The August jobs numbers came in much lower than expected, a kick in the teeth for those touting the “improving economy” narrative. Meanwhile, personal incomes continue to grow but rising prices are eating up that growth and then some.

The economic data suggest the Fed’s plan is failing and stagflation looms on the horizon.

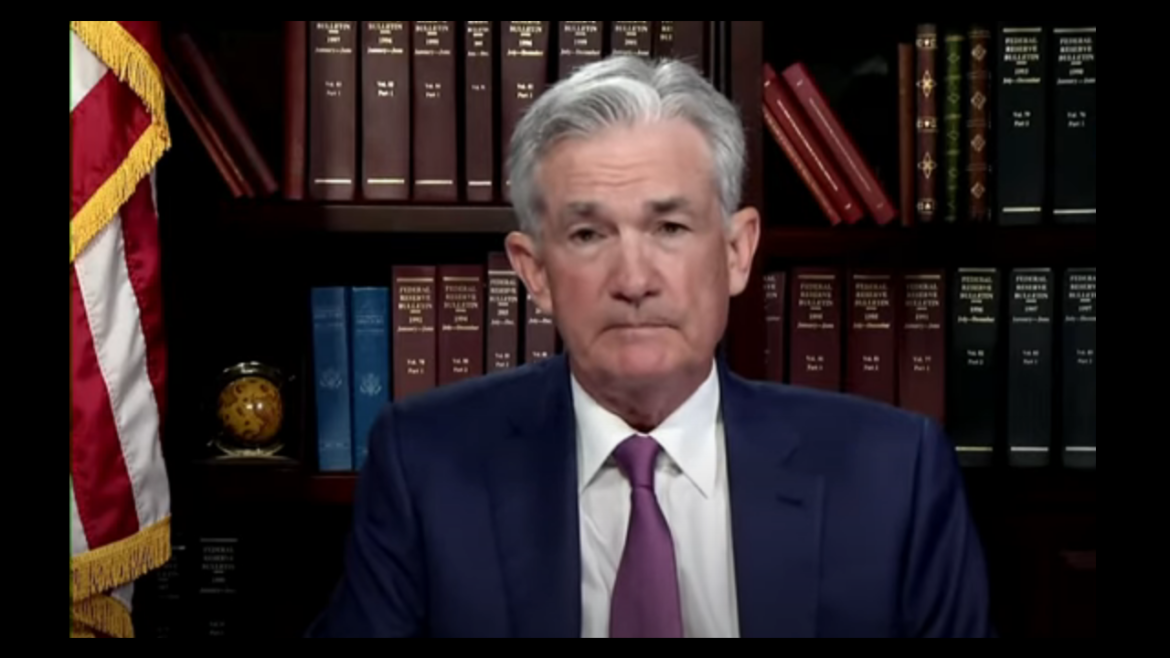

During his Jackson Hole speech, Federal Reserve Chairman Jerome Powell rewrote the history of inflation. In this clip from his podcast, Peter Schiff unravels the yarn that Powell spun.

In a nutshell, Powell claimed prior Fed policymakers mistakenly moved too fast to address inflation that turned out to be transitory, and he said he didn’t want to make the same mistake.

Peter Schiff recently appeared on RT Boom Bust to talk about Fed monetary policy and the possibility of a taper. He said even if the Fed does slow asset purchases, the taper won’t last long. Ultimately, the Fed will expand QE.

Federal Reserve Chairman Jerome Powell spent most of his Jackson Hole speech continuing to try to convince everybody that inflation is transitory. As Friday Gold Wrap podcast host Mike Maharrey points out in this episode, whether it is or isn’t transitory, inflation is a real thing that has a real impact on real people. In this show, he also breaks the news on the August jobs numbers and discusses taper talk.

There’s been a lot of talk about the Federal Reserve tapering quantitative easing. So far, it’s been nothing but talk.

A lot of people expected Federal Reserve Chairman Jerome Powell to offer some details and perhaps a timeline for the taper during his Jackson Hole speech. We got no such thing. Instead, he tapered the taper talk. In fact, Powell never uttered the word “taper.” he spent most of the speech trying to prop up his “transitory” inflation narrative.

While most American investors have faith that the Federal Reserve can and will successfully tighten monetary policy to fight inflation — or have simply bought into the “transitory” inflation narrative — Germans are loading up on gold as a hedge against growing inflationary pressures.

Personal income is rising.

But inflation is eating it up.

Before factoring in inflation, personal income from all sources rose by 2.7% in July year-on-year. The month-on-month gain was a solid 1.1%. This includes wages, stimulus payments, transfer payments (unemployment, Social Security benefits, etc.) along with income from other sources such as interest, dividends, and rental income.

Jerome Powell delivered his much-anticipated speech virtually during the Jackson Hole summit on Aug. 27. Peter Schiff talked about the speech during his podcast. Everybody expected a hawkish speech outlining the Fed’s plan to taper quantitative easing. Instead, Powell tapered the taper talk.

The “transitory” inflation swamping the country has stubbornly persisted into July. Producer prices posted a second straight 1% month-over-month increase, which brought the full-year number to a record 7.8%. Twelve-month US export prices rose 17.2%, and nearly 22% if the rate of the first seven months of 2021 were annualized. (I find it telling that those prices – which are subject to no after-the-fact data collection adjustments – are rising at a rate that is nearly triple the CPI).

Jerome Powell will speak today at the Jackson Hole economic summit. Everybody is on pins and needles in anticipation of the Fed chairman’s speech. In this episode of the Friday Gold Wrap podcast, host Mike Maharrey discusses the Fed’s messaging and then moves past the talk to discuss the “here and now” reality. He also spends some time talking more fundamentally about gold as part of an investment strategy.