ETF gold holding reached another record high in January, according to the latest data from the World Gold Council.

Gold-backed funds added 61.7 tons of gold last month, boosting holdings to an all-time high of 2,947 tons. This continues a trend we saw in 2019 when gold holdings in ETFs grew 19% and eclipsed all-time highs.

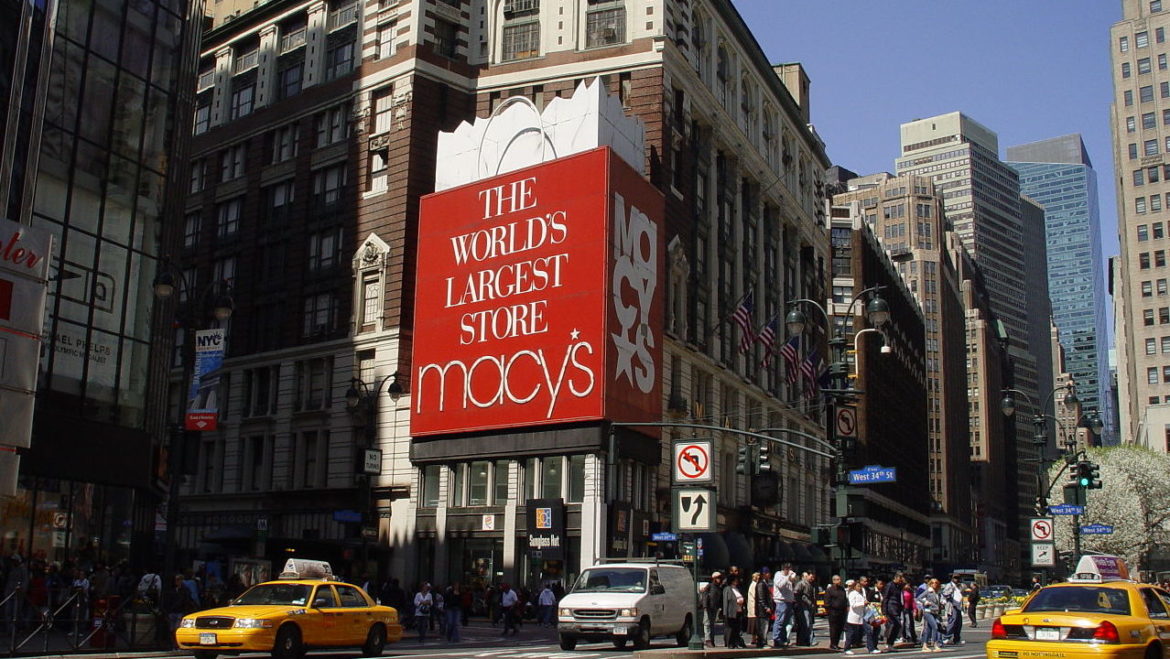

Macy’s department store has announced plans to close 125 stores and cut around 2,000 corporate employees. Along with the store closures, the company will shutter its Cincinnati headquarters and tech offices in San Francisco.

Even with the cuts, sales projections for the next three years “look abysmal.” According to CNBC, same-store sales, on an owned plus licensed basis, are forecast to be down 1% to flat.

This week I went to the SchiffGold office.

Now, you might think, so? I mean, you run the SchiffGold website. What’s the big deal?

Well, it was a big deal because this was the first time I’ve ever actually been to the office. And it’s the first time I’ve met the SchiffGold crew in person.

Gold took a hit on Tuesday but held a key support level and rebounded as the week went on, even as stocks set new records. Why does gold continue to keep showing strength even with all the headwinds? Is it just coronavirus? Or is something else going on? Host Mike Maharrey talks about it in this week’s Friday Gold Wrap podcast.

The Coronavirus has officially reached the “pandemic” status. It’s a scary word that means the coronavirus has crossed international boundaries. So, what does this mean for the markets?

Last October, the Federal Reserve relaunched quantitative easing. Of course, Fed Chairman Jerome Powell insists it’s not quantitative easing. But as Peter Schiff pointed out in a recent tweet, that debate is really just semantics.

The argument over whether the current Fed balance sheet expansion constitutes QE is pointless. QE was always just a euphemism for debt monetization. The Fed monetized debt in the past, its monetizing more debt in the present, and it will monetize even more debt in the future!”

The silver-gold ratio has ticked back up to historically high levels of late.

As I write this article, the ratio stands at just over 88:1. That means it takes 88 ounces of silver to buy an ounce of gold. To put that into perspective, the average in the modern era has been between 40:1 and 50:1.

In simple terms, historically, silver is extremely underpriced compared to gold.

More and more Americans are struggling to pay their rent.

According to a report from the Joint Center for Housing Studies of Harvard University, one in four renters are paying more than half their income on housing. This equates to 10.9 million renters.

Corporate debt has blown through the roof over the last several years. So much so that the Federal Reserve has issued warnings about the increasing levels of corporate indebtedness.

Borrowing by businesses is historically high relative to gross domestic product (GDP), with the most rapid increases in debt concentrated among the riskiest firms amid weak credit standards.”

But as Brandon Smith of alt-market.com noted in an article published at LewRockwell.com, this is a subject the mainstream media “seems specifically determined to avoid discussing these days when it comes to the economy.

Those peddling the narrative that the US economy is great keep pointing to the stock market. Indeed, stocks have continued to push higher, setting records along the way. But Peter Schiff has been saying that stocks aren’t being driven higher by a great economy. In a recent interview on RT Boom Bust, Peter said that if you look at the economic fundamentals, stocks should be coming down.