Will you ever retire?

More and more Americans will not.

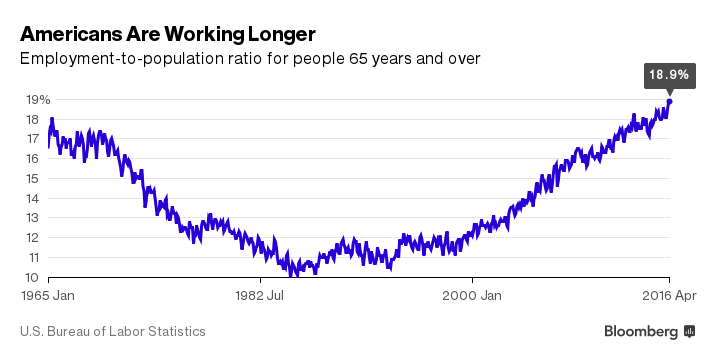

According to the latest data from the US Bureau of Labor Statistics, almost 20% of Americans 65 and older are still working. That’s the largest percentage of older Americans on the job since the early 1960s. With Baby Boomers hitting retirement age, it’s the largest number of Americans over 65 working ever.

Surveys indicate a growing number of people plan to continue working past retirement. The number of Americans who said they intend to continue working “as long as possible” came in at 27%. A full 12% said they don’t plan to retire at all.

When you think about government, innovation isn’t exactly the first thing that comes to mind. Just last week, CNN reported that the US Department of Defense still uses 1970s era computing systems that require “eight-inch floppy disks.” Some of these ancient computers run US nuclear weapon systems:

Such disks were already becoming obsolete by the end of that decade, being edged out by smaller, non-floppy 3.5 to 5.25-inch disks, before being almost completely replaced by the CD in the late 90s. Except in Washington that is. The GAO report says that US government departments spend upwards of $60 billion a year on operating and maintaining out-of-date technologies.”

But when it comes to finding ways to wring money out of their citizens, governments suddenly become exceptionally innovative.

A British barber and businessman recently floated the idea of a “beard tax.”

The head of a major silver mining company says he thinks we will see triple-digit silver prices in the near future.

Keith Neumeyer serves as CEO of First Majestic Silver Corp. The company ranks as the second largest silver producer in Mexico – the world’s leading country in silver production. Neumeyer told Bloomberg a major Japanese electronics maker approached the company last month seeking to lock in future silver stock. This is a sign that supply concerns could significantly boost the price of the white metal – perhaps as much as nine-fold:

For an electronics manufacturer to come directly to us — that tells me something is changing in the market I think we’ll see three-digit silver.”

Neumeyer said he believes the price of silver could surge to $140 per ounce as early as 2019.

Good morning Puerto Rico. Default is coming.

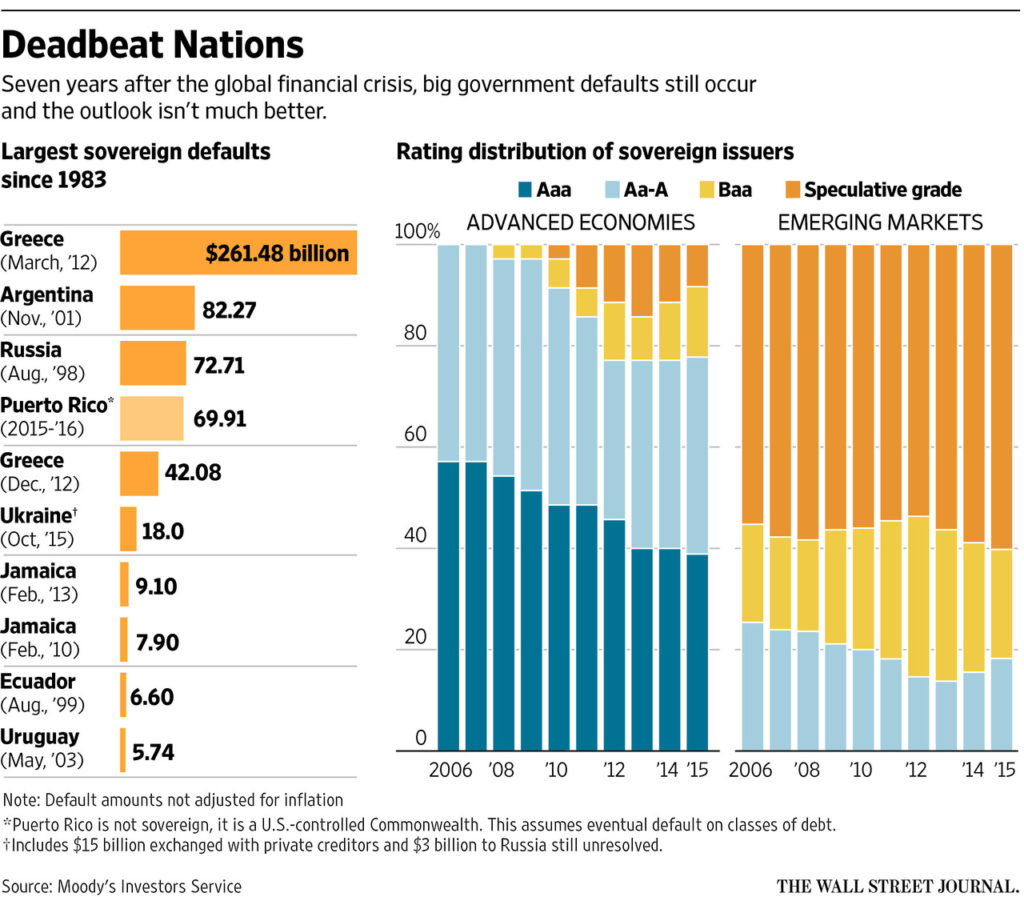

Legislation moving in Congress would set up an oversight board to guide the US territory through what essentially amounts to bankruptcy. It would not expend federal funds to bail out Puerto Rico, but would allow the island’s government to pay back debtors at less than 100%.

This is just a taste of things to come.

A default was unthinkable just a couple of years ago. The national obligation to repay what it owes was once considered almost sacrosanct. In 2013, Puerto Rico Gov. Alejandro García Padilla said paying back all of its debt was not only constitutional, but “a moral obligation.”

Times have changed, as the Wall Street Journal points out:

Though markets have met the event with a shrug, that shouldn’t diminish the significance of the moment. It underlines how much the stigma about government default has faded. Investors would be wise to build this risk into their calculations when lending to governments from now on, especially since arithmetic suggests more defaults are on the way. With less moralizing and more planning, both creditors and debtors will be better off.”

Last week we reported that central banks were jettisoning US debt and buying gold.

Figures released by the IMF this week indicate central bank gold hoarding has not abated.

Russia and China both extended their prolonged buying spree in April. Russia added 16.2 tons to its reserves. China increased its holdings by 10.9 tons. Another major buyer was Kazakhstan. The former Soviet Republic raised its tonnage by 3.2 tons. Turkey added 2.6 tons to its stash.

Not only is the Chinese central bank continuing to expand its gold reserves, the country is steadily becoming a major player in the world gold market. Earlier this month, the largest Chinese bank bought one of the biggest gold vaults in Europe, as it expands its influence on global gold trade.

We’ve said before that the growing level of debt in the US is the elephant in the room we are going to have to address at some point. We’ve talked about the massive government debt and the drag it puts on the US economy. We’ve talked about the crushing weight of student loan debt – increasing at a rate of about $2,726 per second. We’ve talked about the mounting corporate debt, doubling since 2008.

And then there is personal debt.

Americans are burning up the plastic. Credit card balances are on track to hit $1 trillion this year. That is getting close to the all-time peak of $1.2 trillion hit in July 2008, just as the financial crisis was intensifying.

Policies create by Congress helped break Puerto Rico. Now it’s wrangling over over how to fix it, as time seems to be running out on the US territory.

Congress has struggled to find solutions acceptable to both Republicans and Democrats. The House Natural Resources Committee released a compromise bill around midnight Wednesday, hoping to bring the various sides together. Earlier this month, the Puerto Rican Government Development Bank defaulted on a $422 million payment. A $1.9 billion debt payment looms in June. Meanwhile, as Reuters reports, the island is hurtling toward a full-blow humanitarian crisis:

Puerto Rico has already defaulted on some of its roughly $70 billion in debt while trying to cope with a 45% poverty rate among its 3.5 million US citizens. In addition, it is reeling from a Zika virus outbreak that is hurting its critical tourism industry.”

Apparently, it’s a lot easier for government to create a debt crisis than it is to fix it.

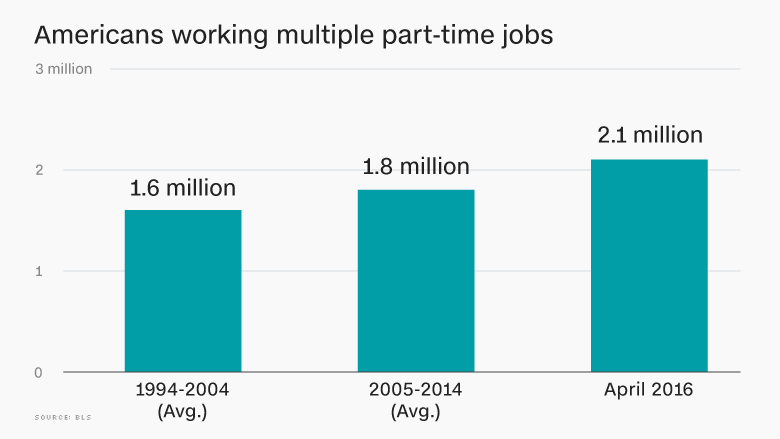

Jobs, jobs, jobs!

We’ve been hearing about strong jobs growth for months. And it’s true. There are lots of new jobs. It’s a good thing too, because a lot of people need two or three to make ends meet in today’s economy.

The Fed is hinting strongly at an interest rate hike in June. In fact a lot of people have taken it as a foregone conclusion that the US central bank will definitely hike rates next month.

But as Peter Schiff pointed out on his recent podcast, the Fed didn’t say it is going to raise interest rates in June. Fed officials said they would consider a rate-hike appropriate if certain things fell into place.

One of the factors the Fed relies heavily on in its “data-dependent” decision making process is the employment picture. As Peter said – it isn’t good. The April numbers were not encouraging:

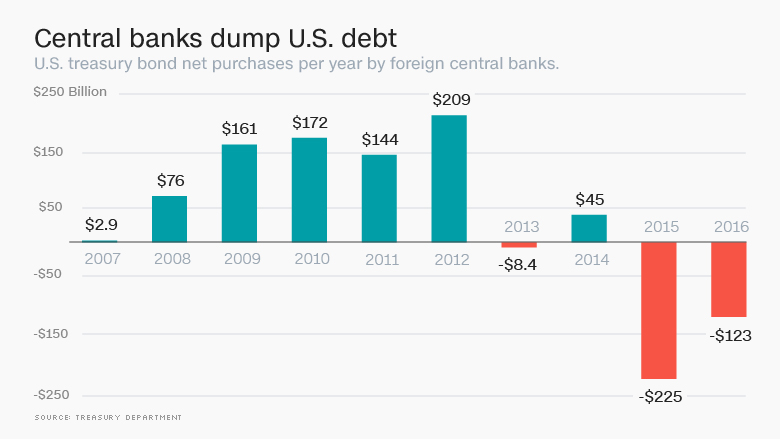

Continuing a trend that started last year, central banks around the world are dumping US debt at a record pace.

Central banks sold off a net $17 billion in US Treasury bonds in March. Sales set a record in January, hitting $57 billion. China, Russia, and Brazil led the way, each dumping at least $1 billion in US debt in March alone.

So far in 2016, global central banks have jettisoned $123 billion in US debt. Last year, they sold off $226 billion. According to the Treasury Department, central banks are selling US Treasuries at a pace not seen since at least 1978.

China is serious about gold and continues to expand its influence on the world gold market.

On Monday, China’s largest bank announced the purchase of one of Europe’s biggest gold vaults. Reuters reported the sale:

ICBC Standard Bank is buying Barclays’ London precious metals vault, giving the Chinese bank the capacity to store gold worth more than $80 billion in the secret location. The vault is one of the largest in Europe, with a capacity to hold 2,000 tons of gold, silver, platinum and palladium. It has been operational since 2012. ICBC Standard Bank said on Monday it has signed an agreement to buy the vaulting business and transfer the associated contracts, subject to consent. The deal is expected to complete in July.”