Many political and social upheavals this year have contributed to gold’s continued bullish run. From the Fed’s quarterly passes on rate hikes to Britain’s exit from the EU, the year’s turmoil has helped keep the yellow metal at a 25% increase for 2016.

The upcoming presidential election may prove to be one of the biggest unknowns that keep gold prices headed north. DBS Group Holdings Ltd.’s foreign exchange strategist, Benjamin Wong stated:

The market has yet to deal with the political uncertainty going into the Nov. 8 presidential election … We remain bullish and gold carries an overweight rating.”

To their credit, DBS Group Holdings Ltd. called gold’s rally this year. Last October, the fund bet on gold gaining in 2016 based on its prediction the Fed would raise rates very slowly. Recently, it’s been actively advising investors to buy during any downturns in the price of gold.

The Japanese economy is a mess.

The Chinese economy is a mess.

And the United Kingdom has been thrown into a sea of uncertainty in the wake of the Brexit vote. So what are the British people doing?

Buying gold.

According to a Reuters report, gold dealers in the UK report an extraordinary interest in gold post-Brexit – much of it from first-time buyers. The Pure Gold Company CEO Joshua Saul said British customers are pouring large portions of their wealth into the precious metal:

The Bureau of Labor released its Consumer Price Index report last Friday, which showed an increase in all consumer items by 0.2 %. The CPI measures the change in price Americans pay for all goods and services. According to the Wall Street Journal, the latest numbers indicate that the “effects of low energy prices and a strong dollar are fading.”

In short, prices are continuing to rise because of the ultra-low interest rates and quantitative easing. This is not only bad news for consumers, it’s worse news for the nation’s economy in general. That’s because the reported CPI is only a small peek into the actual effects of the Fed’s monetary policies. As Peter Schiff has said many times:

The methodology for computing the CPI has deliberately been designed to hide the effects inflation has on consumer prices.”

What’s hidden within the government-created CPI reports is the fact that most Americans are feeling the pinch. Gas price stabilization is also beginning to affect the overall increase.

Little old Chinese ladies are buying gold.

The South China Morning News (a Hong Kong paper) reported that mainland China imported five times more gold from Hong Kong in May. Recently released customs data showed imports from Hong Kong primarily grew due to cross border shipments to meet mainland customer demand.

Many of those customers are little old ladies, according to the paper:

Jasper Lo, chief executive of King International, said many mainlanders, especially ‘Big Mother’ investors – elderly ladies who like to invest in the metal – were major buyers of gold, which has risen in price by 28% this year, up 6% in the last three weeks.”

Gold traders say they expect the Chinese investors will continue to buy gold as the year goes on. According to Lo, economic volatility and uncertainty are driving gold demand on mainland China:

There has been a lot of talk about helicopter money lately.

Last May, Janus Capital’s Bill Gross said structural changes currently occurring in the US economy will ultimately lead the Federal Reserve to adopt this extreme form of monetary policy. Last week, Federal Reserve Bank of Cleveland president Loretta Mester revealed helicopter money is indeed a possibility during an interview on ABC’s AM program:

We’re always assessing tools that we could use. In the US we’ve done quantitative easing and I think that’s proven to be useful. So it’s my view that [helicopter money] would be sort of the next step if we ever found ourselves in a situation where we wanted to be more accommodative.”

Japanese officials have been seriously considering helicopter money. It now appears they won’t go all the way, but according to a Reuters report, Japan may try a “soft” form of helicopter money:

Millions of Americans are saddled with student loan payments. And that’s just considering those who can actually repay their debt. Data released in March revealed that 46% of student loans are not currently being repaid.

But despite the squeeze student loan repayment puts on American budgets, few choose to refinance their debt at lower interest rates. A recent poll of American student debtors reported by Bloomberg reveals some interesting reasons why:

There’s no overarching reason why they don’t refinance, though 20.1% pointed to the federal loan option that ties payment amounts to what they’re earning, and they didn’t want to risk losing it. About a quarter of those who answered the poll…said they simply weren’t aware of how to refinance. And 8.4% said they planned to seek forgiveness for their loans. (A third didn’t specify why they weren’t interested in refinancing; only 2% had been rejected when they attempted to refinance.)”

It’s revealing that many with student loan debt spurn the benefits of lowering their interest rates due to government incentives. In other words, we once again have a situation where US policy is creating an unsustainable bubble. The intentions might be good, but the unintended consequences are perverse.

Late last year, a paper published by the National Bureau of Economic Research showed a large percentage of the increase in college tuition is directly related to expanding financial aid programs. This recent poll reveals yet another incentive that exacerbates the problem in the long-term.

While investors have primarily focused on gold’s bull run, silver has quietly outperformed the yellow metal.

Between Jan. 1 and July 11, the price of silver increased 44.7%, according to the Silver Institute. The price of gold increased 27.7% in that same time period.

The Silver Institute said the surge in the price of silver was “fueled by increased investor interest in silver as a safe haven asset and as leveraged exposure to gold’s price rally.”

Demand for silver has been robust in both paper and physical markets. Exchange traded holdings of the white metal increased by 44.3 million ounces through the first half of 2016, hitting a record high of 662.2 million ounces.

Silver coin sales set a record in 2015 and kept up the pace through the early months of 2016, according to the Silver Institute:

The Japanese economy is sliding into oblivion pulled along by central bank policy. In response, the Japanese people are buying gold.

Economic growth has languished in Japan for nearly two decades despite extraordinary monetary policy including negative interest rates and round after round of stimulus. The government even flirted with the idea of helicopter money, although that appears to be off the table, at least for the time being.

Factory output is down and stocks are slumping. The Japanese government just cut its GDP estimate from 1.7% to 0.4%, and Prime Minister Shinzo Abe urged more central bank intervention. He called for coordinated stimulus from the government and the central bank in yet another attempt to revive the ailing economy.

Meanwhile Japanese people are doing what people have done for centuries when faced with economic uncertainty. They are plunging into gold.

Over the last few months, a number of big-name, mainstream investors have said buy gold. Stanley Druckenmiller publicly advised investors to sell US stocks and buy gold. Legendary hedge fund manager Paul Singer said “it makes sense to own gold.”

With Brexit now a reality, and bond yields slipping lower and lower, the gold bulls continue to charge. This week, Joe Foster, gold strategist at VanEck, jumped on the bandwagon, saying he expects $1,400 gold this year, and he doesn’t believe it will end there:

Many are seeing the looming potential for another financial crisis and making a strategic allocation to bullion as a hedge against systemic risk.”

TD Securities also predicts $1,400 gold and said $1,500 is possible if the Federal Reserve further cools market expectations for an interest rate hike:

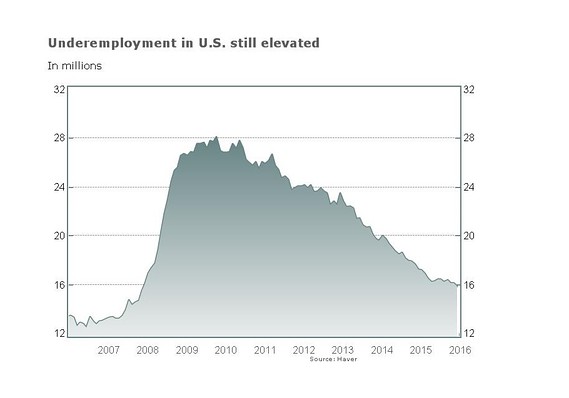

The June jobs report with its 287,000 new jobs lifted both spirits and markets drug down by the recent Brexit vote and other economic bad news. But the oft-reported numbers – jobs added and the unemployment rate – obscure the truth. In fact, the “real” unemployment rate remains above pre-recession levels.

As Peter Schiff pointed out in his most recent podcast, the numbers buried in the numbers tell a different story – a jobs market still struggling mightily even though the mainstream is in celebratory mode:

Overall, a mixed picture, but the headline number, the 287 versus 180 consensus, that’s normally the number the market trades off and that is exactly what happened.”