The Dow Jones fell 603 points on Friday and was down about 1% through the first month of 2020. As Peter Schiff pointed out on his latest podcast, if the old saying “so goes January, so goes the year” turns out to be the case, 2020 could longest bull market in history could be at its end.

The S&P 500 also had a big 1.8% drop on Friday and is slightly in the red in 2020. The Nasdaq fell Friday, but remains the only index that is positive on the year. The Russell 2000 is down about 3.3% on the year.

In the most recent Friday Gold Wrap podcast, Mike Maharrey talked about the fact that the Federal Reserve has increasingly engaged in more and more extraordinary monetary policy. As he put it, extreme has become the norm. Despite what pundits insist is a “great” economy, interest rates are extremely low by historical standards and the Fed is engaging in quantitative easing to the tune of $60 billion a month.

While stock markets continue to make record highs and the economy continues to grow, the question is how long can this last?

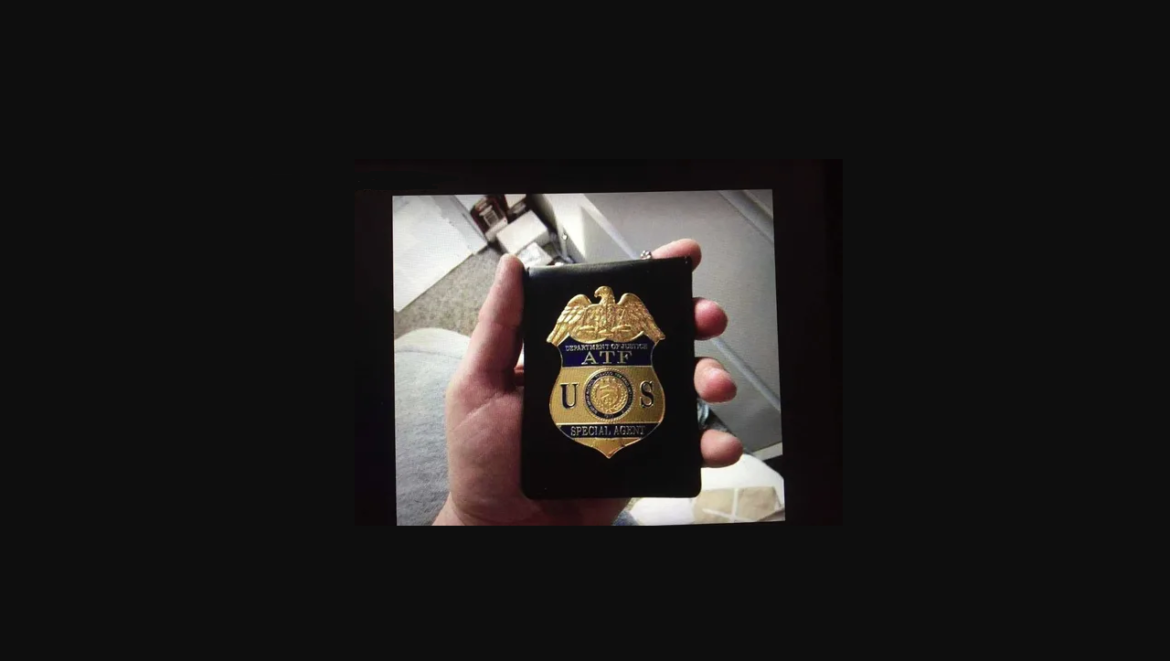

If some guy was trying to talk you into buying gold, would the fact he was an ATF agent make you more comfortable with the transaction?

I’m just going to say upfront, my answer is an emphatic no.

The Federal Reserve held its first FOMC meeting of 2020. It was mostly met with yawns as the Fed held rates steady, and despite a somewhat dovish tone, indicated that it probably wouldn’t make any moves on interest rates this year. We’ve grown so used to low interest rates that it barely registers that the Fed is actually engaged in extreme monetary policy. Extreme has become the new normal. In this week’s Friday Gold Wrap podcast, host Mike Maharrey talks about it. He also touches on the Q4 GDP report and some interesting gold supply and demand trends.

After flat-lining over the last several years, gold mine output fell by 1% in 2019. This is further evidence that we could be heading into a long-term and perhaps irreversible decline in gold mine production.

According to the World Gold Council, total gold mine output in 2019 came in at 3,463.7 tons.

The Federal Reserve held its first Federal Open Market Committee meeting this week. As expected, the central bank held interest rates steady but the overall posture of the Fed came off as rather dovish. Quantitative easing will continue into the near future and Fed Chairman Jerome Powell left the door open for future rate cuts.

The Federal Reserve funds rate will stay locked in at 1.5 to 1.75% and the vote was unanimous. Powell said, “We’re comfortable with our current policy stance and we think it’s appropriate.”

Many of SchiffGold clients hold silver patiently waiting for a drop in the silver to gold ratio. I am very much one of these patient holders of silver.

For those who aren’t familiar, the silver to gold ratio is exactly as it sounds: the price of gold stated in ounces of silver.

Today the silver to gold ratio is trading at about 87:1. In simple terms, this means it takes 87 ounces of silver to buy one ounce of gold.

The CBO projects the federal government will run massive budget deficits into the foreseeable future and says the ballooning national debt poses “significant risk” to the economy and financial system.

According to the CBO, the federal budget shortfall will hit $1.02 trillion in FY 2020 and rise into the foreseeable future. Deficits will average $1.3 trillion per year between 2021 and 2030 and top $1.5 trillion by the end of the decade. The CBO projects cumulative deficits over the next decade to total $13.1 trillion.

Bernie Sanders has gained in the polls of late and only trails Joe Biden by about three percentage points, according to the latest Fox News poll. On top of that, Sanders matches up against President Trump. He leads 48% to 42% in a head-to-head matchup.

Peter Schiff told Fox Business that a Sanders presidency would be an economic disaster for the US, but it would be good for gold.

If Sanders becomes president in 2020, the price of gold will be well above $2,000 on the day after election night.”

The spread of coronavirus in China has made markets jittery. Stocks have gone into a slide and gold has pushed up on safe-haven buying. Last week, Peter Schiff appeared on RT Boom Bust to talk about it. He said that 2020 may well be a bad year for the stock market, but probably not because of the virus. The real problem is markets are overvalued and the air will eventually come out of the bubble.