Japan is in the midst of a slow-motion train wreck. The country has a massive national debt and it is starting to feel the pressure of rising interest rates. In his podcast, Peter Schiff talked about the situation in Japan and pointed out some disturbing parallels to what’s happening in the US.

The mainstream remains optimistic about the trajectory of the economy. Price inflation has supposedly been beaten down. GDP growth was even better than expected, and most economists have tabled their recession predictions. But in his podcast, Peter Schiff explained that it’s all an illusion. The financial crisis has already started, and it continues to play out beneath the radar.

Nobody understands that this crisis has started. But believe me, it has. This was the way the 2008 financial crisis started. It didn’t just happen when Lehman Brothers went bankrupt.”

Will the Federal Reserve raise interest rates again? Or is this hiking cycle over? Will it really hold rates higher longer, or will it cut in the near future? Everybody in the financial world is trying to predict the central bank’s next move.

Fed members insist they are data-dependent and will go where the numbers lead them. But in an interview on CNBC, financial analyst Jim Grant said data alone isn’t enough. You need to put the data into context.

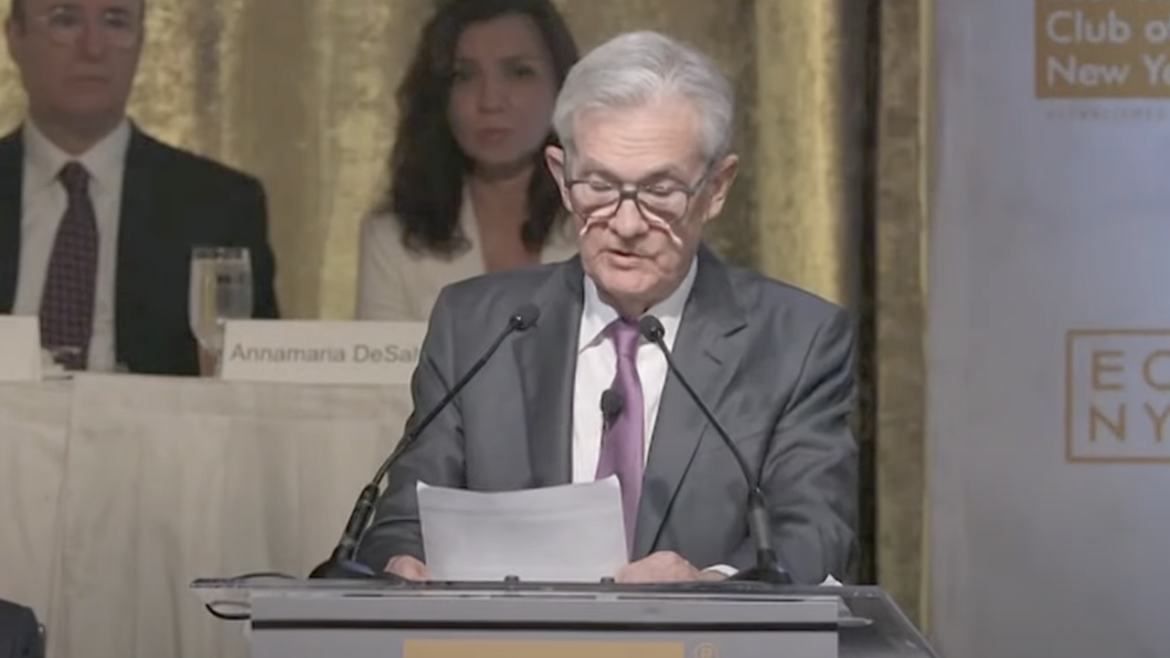

Last week, Federal Reserve Chairman Jerome Powell delivered a speech at the Economic Club of New York luncheon. In his podcast, Peter Schiff broke down some of the Fed chair’s comments and concluded that Powell is not qualified to be a member of any economic club.

The mainstream continues to insist that the economy is fine. Inflation is beat. A soft landing is in play. But in his podcast, Peter Schiff said we’re in the early stages of a financial crisis. It should be obvious, but very few people see it coming.

The economy is strong. The American consumer is resilient. Everything is great. At least that’s the mainstream narrative. In this episode of the Friday Gold Wrap podcast, host Mike Maharrey explains why it’s all just an illusion of prosperity. Along the way, he covers the September retail sales data, Federal Reserve Chairman Jerome Powell’s speech this week, and the recent gold rally.

Problems in the commercial real estate (CRE) sector continue to bubble under the surface. This is a major stress point for US banks and could precipitate the next phase of the financial crisis.

A combination of high interest rates and declining tenancy is putting the squeeze on commercial real estate owners. As a result, banks hold a growing portfolio of delinquent CRE loans.

Every time retail sales come in higher than expected, the mainstream media breathlessly reports this as proof that the American consumer is strong and resilient. In his podcast, Peter Schiff explained that these retail sales numbers aren’t a sign of a strong economy. They just reflect Americans paying more for less. And what’s worse, they’re burying themselves in debt to do it.

The House recently ousted House Speaker Kevin McCarthy in the wake of the continuing resolution to keep spending money and avoid a government shutdown. Dissatisfied Republicans frustrated with the GOP’s unwillingness to address the federal spending problem banded together with Democrats to send McCarthy packing.

While the outcome might be politically satisfying to some, it’s not going to solve the underlying problem.

There is a persistent myth that inflation was “low” in the decade following the 2008 financial crisis.

It’s time to bust that myth.