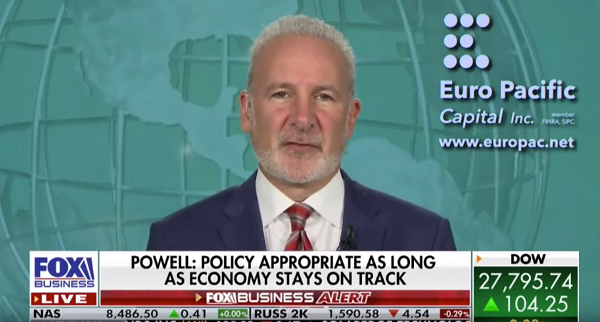

Jerome Powell lectured Congress about the national debt last week, calling it unsustainable. The Federal Reserve chairman is concerned. He admitted that with interest rates already close to zero, the central bank has very little room to cut rates in the event of an economic downturn. Peter Schiff appeared on the Claman Countdown, along with Milken Institute economist Bill Lee to talk about Powell’s comments.

Peter said that while Powell is lecturing Congress, it’s really the Fed’s fault.

When is a $984 billion budget deficit good news?

When you thought you might get a $1 trillion budget deficit.

The Treasury Department released the fiscal year 2019 budget numbers on Friday. The budget shortfall came in at $984 billion right on the CBO estimate. A CNBC report said this would likely, “come as a relief to the Trump administration, which had previously forecast that the deficit would hit $1 trillion during the 2019 fiscal year.”

The US government is spending money and running up debt at an unfathomable rate. The US national debt increased by a staggaring $814 billion in just two months. When confronted with this reality, most people just shrug. Policymakers certainly don’t care. They continue to ramp up spending and call for even more. Paul Krugman recently tweeted that we need more government stimulus — ie spending — to stoke tepid demand.

Democrats have never cared about spending and Republicans swear tax cuts will grow the economy and fix the debt problem. But as we’ve reported many times, debt retards economic growth.

Now we have even more evidence that government stimulus doesn’t stimulate. In fact, it has the exact opposite effect, as we can see from Europe’s spending binge.

The US national debt increased by a staggering $814 billion between Aug. 1 and Oct. 6, according to Treasury Department data.

That represents a 4% increase in the debt — in just a little over two months.

I saw a tweet this week by Paul Krugman asserting, “What we do have is a persistent problem of weak demand; yes, we have full employment now, but only with extremely low interest rates, which means little ability to respond to the next downturn. This makes a strong case for a big government investment program.”

Ah yes. It’s the Keynesian solution to every problem. Just spend more money!

The national debt continues to spiral upward. It increased by another $1.2 trillion in fiscal year 2019. But Paul Krugman says it’s not that big of a deal. He downplayed the national debt in a tweet, claiming emphatically that “DEBT IS MONEY WE OWE TO OURSELVES.”

This encapsulates a common Keynesian argument. Debt can’t really burden future generations. In the aggregate, Americans won’t be any worse off. Paying the national debt merely shifts dollars from one American to another. While future taxpayers will be out some money, the American bondholders who receive the interest payments will end up with more money. When all is said and done, it’s a wash.

The budget deficit for fiscal year 2019 came in just a hair under $1 trillion according to the Congressional Budget Office estimate.

Even if it does come in under the trillion-dollar mark, it would still rank as biggest deficit since 2012. The budget shortfall has only eclipsed $1 trillion four times, all during the aftermath of the 2008 financial crisis.

The US national debt increased by $1.2 trillion in fiscal 2019, which ended Sept. 30. This follows on the heels of a $1.27 trillion increase in the national debt in fiscal 2018.

The fiscal year budget deficit surged passed $1 trillion last month. Spending deficits necessarily mean more government borrowing and we’re seeing that in the numbers as well. Uncle Sam’s outstanding public debt grew by $450 billion in August alone.

The national debt stood at $22.02 trillion on Aug. 1 and surged to $22.47 trillion as of Aug. 27.

The federal government continues to spend money at an insane rate and is running up budget deficits reminiscent of the Great Recession era.

With one month left to go, the federal budget deficit for fiscal year 2019 eclipsed $1 trillion in August, according to Treasury Department data released last Thursday.