Last week, Peter Schiff said we may well be in the calm before the economic storm. In his latest podcast, he said the storm may be on the horizon. But most people are still oblivious, including the Federal Reserve.

Can the auto industry survive in a high interest rate environment? We’re about to find out.

Earlier this month, we reported that the air has started to come out of the subprime auto bubble. Nevertheless, Americans are still buying cars. Last week, we got a Commerce Department report that consumer spending was up thanks in large part to the strongest auto sales in six months. But there is a dark lining in this silver cloud and the long-term prospects for the auto industry could be dimming.

Why?

The SchiffGold Friday Gold Wrap podcast combines a succinct summary of the week’s precious metals news coupled with thoughtful analysis. You can subscribe to the podcast on iTunes.

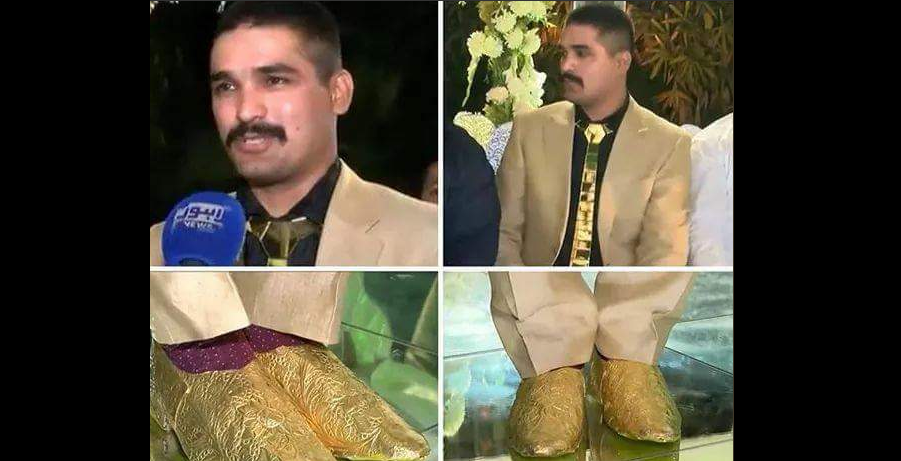

A Pakistani man decided he wanted to make a big splash at his wedding, so he took pimping to the next level. He wore a gold suit complete with gold shoes and a gold tie.

I don’t mean gold-colored shoes and a gold-colored tie. I mean literally gold shoes and a gold tie – as in made out of gold.

There are some troubling signs for the economy in the bond market. Yield curves are going flat.

On Wednesday, the yield curve from 5 to 30 year bonds flattened to as little as 29 basis points. That represents the narrowest spread since 2007. The yield curve between 2-year and 10-year Treasuries also narrowed, touching 41 basis points, also the smallest gap since before the financial crisis. Investors extending to 10 years from 7 pick up just 4.3 basis points, less than a quarter of what they got a year ago, according to Bloomberg.

So, what does this mean?

In recent years, gold has been increasingly valued for its use in various technological applications. In a report late last year, the World Gold Council reported the demand for gold in the technology sector has been growing since 2016 and that growth is continuing to accelerate due to new innovations.

Some of the most amazing developments utilizing the yellow metal have been in the field of medicine. For instance, researchers at the University of Queensland have developed a blood test using gold nanoparticles that could help oncologists in their treatment of cancer patients. According to the university, the test will provide doctors with an early and more accurate prognosis of how cancer treatment is progressing and help guide ongoing therapy.

In a world drowning in debt, the US stands out, according to the International Monetary Fund.

Global debt has reached record levels. According to a recent IMF report, the world has amassed $164 trillion of debt. That comes to 225% of global debt to GDP, levels not seen since the peak of the 2008 financial crisis when combined public and private sector global debt-to-GDP hit 213%.

Late last month, China finally launched its much anticipated yuan-denominated oil futures contract. Many analysts think this is yet another sign that the mighty dollar’s world dominance is coming to an end.

Jim Rickards called them “A-list of top-tier economists.” Michael Boskin, John Cochrane, John Cogan, George Schultz and John Taylor are all senior fellows at the prestigious Hoover Institute. And they all agree on one thing.

The US is going broke.

In his latest podcast, Peter Schiff said we are basically enjoying the calm before the storm right now.

With the US missile strike in Syria, rumblings of a trade war and a generally weak dollar, gold briefly flirted with $1,365 last week. But the anticipation of Federal Reserve rate hikes continues to create strong headwinds against the yellow metal. Last week, the Fed released its March FOMC minutes and most analysts interpreted them as “hawkish.” In fact, many people now think the Fed will nudge rates up again in June, leaving six months to get in the much-anticipated third hike of the year and possibly even get in a fourth.