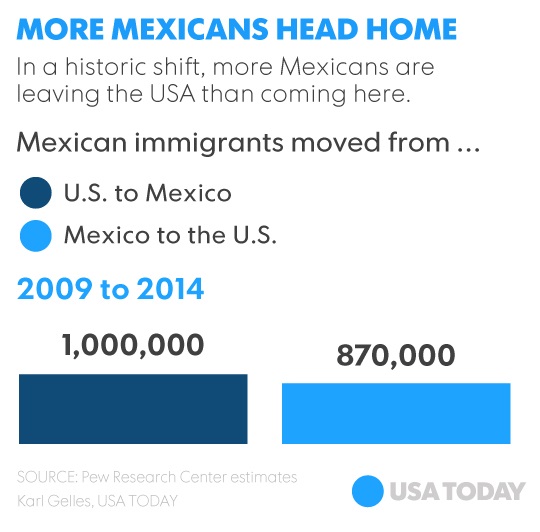

Mexican immigrants are going home.

For the first time in more than 40 years, more Mexicans are leaving the United States than entering. Citing a Pew Research Center report, USA Today notes that from 2009 to 2014, an estimated 870,000 Mexicans came to the US, while 1 million returned home. That represents a net loss for the US of 130,000.

Pew director of Hispanic research Mark Hugo Lopez cited a number of reasons for the immigration shift:

More than 80,000 student loan debtors can now apply for loan forgiveness through the US Department of Education after the conclusion of an investigation into now defunct Corinthian Colleges this week.

The company once owned more than 100 for-profit colleges. It filed for bankruptcy in May in the wake of a probe into its practices. According to a Bloomberg report, the investigation found Corinthian systematically misrepresented the chances of landing a job with a degree from its schools in order to enroll new students.