South African gold output saw its biggest drop in over a year in May, falling 16.2% year-on-year. This is another sign that the one-time world leader in gold production could be running out of the yellow metal.

May’s decline came on the heels of a 5.8% drop in production in April. It was the eighth consecutive month of declining output for South African gold mines, according to Pretoria-based Statistics South Africa.

Have you ever thought about owning gold?

That may seem like a strange question. You’re probably thinking to yourself, “Why everybody has at least thought about investing in gold.” But that’s apparently not true – at least not in Australia. According to a poll conducted by Australia’s leading gold bullion company, 45% of Australians have never even thought about investing in physical gold.

The fact that so many people have never even thought about investing in gold explains why 85% of Australians don’t own any of the yellow metal.

The price of gold in pounds spiked Monday as Brexit confusion and political instability sent Brits scampering into safe havens.

Spot gold against the pound rose nearly 1% after Brexit Minister David Davis and British Foreign Minister Boris Johnson both resigned their posts in protest.

Business Day described Brexit as a “ramshackle exit from the EU,” as a European Central Bank policymaker warned it could damage economic growth in the eurozone.

In another sign the stock market bubble could be near the popping point, investor margin debt hit a new record high, even has the Dow Jones has sold off around 2,500 points since highs earlier in the year.

According to the Financial Industry Regulatory Authority (FINRA) margin debt hit $669 billion in May. That represented a 2.9% increase from April.

What exactly is margin debt and why does it matter?

European gold-back ETFs continued to add yellow metal in June, but globally, total holdings fell for the first time in nearly a year as gold flowed out of North American and Asian funds.

Global gold-backed ETF holdings fell by 49.3 tons to 2,434 tons in June, according to the latest data released by the World Gold Council. It was the first month of net outflows since July 2017.

Even with the sharp June drop, total ETF gold holdings globally remain up on the year by 63 tons.

The SchiffGold Friday Gold Wrap podcast combines a succinct summary of the week’s precious metals news coupled with thoughtful analysis. You can subscribe to the podcast on iTunes.

Is it just me, or has modern American politics devolved into little more than petulant playground namecalling devoid of substance?

I stumbled across this latest outrage as I was perusing the depths of the internet the other day – presidential “challenge coins.” Apparently, according to the mainstream pundits, President Donald Trump can’t even get a fun little presidential tradition right.

The New York Times did an entire feature story on how Trump has ruined presidential challenge coins. I’ll bet most of you haven’t even heard of challenge coins. But they’re a thing. And according to our intrepid NYT columnist, Trump’s execution of this august tradition is a complete outrage!

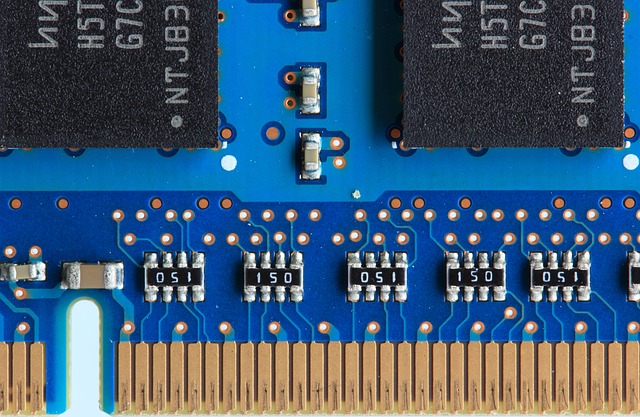

Technology will play a key role in driving precious metals demand in the coming years according to reports released this week by the World Gold Council and the Silver Institute.

The World Gold Council Gold Investor report for July focused on the growing use of gold in technology. According to the report, over the past decade, the tech sector accounted for more than 380 tons of gold demand annually. That’s 13% ahead of central bank purchases during the same time period. The demand for the yellow metal for tech applications logged its sixth consecutive quarter of gains in Q1 2018.

Technology is transforming the way we live, work and play, changing almost every aspect of our world, from industry to financial services to healthcare. Gold plays an integral part in this societal shift,” WGC CEO Aram Shishmanian said.

SchiffGold’s It’s Your Dime features “straight talk” interviews with movers and shakers in the world of precious metals, investing and economics.

In this episode, host Mike Maharrey talks with Dan Kruz, the man behind DK Analytics.

Earlier this month, Peter Schiff said Federal Reserve policy is pushing us toward a no-growth, high-inflation economy.

There are a number of factors in play. There are growing inflation pressures. There are record amounts of debt – both government and corporate. But behind all of these symptoms, we have a disease.

Ron Paul digs down to the root causes of our economic woes in this in-depth look at the US financial system and the need for reform. Paul says a monetary crisis is coming. What will replace the dollar? Paul makes a strong case for gold.