We’ve been talking a lot about rising prices. The CPI has come in hotter than expected every month this year. We’re paying more to buy less.

We see the impacts of inflation on price tags, but sometimes it squeezes us more subtlety. It’s known as “shrinkflation.”

GDP for the second quarter disappointed, coming in at an annualized rate of 6.5%. Is this a sign of impending stagflation?

While 6.5% growth looks good on the surface, economists polled by the Wall Street Journal expected annualized GDP to chart around 9.1%. This was a huge miss and indicates the economy isn’t growing nearly as fast as everybody assumed.

The Federal Reserve held its July meeting this week. Once again, it didn’t do anything. But there was certainly plenty of talk to dissect. In this episode of the Friday Gold Wrap, host Mike Maharrey does just that with some analysis of the messaging coming out of the Fed meeting, along with a look at the newly released GDP numbers and what they might be telling us.

The Federal Reserve insists inflation is “transitory” and the economy is making “progress.” Yet, it continues with the extraordinary monetary policy it launched at the onset of the COVID-19 pandemic. Meanwhile, we’re seeing all kinds of data hinting that the economy may not be as great as advertised. Despite this, and even as prices continue to spiral higher, the Fed’s only monetary policy is talk.

Here’s the key question: what happens if the markets call the Fed’s bluff?

The Federal Reserve wrapped up its July meeting on Wednesday. Once again, there was a whole lot of talk and no action.

The Fed kept interest rates at zero. The Fed kept its quantitative easing program rolling. The Fed didn’t do anything. But the Fed had plenty to say.

M2 Money Supply is measured by the Federal Reserve to calculate the amount of Money in the financial system. The Fed defines M2 as: Seasonally adjusted M2 is constructed by summing savings deposits (before May 2020), small-denomination time deposits, and retail MMFs, each seasonally adjusted separately, and adding this result to seasonally adjusted M1.

Historically, the term inflation was defined as an expansion of the money supply that generally led to higher prices. Therefore increases in M2 is the measure of inflation. Increases in M2

For months, the markets have anticipated the Fed tightening monetary policy in order to take on rising inflation. At the June FOMC meeting, the central bank even hinted that it might start raising interest rates in 2023 instead of 2024, and the central bankers apparently talked about talking about tapering their quantitative easing bond-buying program. But with all of this talk, the loose monetary policy driving inflation continues unabated. Interest rates remain pegged at zero. The Fed balance sheet sets new records week after week. Where exactly is the exit door?

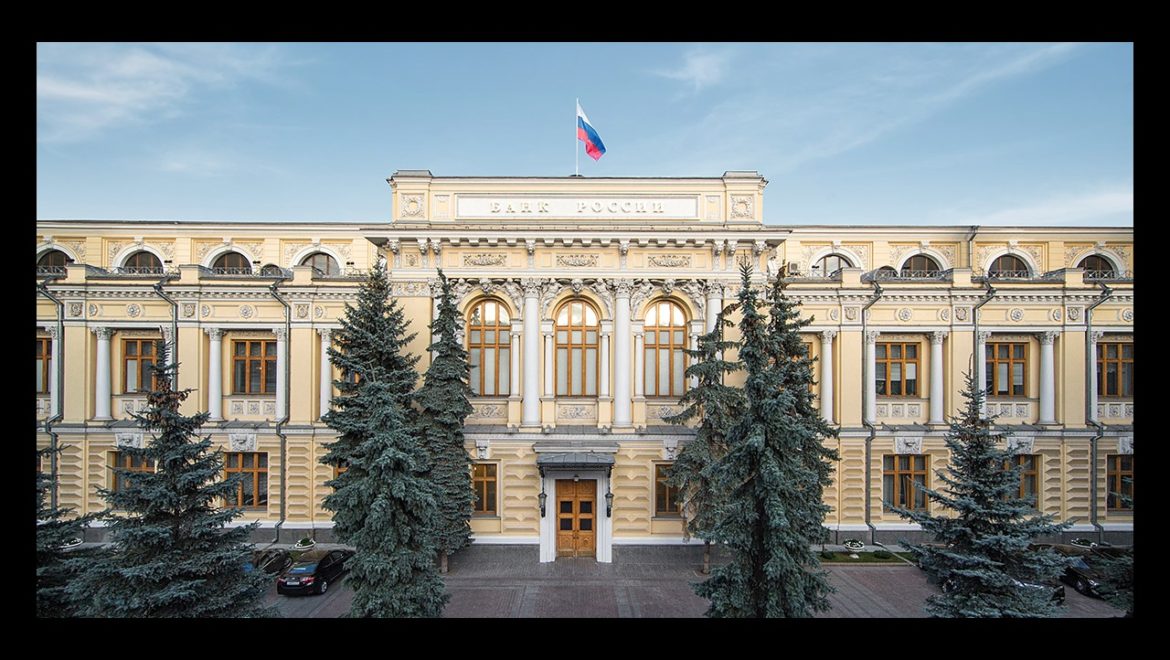

While the Federal Reserve continues to downplay inflation in the US, insisting that it is “transitory,” the Bank of Russia has gone to war with rising prices. Bank of Russia Governor Elvira Nabiullina says she sees “persistent factors” to inflation, and on Friday, the Russian Central bank hiked interest rates by 100 basis points to 6.5%.

In a statement, the Bank of Russia said, “The contribution of persistent factors to inflation increased due to faster growth of demand compared to output expansion capacity.”

Federal Reserve Chairman Jerome Powell continues to insist the surge of rising prices is “transitory. But if this is true, why are inflation projections for 2022 rapidly rising? It seems the markets aren’t buying the transitory theme.

Pop some popcorn. It’s time for some political theater. Congress is gearing up for another debt ceiling fight. In this episode of the Friday Gold Wrap podcast, host Mike Maharey gives you a preview of the next big Washington DC blockbuster production, complete with some debt ceiling history and an explanation as to why we shouldn’t need one. Maharrey also covers retail sales, inflation and the latest movement in the gold market.