The mainstream wasn’t just wrong about inflation in 2020. It was wildly wrong. In this episode of the Friday Gold Wrap podcast, host Mike Maharrey dissects a 2020 video produced by CNBC to show just how wrong they were. He explains why they were wrong and teaches some economics along the way. He also discusses the carnage in the bond market and tells you who is buying gold.

This article looks at the collateral side of financial transactions and some significant problems that are already emerging.

At a time when there is a veritable tsunami of dollar credit in foreign hands overhanging markets, it is obvious that continually falling bond prices will ensure bear markets in all financial asset values leading to dollar liquidation. This unwinding corrects an accumulation of foreign-owned dollars and dollar-denominated assets since the Second World War both in and outside the US financial system.

I recently ran across a video produced by CNBC back in July 2020. It is titled “Why Printing Trillions of Dollars May Not Cause Inflation.”

That aged poorly, didn’t it?

And people wonder why I keep saying you should be skeptical of mainstream narratives.

With the Asian hegemons undoubtedly able to introduce gold standards, where does that leave the dollar?

This article describes just how precarious the fiat dollar’s position has become.

Everybody knew that the Federal Reserve wasn’t going to hike rates at the September FOMC meeting. And yet everybody waited with bated breath to hear what Jerome Powell would say. In his podcast, Peter Schiff explained why people hang on Powell’s every word. It’s not because they think he knows what inflation or interest rates will be next year. They realize that Powell is just guessing. So, why do people care what he thinks?

Meanwhile, inflation is strong — not the economy.

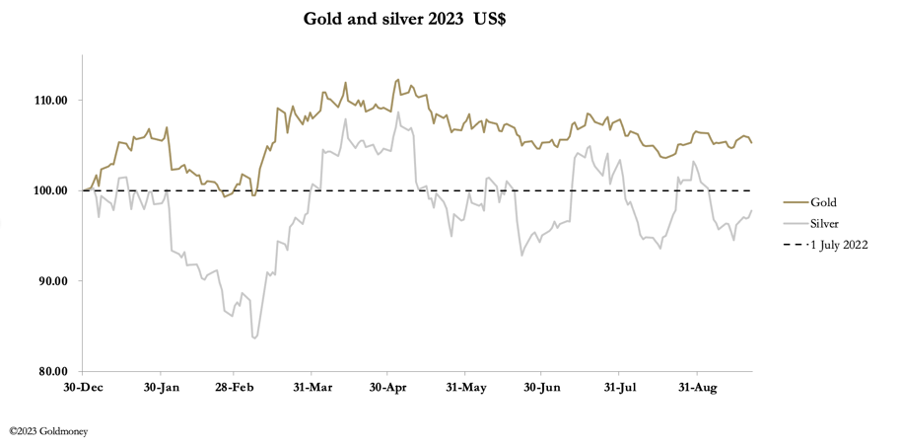

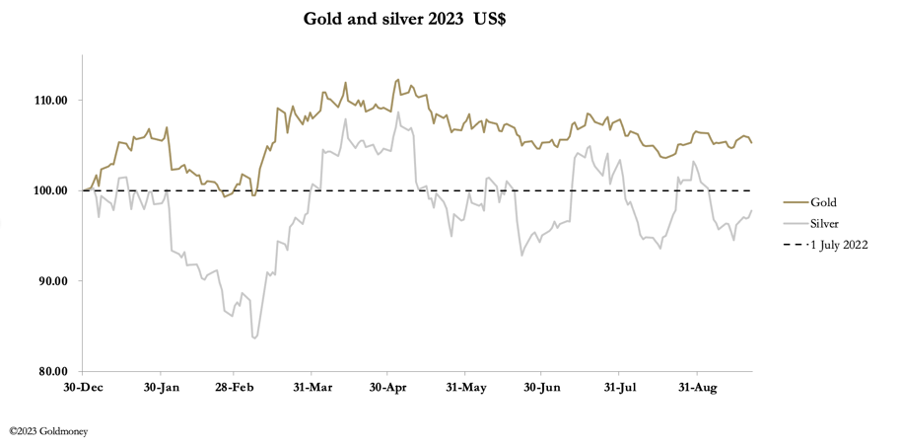

The FOMC and the Bank of England stood pat on interest rates this week. Following the FOMC’s decision, gold and silver fell on the back of its hawkish statement before recovering slightly. In Europe this morning, gold was $1926 up a net $2 from last Friday’s close. Silver fared much better at $23.68, up 65 cents. Silver is obviously in a bear squeeze, while hedge funds have become disinterested in gold.

The Federal Reserve wrapped up its September meeting on Wednesday and left interest rates unchanged. But Powell and Company had plenty to say. In this episode of the Friday Gold Wrap, host Mike Maharrey breaks down the rhetoric and argues that what the Fed says and what it will do are two different things.

The Federal Reserve held interest rates steady at the September FOMC meeting, but the committee indicated that it plans to hold rates higher for longer than originally projected.

As you digest the Fed meeting, it’s important to remember that there is a big difference between “saying” and “doing.”

Russia and the Saudis are driving up oil and diesel prices. But these moves are likely to undermine the rouble more than they undermine the dollar, euro, and other major currencies. Therefore, higher energy prices will rebound on the Russians this winter: if they shiver in Germany, they will freeze in Russia. If the dollar is king of the fiats, the rouble is just a lowly serf.

There is little doubt that Putin and his advisers are aware of this problem. Plan A was to introduce a new gold-backed BRICS currency which might be expected to weaken the dollar and euro relative to the rouble. Plan B was more drastic: to back the rouble itself with gold. This is the financial equivalent of dropping a hydrogen bomb on the dollar and the global fiat currency system upon which it is based.

Most people think everything is fine. The Fed is getting inflation under control and soon they’ll be able to cut interest rates, keeping the economy from falling into a deep recession. In his podcast, Peter Schiff poured cold water on this narrative. He explains why the Fed won’t be able to repeat the magic it pulled off after the financial crisis and COVID.