Fundamentals Point To Healthy Growing Gold Market (Video)

World Gold Council chief market strategist John Reade recently talked to Commodity TV about the current state of the gold market and what he sees in the future.

Reade cast an optimistic tone, saying the supply and demand fundamentals point toward a healthy, growing gold market moving forward.

The yellow metal has been relatively range-bound for most of the year. Reade noted two factors currently creating headwinds for the price of gold – the US dollar and real US interest rates.

If I look at the gold price with the background of real interest rates and the US dollar, I don’t find anything particularly strange about what’s taking place.”

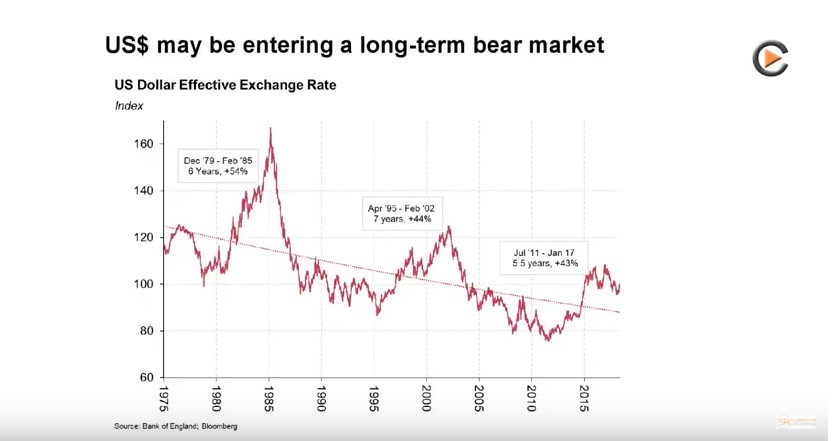

The dollar has shown some strength in recent weeks, but Peter Schiff has said it is nothing more than upside correction in the midst of a bear market, emphasizing that the primary trend is down. Some mainstream analysts have also talked about a dollar bear. TD’s Bart Melek hit on very similar themes at a precious metals conference in Singapore and predicted gold will rebound in 2019 as the dollar weakens. Commodity TV also noted this downward trend.

And of course, the Fed has been hiking interest rates. Most analysts expect the Fed to nudge rates up again this week. This has created additional headwinds for gold. But there are indications that they could be reaching the end of the hiking cycle.

Reade said physical demand is another important factor that often gets lost in the shuffle. He called the market “OK – reasonable – but certainly not super strong.” Taken together, these factors explain the range-bound behavior of the price in recent months.

If you add these things together – the fact that the physical market is in good shape by not super-strong, and the fact that the Fed is hiking interest rates and the US dollar when it’s strong weighs upon gold, I actually find the gold price to be explainable in terms of the world at the moment.”

Reade said he sees physical demand growth in the near future, especially in China and India. These two countries have a huge impact on the gold market, making up about 50% of the demand. He sees that demand growing.

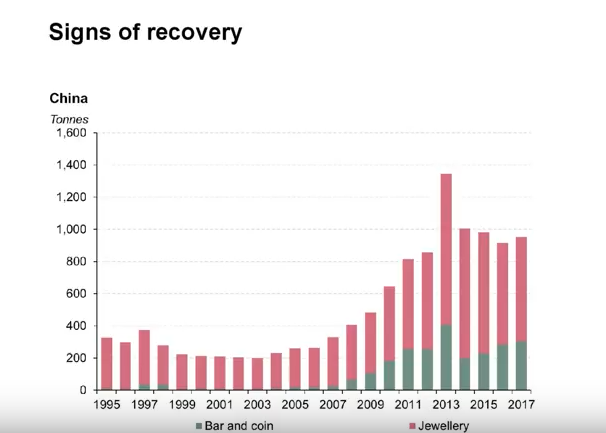

Reade called gold demand in China over the last 10 to 15 years “explosive,” noting that it has gone from about 200 tons per year to 1,000 tons per year. But when the price dropped in around 2013, the demand fell off somewhat. Reade said the market had grown too big, but it has since rebalanced and we’re beginning to see growth again.

Reade said he thinks gold demand will continue to surge in China as the economy continues to develop and incomes increase.

If we look at our research, the biggest driver of long-term growth for gold demand is economic growth and particularly consumer income. And Chinese consumer income is growing. And if they’re going to rebalance their economy from investment toward consumption going forward, that should be really positive going forward. So, the biggest market in the world has turned, and I’m quite positive about the prospects going forward.”

Reade said he sees similar growth dynamics in India, the world’s second-largest gold market.

There we’re seeing now that there’s a big restructuring taking place in the Indian economy, which should be very beneficial for gold demand there.”

Reade noted a major push by the Indian government to increase rural incomes. About 70% of gold demand in India comes from rural parts of the country.

Again, going back to what we said before, if the biggest driver of gold demand is consumer incomes, and 70% of it comes from the rural areas, doubling the rural areas’ wealth over the next five years will be a very positive driver for the gold market.”

On the supply side, Reade said he thinks mine output has likely plateaued and could even begin to drop over the next several years.

The reason for that is fairly simple. Gold mines need to be replaced. They don’t last forever. So, we know the mines are getting older and getting more mature. So, therefore, you need to keep discovering new gold, and you need to be starting new projects and new mines. So, if we look at the project pipeline – things that will be developed over the next five years or so, then it looks a bit sparse. There’s probably not enough new mines coming into production to replace the mines that are running out of ground.”

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

This weekend, Todd Sachs interviewed Peter on the state of the economy. They discuss the parallels between now and the 2007-2008 housing crisis, the role of economic sentiment in voters’ opinions, and why foreign central banks are losing faith in the dollar.

This weekend, Todd Sachs interviewed Peter on the state of the economy. They discuss the parallels between now and the 2007-2008 housing crisis, the role of economic sentiment in voters’ opinions, and why foreign central banks are losing faith in the dollar. Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] Peter released a brief video addressing the looming resurgence of inflation. Ironically, on the back of disappointing inflation numbers, gold witnessed a dip below $2000 on Tuesday due to higher-than-expected CPI data.

Peter released a brief video addressing the looming resurgence of inflation. Ironically, on the back of disappointing inflation numbers, gold witnessed a dip below $2000 on Tuesday due to higher-than-expected CPI data. Gold surged to a new record high of $2135 early Sunday morning before pulling back sharply Monday. In this video, Peter Schiff explains why this is a buying opportunity. After setting the record, gold quickly sold off and consolidated, dropping over $100 back to around $2,020. Some people see the quick selloff as a bearish […]

Gold surged to a new record high of $2135 early Sunday morning before pulling back sharply Monday. In this video, Peter Schiff explains why this is a buying opportunity. After setting the record, gold quickly sold off and consolidated, dropping over $100 back to around $2,020. Some people see the quick selloff as a bearish […] During a recent interview at the 2023 Precious Metals Summit Zurich event, Doom, Boom & Gloom Report publisher Marc Faber says now is the time to buy gold, silver and platinum because inflation is here to stay.

During a recent interview at the 2023 Precious Metals Summit Zurich event, Doom, Boom & Gloom Report publisher Marc Faber says now is the time to buy gold, silver and platinum because inflation is here to stay.