Gold and silver tanked after last Friday’s job report. But both metals have rallied a bit since the July CPI numbers came in right at expectations. In this episode of the Friday Gold Wrap, host Mike Maharrey looks a little deeper at jobs and CPI. Then he goes off-script and addresses some listener comments.

The July Consumer Price Index (CPI) data came out this week. For the first time, the numbers were in line with expectations, leading many mainstream pundits to declare “transitory” inflation is already starting to cool down. Peter Schiff broke down the report in his podcast. He said inflation is far from cooling off. In fact, when it comes to rising prices, you haven’t seen anything yet.

For the first time this year, CPI data came in within expectations. Many in the mainstream took this as a sign “transitory” inflation might be cooling. But many prices continue to increase.

The BLS Consumer Price Index (CPI) has become one of the most anticipated data points each month. The CPI has become a controversial measure over the years. Many correctly point out that it is continuously refined to lower the inflation readings using mechanisms like Owners Equivalent Rent and goods substitution. This makes sense from a strategic standpoint as inflation expectations have shown that they can cause inflation to increase. Thus understating inflation can rein in expectations.

Peter Schiff recently appeared on the Matt Walsh podcast. During the interview, he broke down exactly how the Federal Reserve and the US government team up to hit you with an inflation tax.

Prices are rising throughout the US economy. Federal Reserve Chairman Jerome Powell keeps telling us this inflationary surge is “transitory.” But transitory doesn’t mean what you think it means. The truth is higher prices are forever.

Here’s just a sampling of the price increases we’ve seen over the past few months.

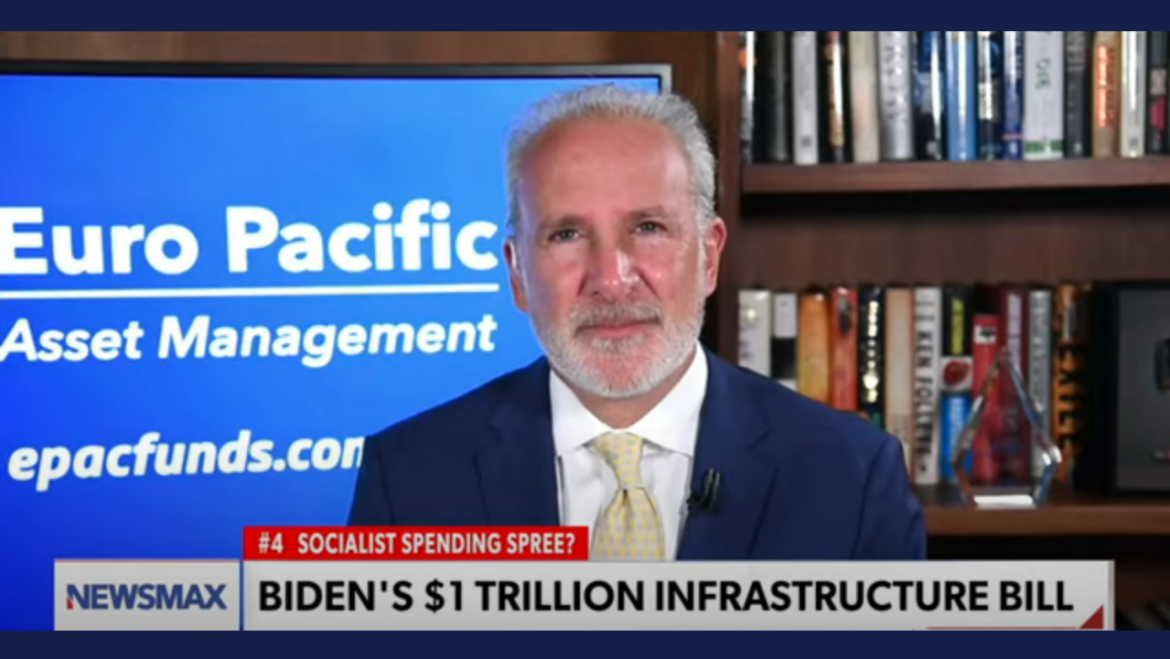

Congress is moving toward finalizing a $1 trillion infrastructure bill. Peter Schiff appeared on Newsmax “The Count” with Jenn Pellegrino to talk about the spending spree.

Biden said spending billions on government projects will help America to “build back better.” Politicians have been promising this for decades. But Peter said it’s the wrong approach. We should get government out of the way and let the free market work.

The BLS provides an employment picture of the US on the first Friday of every month. It estimates how many jobs were added or subtracted by sector. While some of the assumptions may be controversial (e.g. the birth/death model) and job numbers are prone to revisions, it remains the most widely anticipated statistic each month by the financial markets. Considering its popularity, the job numbers are heavily analyzed by many sources. This article uses visuals and historical data to provide greater insight and perspective.

Gold was solidly above $1,800 an ounce this week until Fed Vice Chair Richard Clarida mentioned the economy reaching the Fed’s goals earlier than expected and raised the specter of monetary policy tightening. But is the economy really improving as much as everybody seems to think? In this week’s Friday Gold Wrap, host Mike Maharrey digs into some of the economic numbers and determines they’re faking it.

In yet another sign inflation might not be transitory, over 85% of manufacturers reported increasing prices in July in the most recent manufacturing ISM report. At some point, producers will have to take steps to mitigate the impact of rising prices. That means passing costs on to consumers, cutting costs, or some combination of the two.

Inflation continues to run rampant and it’s distorting the entire economy.

Rising prices create the illusion of economic growth. And they are also allowing the US government to stealthily default on its massive debt. This is not a sign of a strong economy.