The SchiffGold Friday Gold Wrap podcast combines a succinct summary of the week’s precious metals news coupled with thoughtful analysis. You can subscribe to the podcast on iTunes.

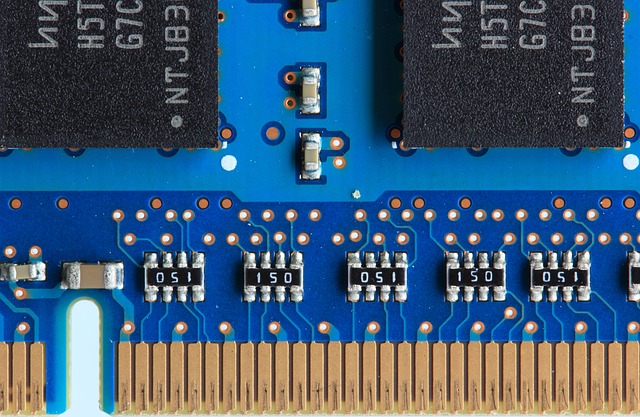

Technology will play a key role in driving precious metals demand in the coming years according to reports released this week by the World Gold Council and the Silver Institute.

The World Gold Council Gold Investor report for July focused on the growing use of gold in technology. According to the report, over the past decade, the tech sector accounted for more than 380 tons of gold demand annually. That’s 13% ahead of central bank purchases during the same time period. The demand for the yellow metal for tech applications logged its sixth consecutive quarter of gains in Q1 2018.

Technology is transforming the way we live, work and play, changing almost every aspect of our world, from industry to financial services to healthcare. Gold plays an integral part in this societal shift,” WGC CEO Aram Shishmanian said.

In his latest podcast, Peter Schiff reflected on Independence Day. He said he loves the holiday because it’s uniquely American and it celebrates the sacrifices the founding generation made to bring forth a country conceived in liberty. But he said the Fourth of July also makes him a little sad because it reminds him of what we’ve lost.

I’m sad that we no longer have the nation our founders created for us, that we have lost all that it means to be an American.”

It’s no secret that Bitcoin has tumbled since its meteoric rise late last year. After nearly touching the $20,000 mark, the cryptocurrency is trading at around $6,600 today. Other cryptocurrencies such as Litecoin, Ripple and Ethereum have also all shed big chunks of their value. But at least these cryptocurrencies are still alive and kicking. Hundreds have simply died.

Deadcoins.com lists over 800 cryptocurrencies that no longer exist or have a value of 1 cent or less.

SchiffGold’s It’s Your Dime features “straight talk” interviews with movers and shakers in the world of precious metals, investing and economics.

In this episode, host Mike Maharrey talks with Dan Kruz, the man behind DK Analytics.

A 1980s era Far Side cartoon featured a veterinary student named Doreen studying equine medicine in Chapter 9 of her textbook. On the left-hand side of the page was a list of horse ailments. They included things like a broken leg, infected eye, runny nose, and a fever to name just a few. On the right-hand side of the page, the treatment for each ailment was “Shoot.” The caption read, “Like most veterinarian students, Doreen breezed through Chapter 9.”

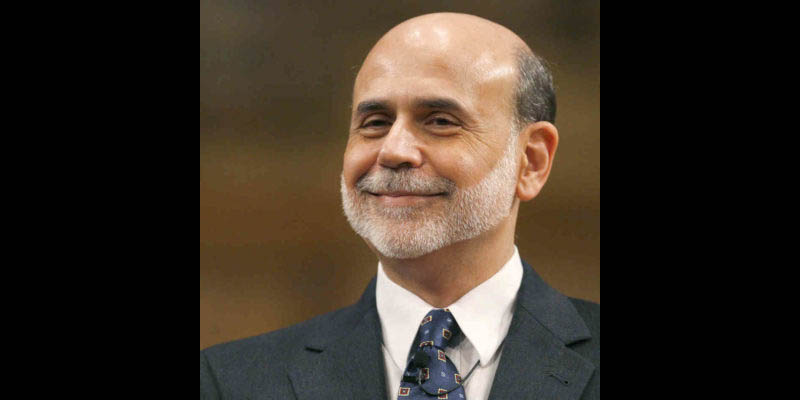

Ben Bernanke, Milton Friedman and the Ivy League economics departments that all regurgitate the same theory on the Great Depression pretty much treat the economy as simple-mindedly as Doreen’s textbook treated equine medicine.

Earlier this month, Peter Schiff said Federal Reserve policy is pushing us toward a no-growth, high-inflation economy.

There are a number of factors in play. There are growing inflation pressures. There are record amounts of debt – both government and corporate. But behind all of these symptoms, we have a disease.

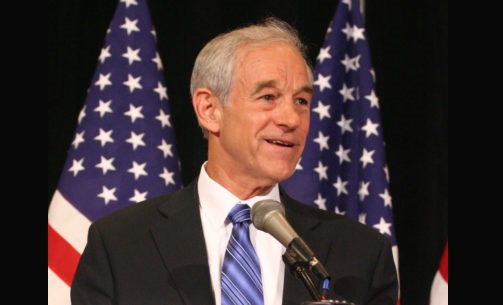

Ron Paul digs down to the root causes of our economic woes in this in-depth look at the US financial system and the need for reform. Paul says a monetary crisis is coming. What will replace the dollar? Paul makes a strong case for gold.

Gold and silver are money. But most governments treat precious metals like a commodity. They don’t accept it as payment. Worse than that, they tax it. Think about the absurdity of this policy. Can you imagine getting taxed for getting change at the bank?

Fortunately, we’re beginning to see a shift. Many states are repealing taxes on gold and silver, and treating precious metals more like money. Wyoming is the latest state to reform its laws.

The SchiffGold Friday Gold Wrap podcast combines a succinct summary of the week’s precious metals news coupled with thoughtful analysis. You can subscribe to the podcast on iTunes.

When looking at the gold market, it’s easy to get caught up in the daily price fluctuations or the most recent headlines on the financial channels and forget about long-term market dynamics. Gold, after all, is generally more of a long-term investment that has historically served as a hedge against economic turmoil and protected investors against fiat currency devaluation – otherwise known as inflation.

The World Gold Council recently released its Gold 2048 report providing in-depth analysis of how the gold market will potentially evolve over the next 30 years. In general, things look pretty bullish for the yellow metal if you consider a longer view.