Egypt’s Second Richest Man Has Half His Net Worth Invested in Gold

The second richest man in Egypt has put half of his $5.7 billion net worth in gold.

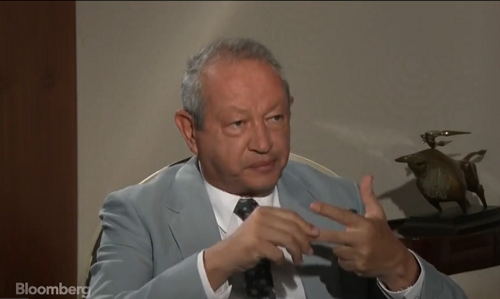

During an interview with Bloomberg, Naguib Sawiris said he expects gold to rally above $1,800 per ounce as “overvalued” stock markets crash.

The stock market is overvalued and I feel that another crash will happen. That is why 50% of my net worth is in gold. It’s a very high percentage and it was not half of my net worth when I started.”

In addition to a stock market collapse, Sawiris also said underlying demand for gold that will help push the price higher.

You have India and you have China; they’re big consumers, and they will not stop consuming. People also tend to go to gold when there are crisis, and we are like full of crises right now. We’ve got the Middle East, you know? Look at all the rest of the world – Iran. And Mr. Trump doesn’t help.”

US Global Investors CEO Frank Holmes also listed demand in India and China as one of three reasons he’s bullish on gold. Holmes and Sawiris echo one of the points the World Gold Council made when it said gold is set to shine in 2018. As the economies in China and India grow, so will the demand for gold.

Sawiris is not only invested in physical gold.

I am one of the largest investors in gold mining in the world right now. I had to convince my mom in the beginning. But, it has been a very good investment for me.”

Sawiris ranks as the second richest man in Egypt behind his younger brother Naguib. He has been somewhat controversial due to his willingness to invest in North Korea. He founded North Korea’s first telecom operator, Koryolink. Sawiris called himself a goodwill ambassador and said he wants to help the Korean people.

I’m doing good for the people of North Korea. And me being there is good news for you, not bad news, because I am a peace-oriented person. I represent the right economic models. I’m not a socialist/communist.”

He said he has been waiting for years for peace to break out.

I am taking all the hits, I am being paid in a currency that doesn’t get exchanged very easily, I have put a lot of money and built a hotel and did a lot of good stuff there.”

Sawiris said he has gradually built up his investment in gold. He said he believes that’s the safest place to preserve his wealth in the current economic climate. Ultimately, he is in gold because of its safety amid rising geopolitical risks as well as unyielding demand for the yellow metal.

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]