CBO Estimates FY2019 Federal Budget Deficit Was Just A Hair Under $1 Trillion

The budget deficit for fiscal year 2019 came in just a hair under $1 trillion according to the Congressional Budget Office estimate.

Even if it does come in under the trillion-dollar mark, it would still rank as biggest deficit since 2012. The budget shortfall has only eclipsed $1 trillion four times, all during the aftermath of the 2008 financial crisis.

According to the CBO estimate, the deficit will come in at $984 billion. That amounts to 4.7 percent of GDP, the highest percentage since 2012. It would be the fourth consecutive year in which the deficit increased as a percentage of GDP. The debt-to-GDP ratio is estimated to have increased a hefty 26 percent over last year.

The Treasury Department will release its official numbers later this month.

The CBO called the federal government’s budget trajectory “unsustainable.”

The pundits in the mainstream media tend to focus on the Trump tax cuts as the cause for the surging deficits, but revenues are actually up. Spending is the real culprit.

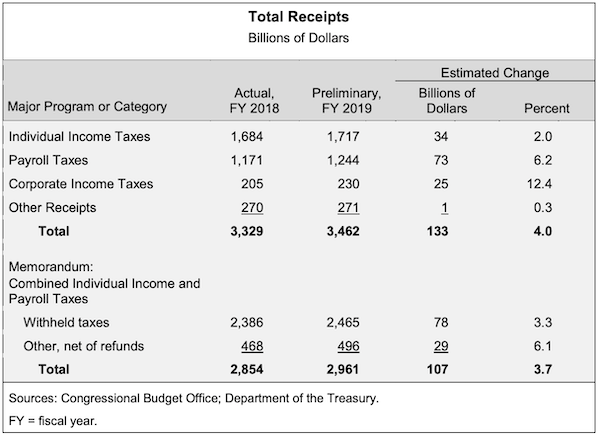

Revenue was up 4 percent over fiscal 2018, according to the CBO estimates. Individual and payroll tax receipts increased by $107 billion. Corporate taxes were up $25 billion, a 12 percent increase over last year. Increases in tariff revenue also boosted total government receipts.

Meanwhile, spending was up 8 percent last year, coming in at $4.45 trillion. There were significant increases in outlays for both domestic and military spending. Department of Defense spending rose by $47 billion (8 percent). The Department of Education spent $66 billion more last year. And the net interest on public debt was up by 14 percent.

The spending will continue into the foreseeable future. The bipartisan budget deal signed by President Trump over the summer suspended the borrowing limit for two years and will increase discretionary spending from $1.32 trillion in the current fiscal year to $1.37 trillion in fiscal 2020 and then raises it again to $1.375 trillion the year after that. The deal will allow for an increase in both domestic and military spending.

Unsurprisingly, the national debt is spiraling upward. The national debt increased by $1.2 trillion in fiscal 2019, according to Treasury Department data. The gross national debt currently comes in at a staggering $22.7 trillion and climbing.

To put that into perspective, last February, the national debt topped $22 trillion. When President Trump took office in January 2017, the debt was at $19.95 trillion. That represented a $2.06 trillion increase in the debt in just over two years. The borrowing pace continues to accelerate, with the Treasury set to borrow over three-quarters of a trillion more in just six months. (If you’re wondering how the debt can grow by a larger number than the annual deficit, economist Mark Brandly explains here.)

This kind of “economic stimulus” is a Keynesian dream. Trump claims he’s created the best economy in the history of America, but government spending at levels we would normally see during a recession have juiced the economy. The “great” economy Trump keeps boasting about is actually smoke and mirrors sustained by federal spending and consumers borrowing themselves into record levels of debt.

Republicans like to blame Democrats for big-spending and deficits, but the current spending spree is a bipartisan effort. Virtually nobody in Washington DC is doing anything to rein in this runaway train. It’s is quickly heading down the tracks toward a fiscal disaster.

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]