It’s no secret that Bitcoin has tumbled since its meteoric rise late last year. After nearly touching the $20,000 mark, the cryptocurrency is trading at around $6,600 today. Other cryptocurrencies such as Litecoin, Ripple and Ethereum have also all shed big chunks of their value. But at least these cryptocurrencies are still alive and kicking. Hundreds have simply died.

Deadcoins.com lists over 800 cryptocurrencies that no longer exist or have a value of 1 cent or less.

SchiffGold’s It’s Your Dime features “straight talk” interviews with movers and shakers in the world of precious metals, investing and economics.

In this episode, host Mike Maharrey talks with Dan Kruz, the man behind DK Analytics.

A 1980s era Far Side cartoon featured a veterinary student named Doreen studying equine medicine in Chapter 9 of her textbook. On the left-hand side of the page was a list of horse ailments. They included things like a broken leg, infected eye, runny nose, and a fever to name just a few. On the right-hand side of the page, the treatment for each ailment was “Shoot.” The caption read, “Like most veterinarian students, Doreen breezed through Chapter 9.”

Ben Bernanke, Milton Friedman and the Ivy League economics departments that all regurgitate the same theory on the Great Depression pretty much treat the economy as simple-mindedly as Doreen’s textbook treated equine medicine.

Earlier this month, Peter Schiff said Federal Reserve policy is pushing us toward a no-growth, high-inflation economy.

There are a number of factors in play. There are growing inflation pressures. There are record amounts of debt – both government and corporate. But behind all of these symptoms, we have a disease.

Ron Paul digs down to the root causes of our economic woes in this in-depth look at the US financial system and the need for reform. Paul says a monetary crisis is coming. What will replace the dollar? Paul makes a strong case for gold.

Gold and silver are money. But most governments treat precious metals like a commodity. They don’t accept it as payment. Worse than that, they tax it. Think about the absurdity of this policy. Can you imagine getting taxed for getting change at the bank?

Fortunately, we’re beginning to see a shift. Many states are repealing taxes on gold and silver, and treating precious metals more like money. Wyoming is the latest state to reform its laws.

The SchiffGold Friday Gold Wrap podcast combines a succinct summary of the week’s precious metals news coupled with thoughtful analysis. You can subscribe to the podcast on iTunes.

When looking at the gold market, it’s easy to get caught up in the daily price fluctuations or the most recent headlines on the financial channels and forget about long-term market dynamics. Gold, after all, is generally more of a long-term investment that has historically served as a hedge against economic turmoil and protected investors against fiat currency devaluation – otherwise known as inflation.

The World Gold Council recently released its Gold 2048 report providing in-depth analysis of how the gold market will potentially evolve over the next 30 years. In general, things look pretty bullish for the yellow metal if you consider a longer view.

Peter Schiff talked politics in his latest podcast and raised a sobering question: Could the US be on the path toward a socialist administration?

Peter noted that we are long overdue for a recession. There are plenty of signs a major economic downturn could be lurking right around the corner, including stock market weakness. And as we reported today, US Treasury yield curves are flattening. The average global yield curve has inverted. Inverting yield curves are a strong predictor of recession.

This is bad news for President Trump, who has taken credit for the “great” economy and strong stock market. Peter said the president has set himself up as the fall-guy when the crash happens. Meanwhile, the Democratic Party is drifting further left.

The economy is strong!

Or so the mainstream financial talking heads tell use every day.

Meanwhile, one of the best predictors of a looming inflation is flashing red.

The yield curve between the two and 10-year Treasuries narrowed to around 34 basis points this week. That’s the lowest level since 2007 – right before the financial crisis. Even more troubling, the global yield curve has inverted for the first time since 2007.

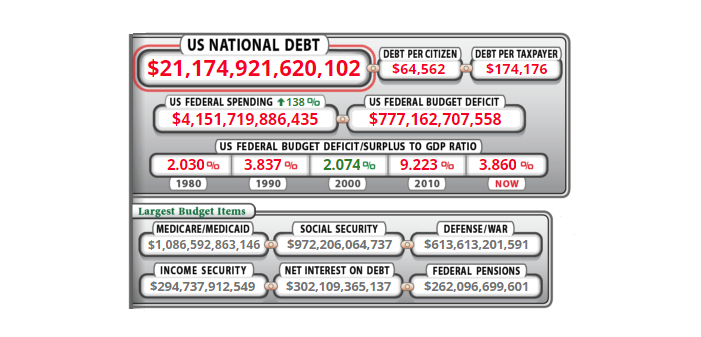

At the current trajectory, the cost of paying the annual interest on the US debt will equal the annual cost of Social Security within 30 years, according to a recent report released by the Congressional Budget Office.

By 2048, as interest rates rise from their currently low levels and as debt accumulates, the federal government’s net interest costs are projected to more than double as a percentage of GDP and to reach record levels. Those costs would equal spending for Social Security, currently the largest federal program, by 2048.”