OK. We know people who go around burglarizing homes and businesses probably aren’t the sharpest tools in the shed. But a burglar in Grand Rapids, Mich., may take the cake for dumb criminals.

The poor soul caught on camera burglarizing a local business was criminally confused. He apparently thought the company had left a stack of gold bars out on the sales floor – in front of the window.

Earlier this week, I shared a story about my wife finding a bag of change in the attic of her grandparent’s old house that turned out to be worth over $2,000. The dimes, quarters and half-dollars in the bag were all minted before 1965. In other words, they were all made primarily of silver. The value of the metal in these so-called junk silver coins is now worth far more than their face value. This demonstrates just how much the Federal Reserve has devalued your money.

One way we measure this devaluation of money is by the inflation rate. Practically speaking, rising inflation simply means we are losing purchasing power. Our dollar buys less and less as time moves on. This puts the squeeze on all of us – even the Tooth Fairy.

The US economy is now technically in the second-longest recovery in history. If it continues another 14 months, it will eclipse the longest recovery, which took place in the 1990s.

As Peter Schiff pointed out in his latest podcast, the Federal Reserve pulled out all the stops in the 1990s to keep the recovery going. That set the stage for the dot-com crash and ultimately the Great Recession.

Now the Fed is doing it again.

The World Gold Council described overall demand for gold as “soft” in its Global Demand Trends Q1 2018 report. Global demand was down 7% year-on-year.

The WGC said the drop was primarily due to weak investment demand. Investors added to their holdings of gold coins and bars, as well as gold-backed ETFs, but at a slower pace than Q1 2017.

There were some bright spots in the report. Gold demand in the technology sector marked its sixth consecutive quarterly gain. Jewelry demand held steady. And not all investors are spurning the yellow metal.

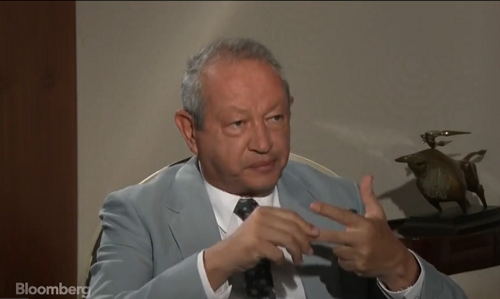

The second richest man in Egypt has put half of his $5.7 billion net worth in gold.

During an interview with Bloomberg, Naguib Sawiris said he expects gold to rally above $1,800 per ounce as “overvalued” stock markets crash.

The US government has hit borrowing levels not seen since the peak of the financial crisis.

The US Treasury’s net borrowing totaled $488 billion from January through March, according to a statement released Monday. That was $47 billion more than the department’s estimate. It was also a record for first quarter borrowing, according to Bloomberg.

Could we be seeing a run on the Federal Reserve Bank of New York? Jim Rickards thinks we just might be. But it’s not your typical cash run. It’s a run on the bank’s gold.

The classic image of this is the scene from the Christmas-season film It’s a Wonderful Life, with Jimmy Stewart. We’ve all seen it. Now, something similar is happening at the Federal Reserve Bank of New York. What’s different is that the run on the bank involves gold, not cash. The New York Fed will never run out of cash because they can print all they need. But they could run out of gold.”

He’s been dubbed the “Bond King,” but Jeffery Gundlach isn’t particularly bullish on bonds right now – at least not US government bonds. And he’s certainly not bullish on stocks. Gundlach has his eyes on gold.

Gundlach heads DoubleLine Capital, overseeing some $119 billion in assets. During a speech at the 2018 Sohn Investment Conference last week, he said an “explosive, potential energy” of a huge “head-and-shoulders bottom” base was signaling a move of $1,000 in gold prices.

Bernie Sanders wants everybody to have a job with health benefits paying $15 per hour. Most people would like to see that happen. But Bernie is willing to put your money where his mouth is. He’s come up with a plan guaranteeing every American worker “who wants or needs one” such a job. Here’s how the Washington Post described the proposal.

Sanders’s jobs guarantee would fund hundreds of projects throughout the United States aimed at addressing priorities such as infrastructure, care giving, the environment, education and other goals. Under the job guarantee, every American would be entitled to a job under one of these projects or receive job training to be able to do so, according to an early draft of the proposal.”

According to a representative from Sanders’ office, the senator has not come up with a cost estimate for the proposal or decided how a government this is more than $21 trillion in debt would fund such a program.

As Peter Schiff put it in his latest podcast, Bernie Sanders has come up with a lot of dumb ideas, but this one is probably the dumbest.

About a year ago, the IMF published a creepy paper offering governments suggestions on how to move toward a cashless society even in the face of strong public opposition. It hasn’t been in the news a whole lot lately, but the war on cash undoubtedly continues.

Governments and central bankers claim moving toward a cashless society will help prevent crime and will boost convenience for the average citizen. But the real motivation behind the war on cash is control over you. We got a first-hand look at what happens when governments restrict access to cash when India plunged into a cash crisis after the Indian government enacted a policy of demonetization in November 2016.

Andy Haldane serves as chief economist and the Executive Director of Monetary Analysis and Statistics at the Bank of England. He proposed the elimination of cash during a speech in the fall of 2015. Durham University professor of finance and economics Kevin Dowd has written a paper titled Killing the Cash Cow: Why Andy Haldane Is Wrong About Demonetization. Dowd wrote an article published by the Mises Wire outlining his arguments. It provides a fantastically detailed overview of the war on cash and why it threatens “widespread economic damage.”