A lot of big-time investors are turning bullish on gold.

Last month, Stanley Druckenmiller publicly advised investors to sell US stocks and buy gold. Legendary hedge fund manager Paul Singer said “it makes sense to own gold.” Even George Soros has jumped on the gold bandwagon, recently selling stocks and buying gold. Other mainstream investors and analysts have also gotten that gold gleam in their eyes.

What is driving this newfound gold bullishness? It really comes down to one simple word.

Fear.

With all of the economic uncertainty, negative interest rates, and general instability in the world, people are once again turning to the historical safe-haven – gold.

On June 7, the Washington DC Council voted to raise the city’s minimum wage to $15 per hour. DC joins New York and California, along with a number of major US cities that have made the move to boost the minimum wage over the last year.

The DC Council’s vote was a major symbolic victory for supporters of the well-organized “Fight for $15” campaign. According to the Washington Post, the effort resonates with Americans:

Polls find strong support for a $15 wage floor as many Americans have become frustrated by the loss of well-paying manufacturing jobs and the growth of low-paying retail and service jobs.”

Last spring, ReasonTV asked residents of the “trendy, hipster enclave” of Silver Lake in Los Angeles, “What is the ‘right’ minimum wage?” Unsurprisingly, most assumed a higher minimum wage is a no-brainer – a win-win for society and workers.

The British have gotten gold fever.

According to a Reuters report, uncertainty surrounding the upcoming Brexit vote is driving quite a gold boom:

At Sharps Pixley, a gold showroom in London’s smart Mayfair district, demand for bullion bars and coins is rising, with men and women of all ages buying up the safe-haven metal in case of a British exit from the European Union.”

Sharps Pixley chief executive Ross Norman told Reuters that stocks of gold coins and bars are selling out before they even hit the shelves. Demand for Britannia coins is particularly strong. Since they are legal tender, Britannias are not subject to capital gains taxes.

In an interview with the World Gold Council for the latest edition of Gold Investor, former Bank of England head Lord Mervyn King made the case that it’s sensible for central banks to buy and hold gold.

Interestingly, the reasons he offered are good reasons for individual investors to buy gold as well.

King addressed the fact that many Asian and South American nations are increasing their gold reserves. He said they don’t want to rely completely on US bonds, and pointed out that while most people take it as given the US would never default, debt comes with inherent risk. Just ask the people who invested in Puerto Rican bonds.

I can understand why they feel that some proportion of their portfolio needs to be in gold. Over the last decade or so, the claims by some emerging market countries on the US have grown. Who knows what the future holds, but China and other countries do not want to be in a situation where all their international assets are in effect dependent on the US. Of course the US would not want to renege on its debts, but if some awful conflagration occurred, then all China’s assets in the US might be annulled. So there are plenty of big concerns that make it extremely reasonable to have assets in your portfolio that are not dependent on the goodwill of other countries.”

The shockingly bad May jobs report dumped a bucket of cold water on central bankers and mainstream pundits. A June interest rate hike that was a foregone conclusion just a week ago disappeared like a teenager when it’s time to do the dishes. Suddenly, a lot of people are starting to realize the great Obama economy isn’t quite as advertised.

Peter Schiff has said several times we are in a “phony recovery,” and the US economy is likely already in recession. A few other “contrarian” voices like Mike Maloney have echoed Peter’s warning. If we dig a little deeper, we find buried in the jobs data a major red flag that indicates that they are probably right.

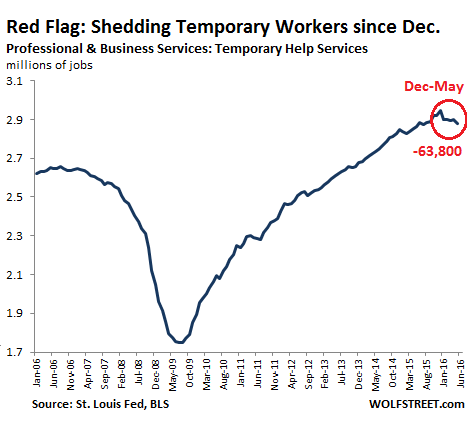

The number of temporary jobs has been on the decline since peaking last December. In May, the economy shed 21,000 temp jobs, bringing the total to nearly 64,000 lost since December of last year.

Why is this so significant?

Economists say election uncertainty is subduing economic growth. But it seems more likely the horrible economy is driving this strange election cycle.

For months, Peter Schiff has been saying if the US isn’t already in recession, it will be in one soon. Former Reagan Office of Management and Budget Director David Stockman recently told Neil Cavuto on Fox Business that the next president will inherit a recession. Last Month, Mike Maloney said the data screams a recession is already here.

For the most part, Peter and others are still voices calling in the wilderness. The mainstream keeps towing the line and pushing the idea that the economy is fundamentally sound and improving. But Americans know better, as the unrest and turmoil evident in this presidential election cycle makes clear.

If you’ve ever played Jenga, you know each player takes turns pulling blocks out of the core of a tower and then placing them on top. The tower gets less and less stable as the game goes on, until eventually it comes crashing down.

This is kind of like what the Federal Reserve does with the US banking and monetary system – except they actually claim they are making things more stable as they go.

Comments by two Federal Reserve governors last week indicate the central bank will likely require American banks considered “too big to fail” to further bulk up their balance sheets in order to protect against big losses and potential future bailouts in an economic crisis.

This is yet another demonstration of the arrogance of central bankers. They think they can control and stabilize an inherently unstable monetary and banking system. In fact, their constant intervention arguably creates a great deal of the economic instability they claim to protect us from.

Not long ago, a video surfaced featuring Democratic Party candidate Bernie Sanders claiming bread lines were a sign of good times.

You know, it’s funny. Sometimes American journalists talk about how bad a country is when people are lining up for food. That’s a good thing. In other countries, people don’t line up for food. The rich get the food and the poor starve to death.”

Well, it must be the best of times in Venezuela!

Here’s how Public Radio International described the scene just a couple of weeks ago:

Demand for physical gold and silver continues to surge with bullion coins flying out of the US Mint at a frenzied pace.

May gold coin sales increased more than 206% over the same month last year. The mint sold 76,500 ounces of American Gold Eagles in May and 18,500 ounces of Gold Buffalos. That compares with 21,500 ounces of Gold Eagles and 9,500 ounces of Gold Buffalos in 2015.

May typically marks the beginning of the slow season for gold coin sales, but 2016 was atypical. This was the strongest May for US Mint gold coin sales since 2011.

The US faces a massive debt problem. We all know it. But politicians and government officials are either unwilling or incapable of doing anything about it.

David Stockman mentioned the burden of debt in a recent interview with Neil Cavuto on Fox Business:

We have $63 trillion of total debt in this economy. The public sector – county, state, and local – is nearly $25 trillion. And we’re getting old. The Baby Boomers are retiring, 10,000 a day. In another 5 or 10 years we’re going to have a massive increase in the retired population. How do you fund all that? Who’s going to pay the taxes?”

Despite the glaring magnitude of the problem, government officials seem content to keep their heads buried in the sand and ignore it until it’s too late. Even when they acknowledge it, they seem utterly incapable of effectively dealing with the issue.

Illinois offers a prime example. The Prairie State has the lowest credit rating of any state in the US, and it hasn’t had an operational budget for almost a year. The situation passed the level of a “crisis” months ago. Still, with the end of this year’s legislative session looming, the state doesn’t appear close to getting a budget in place. The Wall Street Journal recently reported on the Illinois budget debacle: