Gold Has Outperformed Most Major Assets Since December Rate Hike

In the weeks leading up to the December Federal Reserve rate hike, the price of gold fell and most mainstream analysts were bearish on the yellow metal. After all, rising interest rates are bad for gold. right? But we took a contrarian position, saying the negative relationship between rising interest rates and the price of gold is really more of a “sell the rumor, buy the fact” phenomenon.

As it turns out, we were right. In the weeks since the Federal Open Market Committee nudged the interest rate up another 25 basis points on Dec. 13, gold has outperformed most other major assets.

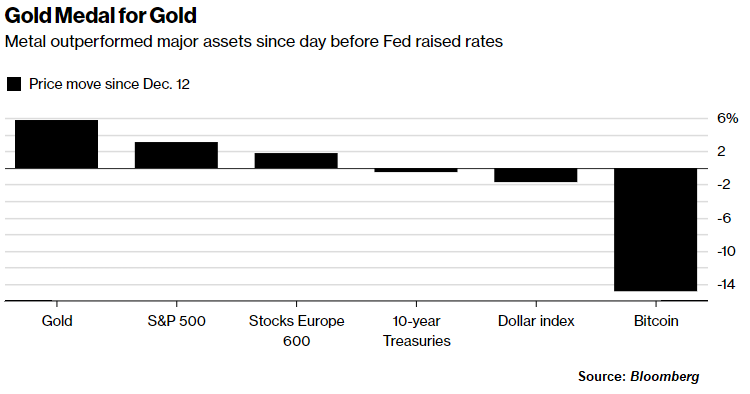

According to analysis by Bloomberg’s Mike McGlone, gold has gained more than the S&P500, Stocks Europe 600, 10-year Treasuries, the dollar index and even Bitcoin.

Since Dec. 12, the day before the Fed moved, gold climbed 5.7% to $1,314.36 an ounce, last week touching the highest level in three months. [Gold is trading even higher as I write this at $1,320.10 per ounce.] The S&P 500 Index gained 3.1% in the same period and bitcoin was down 14%. Gold’s advance was driven by the dollar, which fell 1.5%.”

McGlone said, “Unless greenback weakness reverses, gold should shine.”

The rising gold price in the wake of the latest Fed interest rate hikes fits into a broader trend. Consider this: the Fed started raising interest rates two years ago. With the rate a full 125 basis points higher than it was in December 2015, gold is trading at around $250 per ounce higher than it was then. That’s more than a 23% increase.

Conventional wisdom holds that tighter monetary policy tends to increase bond yields and boost earnings. That makes bonds more appealing to investors, theoretically lowering the appeal of gold and silver. So, when the Fed starts talking rate hikes, the air generally comes out of the precious metals markets.

Last summer, Peter Schiff explained why the current rising rate environment is good for gold despite the conventional wisdom.

Raising interest rates usually signal inflation is “healthy.” Central bankers become hesitant to raise rates if inflation isn’t somewhere near their 2% target. They have to at least feel confident inflation will pick up. As Peter explained, inflation is key when it comes to gold.

Rising interest rates are not negative for gold. I mean, the main reason that interest rates are rising around the world is because inflation is picking up around the world. Higher inflation is positive for gold. I mean, it is the most bullish thing for gold. And in fact, when inflation rates are rising, that means money is buying less, right? The purchasing power of money is going down. And that’s when you want to own gold.”

And while higher rates do boost bond yields, inflation is not a friend of the bond market. Bonds lose value as inflation increases. If you are holding a bond that you bought with a 5% interest rate and the rate moves up to 7%, your bond becomes less valuable on the market. Why would an investor buy your 5% bond when he can get a 7% bond? That is bullish for gold because gold is something you would own as an alternative to bonds.

A bear market in bonds is bullish for gold. But for some reason everybody just thinks, well, if interest rates are going up, that just makes gold less attractive because you’re giving up the opportunity cost. It makes bonds less attractive, because bonds are falling in value. It makes currency less attractive because interest rates are rising because currency is losing value. But gold won’t be losing value. Gold is going to be storing value.”

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]