Budget Deficit Shoots Past $1 Trillion for Fiscal 2019

The federal government continues to spend money at an insane rate and is running up budget deficits reminiscent of the Great Recession era.

With one month left to go, the federal budget deficit for fiscal year 2019 eclipsed $1 trillion in August, according to Treasury Department data released last Thursday.

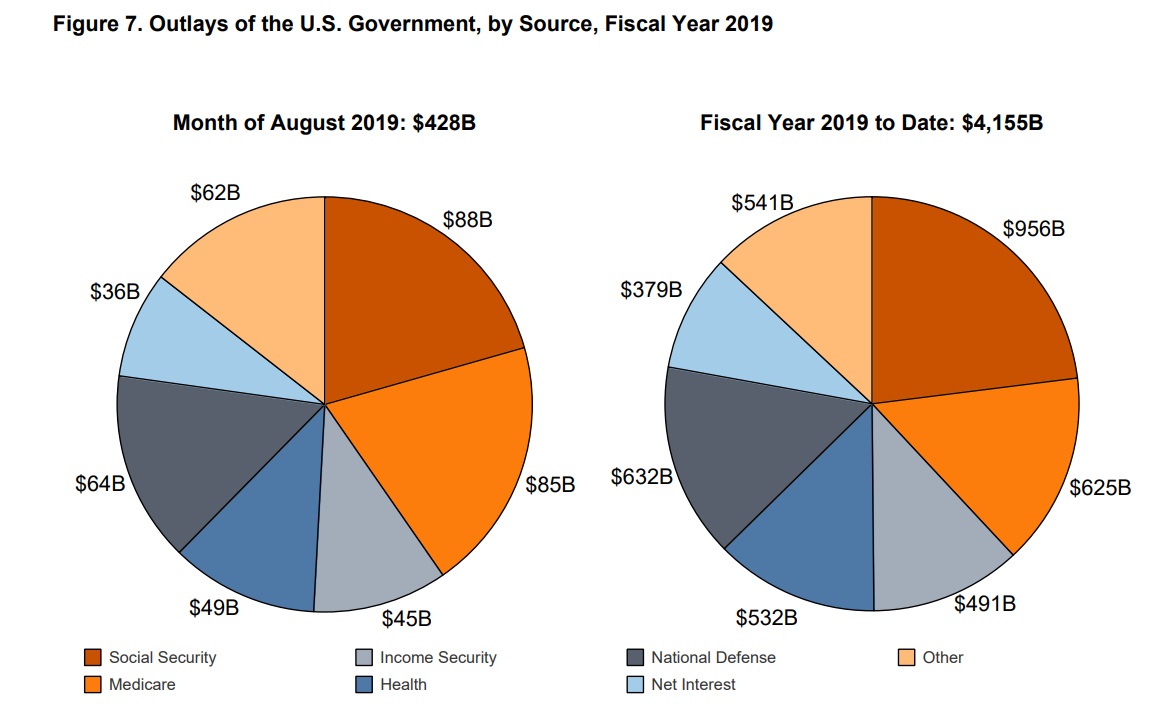

The budget shortfall for the month of August came in at $200.3 billion. Last month, Uncle Sam spent $428.3 billion and took in $228 billion in revenue.

The pundits in the mainstream media tend to focus on the Trump tax cuts as the cause for the surging deficits, but revenues are actually up. Spending is the real culprit.

For the fiscal year (beginning Oct. 1), the Trump administration has spent $4.16 trillion. That’s up 7% over last year. Uncle Sam has already spent more this year than it did in the totality of FY 2018.

As Peter Schiff put it in a tweet last month, we’re seeing the most incredible growth in peacetime government spending ever.

Revenue for 2019 is up about 3% with a big boost coming from the Trump administration’s tariffs on Chinese imports.

The 2019 budget deficit now stands at about $1.07 trillion. That’s a 19% increase in the budget gap since Oct. 1. The last time the federal government ran a $1 trillion-plus deficit was in 2012 as the US economy struggled to come out of the Great Recession. The Obama administration ran four consecutive trillion-plus dollar deficits between 2009 and 2012.

Officials say the budget shortfall could narrow slightly next month and the fiscal year deficit may end up below that $1 trillion mark. The federal government generally runs a surplus in October due to a revenue boost from the influx of quarterly estimated tax payments. The CBO projects that the 2019 fiscal year deficit will come in at $960 billion.

The CBO tends to take a conservative approach to its number-crunching. Other analysts say they expect the FY 2019 deficit to come in over $1 trillion. Regardless, it will be a significant increase over the 2018 deficit, which was the largest in six years at $779 billion. The federal government eclipsed that number last month.

In February, the national debt topped $22 trillion. When President Trump took office in January 2017, the debt was at $19.95 trillion. That represented a $2.06 trillion increase in the debt in just over two years.

And there is no end in sight to the spending. Last month, Pres. Trump signed a bipartisan budget deal that will increase discretionary spending from $1.32 trillion in the current fiscal year to $1.37 trillion in fiscal 2020 and then raises it again to $1.375 trillion the year after that. The deal will allow for an increase in both domestic and military spending.

The out of control spending and spiraling deficits are concerning enough on their own terms, but they become absolutely horrifying when you consider that these budget shortfalls are happening during an economic expansion. You would normally expect numbers like this during a major recession. This raises an important question: if Uncle Sam’s financial situation is this bad in these supposedly good economic times, what’s going to happen when things turn sour?

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]