It’s Friday the 13th.

Are you scared?

Well, I ain’t skeert!

South African gold output saw its biggest drop in over a year in May, falling 16.2% year-on-year. This is another sign that the one-time world leader in gold production could be running out of the yellow metal.

May’s decline came on the heels of a 5.8% drop in production in April. It was the eighth consecutive month of declining output for South African gold mines, according to Pretoria-based Statistics South Africa.

Total household debt climbed to a record $13 trillion in 2017. One factor driving overall American indebtedness higher is the ever-increasing burden of student loans.

A recent article in the New York Times focused on three charts that illustrate the ever-increasing toll of the student loan bubble – and it’s not just impacting students. Parents are increasingly feeling the squeeze.

Last May, the head of the world’s largest mining company said we’ve found all of the gold. Goldcorp CEO Ian Telfer told the Financial Times, “we’re right at peak gold here.”

Peak gold is the point where the amount of gold mined out of the earth will begin to shrink every year, rather than increase, as it has done pretty consistently since the 1970s.

You could blow off Telfer’s comments off as hyperbole or the musings of a contrarian except that he’s not the only person in the gold mining industry worried about decreasing gold production. As a recent Business Insider article reported, many of the top people responsible for supplying the world’s gold say we’re running out of the yellow metal.

In last Friday’s podcast, Peter Schiff talked about the potential impact of the trade war, arguing it could prick the US bubble economy. As a follow-up, in his latest podcast, Peter talked more about why a trade war could be worse for the US economy than most pundits seem to think, and he dug down to the root cause of the trade deficit.

The bottom line is slapping tariffs on Chinese imports isn’t going to solve the problem.

Have you ever thought about owning gold?

That may seem like a strange question. You’re probably thinking to yourself, “Why everybody has at least thought about investing in gold.” But that’s apparently not true – at least not in Australia. According to a poll conducted by Australia’s leading gold bullion company, 45% of Australians have never even thought about investing in physical gold.

The fact that so many people have never even thought about investing in gold explains why 85% of Australians don’t own any of the yellow metal.

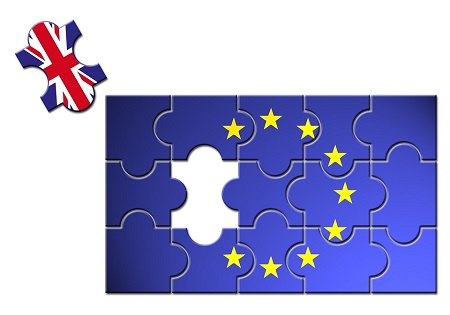

The price of gold in pounds spiked Monday as Brexit confusion and political instability sent Brits scampering into safe havens.

Spot gold against the pound rose nearly 1% after Brexit Minister David Davis and British Foreign Minister Boris Johnson both resigned their posts in protest.

Business Day described Brexit as a “ramshackle exit from the EU,” as a European Central Bank policymaker warned it could damage economic growth in the eurozone.

In another sign the stock market bubble could be near the popping point, investor margin debt hit a new record high, even has the Dow Jones has sold off around 2,500 points since highs earlier in the year.

According to the Financial Industry Regulatory Authority (FINRA) margin debt hit $669 billion in May. That represented a 2.9% increase from April.

What exactly is margin debt and why does it matter?

There was a lot of trade war talk at the end of last week. In fact, on Friday, some pundits said the trade war officially began. Last Thursday, President Trump said the US may ultimately impose tariffs on more than a half-trillion dollars’ worth of Chinese goods, and a round of tariffs went into effect. The United States began collecting tariffs on $34 billion in Chinese goods. China implemented additional tariffs on some import products from the United States immediately after US tariffs took effect, according to Chinese state media.

The stock markets shrugged it off. Both the NASDAQ and Dow were up over 100 points. In his latest podcast, Peter Schiff said the markets seemed to be saying, “Who cares about a trade war? Bring it on!”

European gold-back ETFs continued to add yellow metal in June, but globally, total holdings fell for the first time in nearly a year as gold flowed out of North American and Asian funds.

Global gold-backed ETF holdings fell by 49.3 tons to 2,434 tons in June, according to the latest data released by the World Gold Council. It was the first month of net outflows since July 2017.

Even with the sharp June drop, total ETF gold holdings globally remain up on the year by 63 tons.