Could Rising Margin Debt Be a Sign the Stock Market Bubble Is Close to Popping?

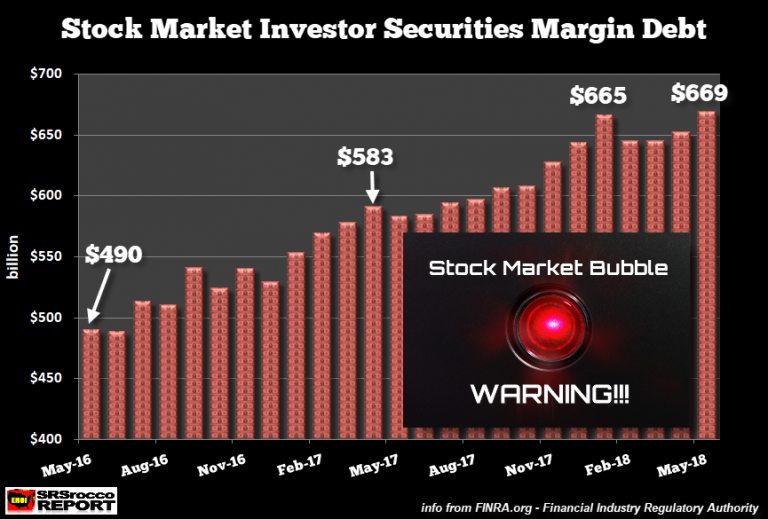

In another sign the stock market bubble could be near the popping point, investor margin debt hit a new record high, even has the Dow Jones has sold off around 2,500 points since highs earlier in the year.

According to the Financial Industry Regulatory Authority (FINRA) margin debt hit $669 billion in May. That represented a 2.9% increase from April.

What exactly is margin debt and why does it matter?

In simplest terms, margin debt is money investors borrow from their broker to purchase securities.

Let’s say you want to buy $10,000 of ABC stock but you don’t want to put up all of the cash up front. You can borrow a portion of the capital from your broker. Under Federal Reserve rules, the broker can lend the investor up to 50% of the initial investment. In this scenario, the investor would deposit $5,000 and take on $5,000 in margin debt. The shares of ABC stock act as collateral for the loan.

Problems arise if the price of the stock drops. As a recent article in Forbes explains, when stock prices fall, investors have to add funds to their accounts to satisfy a margin call. Under FINRA rules, investors must maintain a maintenance margin requirement of 25%. In other words, the investor’s equity must remain above that ratio in a margin account. If a stock owned on margin falls below $5 per share, most brokerage firms will require the investor to pay for the stock at 100% or face liquidation. As Forbes put it:

A bear market thus accelerates during periods of margin selling as it did into March 2009.”

Margin debt hit its previous record high of $665 billion in January. That was when the Dow topped 26,500 points. But as SRSrocco points out, the market has sold off several thousand points while investors placed an even higher amount in margin bets in May.

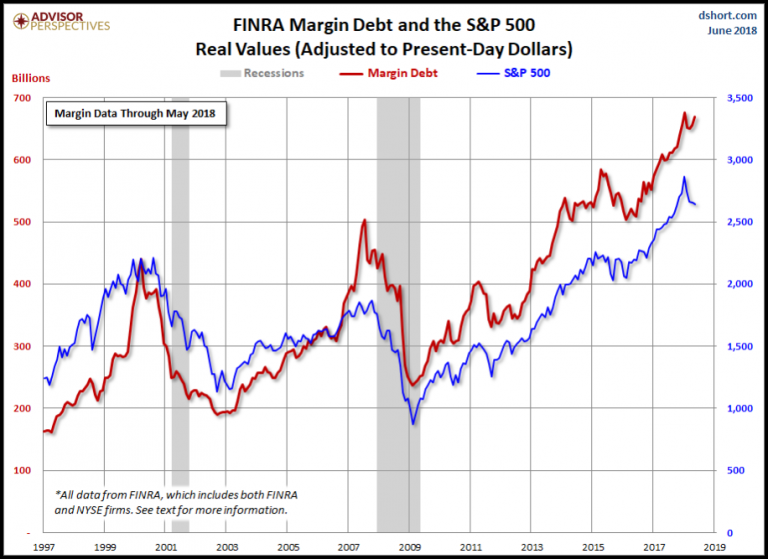

At this point, margin debt is nearly $170 billion higher than its peak in 2007. You remember what happened at the end of 2007, right?

SRSrocco pointed out that we are 10 years into the business cycle without a significant correction. The Dow had a minor correction when it lost 2,000 points in early 2016. Investors who thought the air was coming out of the bubble piled into gold and silver. Flows into gold-backed ETF’s spiked the second highest level Q1 2016 during the brief correction. The quarter with the most Gold ETF inflows was Q1 2009, as investors panicked when the Dow Jones fell to 6,600 points.

It’s impossible to know what lies ahead, but as SRSrocco put it:

Due to the massive debt and leverage in the system, I believe we are going to start seeing major Fireworks during Q3-Q4 2018.”

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]