We ended last week with some weaker than expected economic data – particularly the jobs numbers, but the stock market continues to go up. These days, the mainstream reacts to everything as good news. No matter what the data suggests, everybody seems to think things will come up smelling roses because of stimulus. But in a recent podcast, Peter said all of this smells more like stagflation.

Silver tends to get lost gold’s spotlight but there are reasons to consider adding silver to your portfolio as well. The silver-gold ratio remains at historically high levels. Practically speaking, this means silver is on sale. The supply and demand dynamics also look good for the white metal. Demand is up and global mine output fell last year.

There have been financial commentators, pundits, and asset managers who have stated that during periods of stagflation — low real GDP growth and high inflation — silver has underperformed gold. But as Dan Kurtz of DK Analytics shows, that conventional wisdom doesn’t hold up to scrutiny.

Peter Schiff recently appeared on RT Boom Bust, along with Investor’s Advantage Corporation founder John Grace, to talk about the recent jobs report. Peter summed things up with a dire warning. Stagflation is coming and it’s going to be worse than 2008.

When the New York Times published an op-ed from a White House insider claiming there are people inside the Trump administration actively working to undermine the president, the markets shrugged it off. In fact, as Peter Schiff said in a recent interview on thestreet.com, the markets are shrugging pretty much everything off.

Everything is bullish as far as investors are concerned. They believe the US economy is in great shape. According to President Trump, it’s in the best shape ever. This is the greatest boom in the history of the United States. And so that fantasy continues to dominate the narrative and markets are shrugging off all the bad news.”

Despite the optimism, Peter said the economy is headed for the “greatest bust ever.” And that’s the perfect storm for gold.

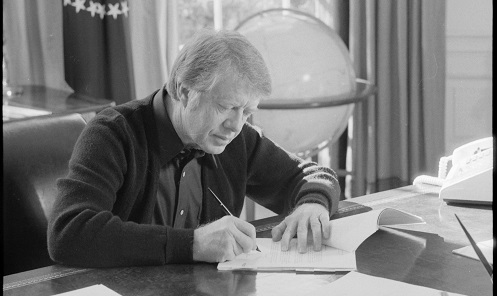

The Dow Jones was up Friday, avoiding it ninth consecutive down day. As Peter Schiff noted on his most recent podcast, such a long stretch of declines is pretty rare. Eight straight down days has only happened 43 times since the Dow launched in 1896. The last time we had nine straight days of Dow Jones decline, Jimmy Carter was president.

Peter said this is a little ironic because he sees another Carter-era phenomenon on the horizon – stagflation.