Mainstream media pundits and government officials continue to talk about a growing US economy, but signs in America’s heartland point in the opposite direction.

Peter Schiff has made the case that the stagnating economy is driving this strange election cycle, and helps explain the rise to prominence of Donald Trump and Bernie Sanders.

But the election isn’t the only sign everyday Americans sense problems in the economy. Their behavior also reveals concern.

According to a MSN Money report, Americans have drastically reduced eating out. Growth in the fast food sector has come to a screeching halt:

Visits to fast-food restaurants had been growing at a quarterly clip of 2% since September 2015, but haven’t grown at all in March, April or May, according to as-yet-unpublished data from market research firm NPD Group Inc. When fast-food growth comes to a halt, ‘that’s a red flag because it’s been an area of growth and it’s 80% of the industry,’ NPD restaurant analyst Bonnie Riggs said.”

My how things change.

This time last month, it was a foregone conclusion that the Federal Reserve was going to raise rates in June. Then the government released a shockingly bad jobs report and suddenly that rate hike was taken off the table. Even so, many pundits believed July would finally bring the much anticipated boost in the interest rate. But in the wake of the UK’s decision to leave the EU – that one is pretty much off the table as well.

In fact, many analysts now believe Janet Yellen won’t boost rates at all in 2016.

Peter Schiff recently appeared on CNBC’s Trading Nation and said the Brexit vote was “just what the doctor ordered as far as getting her out of jail free,” because now Yellen has the perfect excuse not to raise rates.

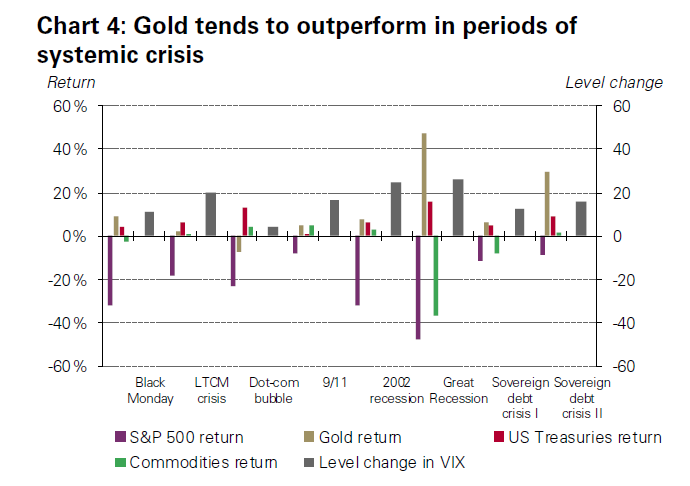

In a report released in the wake of the Brexit vote, the World Gold Council predicted “strong and sustained inflows into the gold market.”

In the immediate aftermath of the referendum, gold surged, reaching as high as $1,358.54 per ounce before falling back later in the day Friday. It was the highest level for gold since 2014. As World Gold Council analysts put it, gold did exactly what it was supposed to do:

Gold is fulfilling its classic role as a safe haven asset and performing exactly as the many investors that bought it in the run up to the referendum will have hoped. We expect to see strong and sustained inflows into the gold market driven by the intense market uncertainty that now faces the global markets.”

In fact, the sale of physical gold in the UK was brisk in the weeks leading up to the vote. The World Gold Council said it expects that trend to continue and even accelerate:

Purchases of gold coins by small retail investors, which were already up sharply in the months running up to the vote, should accelerate further.”

The price of gold soared in the wake of the Brexit vote, going as high as $1,350 on Friday before settling back slightly. As of the Monday morning after the vote, the yellow metal was up more than 5% from its close Thursday before returns started coming in.

The spike in gold after the shock of Brexit isn’t surprising, but many analysts say the bull run will likely continue.

The UK’s decision to exit the EU caught the mainstream off guard. Most analysts had predicted the stay vote would carry the day. Unsurprisingly, startled stock markets sold off and gold rallied when it became clear the pundits were wrong. Of course, historically investors turn to safe-haven assets like gold and silver in times of turmoil, so a spike in the price of gold is exactly what you would expect. Naeem Aslam, chief market analyst at Think Forex in London, called gold the “real winner” in the Brexit vote.

But there are indications that a lot more factors than just short-term, knee-jerk, safe-haven buying are pushing the price of gold up. That means this may be more than a reactionary spike in the market. A recent MarketWatch article made the case for $1,500 or even $1,900 gold in the next year or so:

The decision, known as Brexit, has vast implications for global financial markets, economies and currencies as well as for monetary policies among the world’s major central banks. That means gold could soon have many more reasons to rally.”

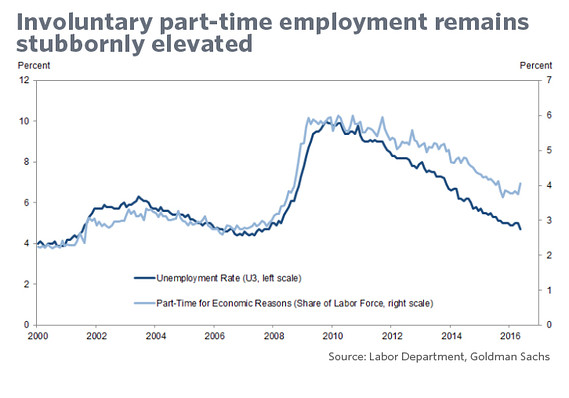

It appears some of the Obamacare chickens are starting to come home to roost.

Opponents of the massive intervention in the health care and insurance markets warned that it would increase prices and negatively impact employment. Supporters of the government health care program poo-pooed those predictions. But as some of the real-world implications of Obamacare become more apparent, it appears those predicting those unintended consequences were right.

We’ve heard countless stories about soaring insurance premiums across the country over the last several months. According to a recent Chicago Tribune report, rising insurance costs will continue into the future:

The British vote to leave the EU Thursday sent shockwaves through the financial markets and pushed gold to a 2-year high.

In the historic Brexit referendum, the British voted to leave the European Union by a 51.9 to 48.1 margin. Unofficially, 17,410,742 Brits cast exit votes, with 16,141,241 casting ballots to remain in the EU.

Nigel Farge headed up the UK Independence Party. He called the vote a victory for the little guy:

The dawn is breaking on an independent UK. If the predictions are right this will be a victory for the real people, for the ordinary people, and for the decent people.”

As it became clear the UK exit from the EU would prevail, gold surged. The price of the yellow metal climbed 4.7% to $1,316.05 an ounce by 11 a.m. in London. When markets opened in the US, gold rose as much as 8.2%, hitting $1,358.2 an ounce before paring gains and settling around $1,325 per ounce. Dominic Schnider, head of commodities and Asia-Pacific foreign exchange of the wealth-management unit at UBS Group AG said this is exactly what one would expect:

Last week, Jim Grant argued that the US manufacturing economy is flirting with recession, if it isn’t there already. He said the horse of speculation is ahead of the cart of enterprise. In other words, even though asset prices such as the stock market and real estate are rising, creating the illusion of economic prosperity, the actual underlying economy is a mess.

This reflects the views of a few other people like Peter Schiff and Mike Maloney who have argued that the US has already entered a recession. But by-and-large, these are voices crying in the wilderness. For the most part, mainstream analysts and government officials have not acknowledged the underlying problems in the economy. Even so, every once in a while, the truth leaks out through cracks in the mainstream narrative.

CNBC recently published an article by Pento Portfolio Strategies president Michael Pento arguing that a recession has already arrived:

While investors have been focused on the perennial failed hope for a second half economic recovery, they have been missing the most salient point: the US most likely entered into a recession at the end of last quarter.”

The CEO of one of the world’s largest gold mining companies says he expects gold supply to shrink over the next five years.

Gary Goldberg heads Newmont Mining. The company operates gold mines on five continents and employees more than 16,000 people. In an interview with Mining.com, Goldberg said he sees gold supply contracting in the near future as the gold market continues to expand.

Well, we have seen [the gold market] pop up a bit earlier this year off the back of higher investments in ETFs. We still see good demand for gold in China and in India. We see the medium- to long-term as being very good. I think you have seen a decrease in supply as there has been less investment in new properties. We are one of the few who are building two brand-new mines…Overall we see gold supply dropping by about 7% by 2021.”

Wall Street’s “bond king” said investors have lost faith in central banks, and called the Federal Reserve the “Zombie Fed.”

Jeffrey Gundlach made the comments in an interview with Reuters after safe-haven German Bund yields fell below zero on for the first time and global equity markets continued a precipitous slide:

Central banks are losing control and they don’t know what to do … just like the Republican establishment and Donald Trump.”

CNBC reported German 10-year sovereign bonds going negative for the first time ever on Tuesday:

At around 8.30 a.m. London time, the yield hit zero and briefly fell into negative territory as investors continued to flock to safe-haven assets. Bond prices and yields move in opposite directions and a negative yield implies that investors are effectively paying the German government for the privilege of parking their cash. By the end of the European trading day, the yield was still just in negative territory at negative 0.0020%.”

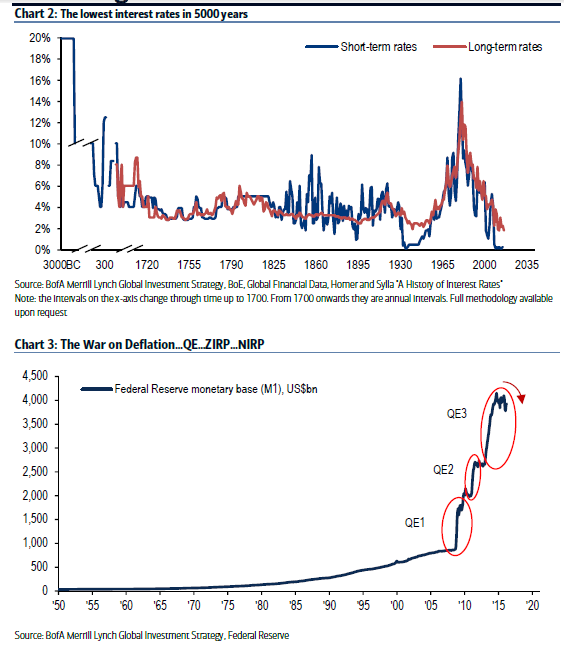

Do you know the last time the world’s interest rates were this low?

About 5,000 years ago.

Let that sink in for a moment.

Since the financial crisis in 2008, world governments have printed $12.3 trillion of money. Central banks have cut interest rates 654 times since the Lehman Brother collapse. There are nearly $10 trillion worth of negative yielding bonds.

And what have we gotten for all of this quantitative easing, interest rate slashing, and central bank monetary manipulation? Economic growth in advanced economies that won’t likely eclipse 2% this year and a global debt problem that has only grown more acute.