Global debt rose $10 trillion to a record $397 trillion in the first half of 2023, according to the Institute of International Finance (IIF).

The big increase in debt occurred despite tightening credit conditions, and it is an increasingly worrisome problem because the “free lunch” of artificially low interest rates is over.

After the CPI data came out last week, gold rallied. On his podcast, Peter Schiff talked about the rally and the trajectory of gold. He said we can expect even bigger moves up when the markets figure out the inflation problem isn’t solved.

Joe Biden says the economy is great. Paul Krugman says the inflation war is over and we won. But Americans aren’t buying the narrative. They’re growing increasingly worried about the economy and inflation.

The University of Michigan Index of Consumer Sentiment tanked in October with inflation worries at the highest level since last May.

The CPI has cooled in recent months, but Americans say they’re still struggling with rising prices and they’re worried about inflation. Why is there this dichotomy between people’s perceptions and the official data?

Peter Schiff recently appeared on Real America with Dan Ball to talk about the economy. He said the problem is the government isn’t being honest about inflation.

Great news! The inflation war is over and we won! At least that’s how Paul Krugman sees it. But he’s playing tricks with the data and making assumptions that are meaningless in the real world. In this episode of the Friday Gold Wrap, host Mike Maharrey dissects Krugman’s claims in light of the September CPI data. He also talks about market reaction to the CPI and shares some interesting gold news from Zimbabwe.

“Hotter than expected.”

This seems to be a recurring theme when it comes to price inflation.

The September CPI data gave us another variation on that tune. And it should once again remind us that the Federal Reserve is nowhere near its 2% target.

An important error in statistical analysis is that mathematical economists have lost sight of what their beloved statistics represent —none more so than with GDP.

In this analysis, I explain why GDP is simply the total of accumulating currency and credit which is wrongly taken to reflect economic progress — there being no such thing as economic growth, only the growth of credit. Once that point is grasped, the significance of this basic error becomes clear, and the fiat currency paradigm is revealed for what it is: a funny money game that will go horribly wrong.

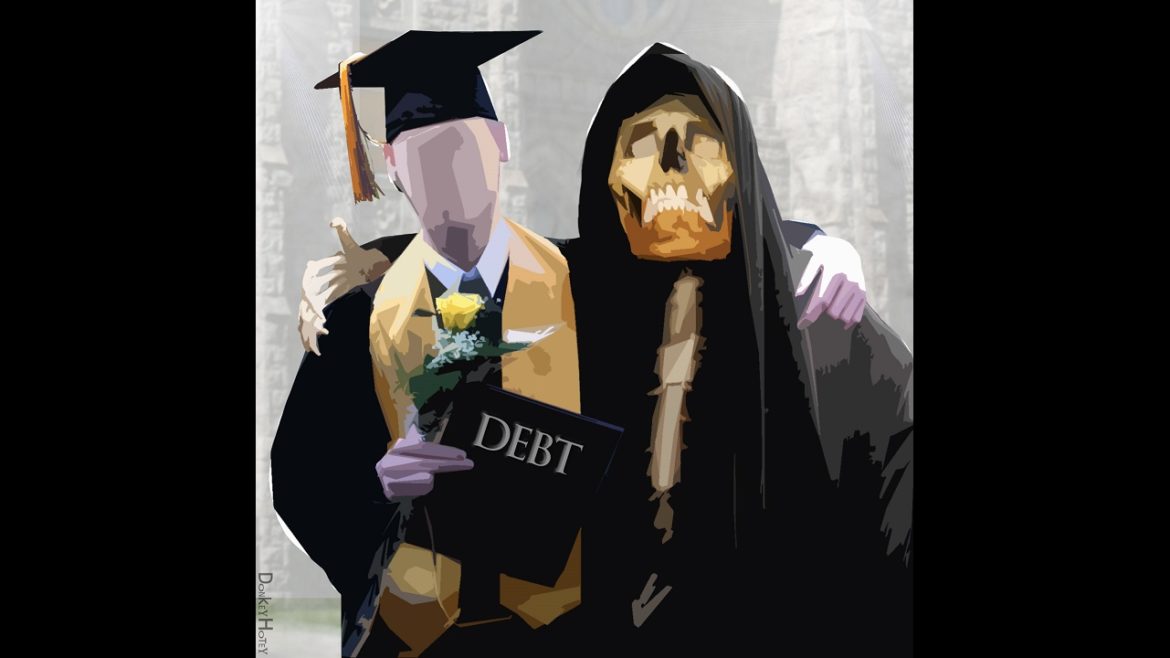

After a more than 3-year pause, government student loan repayments started again this month and it’s already putting the squeeze on borrower’s wallets. This is bad news for an economy already strained by massive levels of debt and rising interest rates.

Interest accrual on student loans resumed on September 1 with the first payments coming due in October.

Twenty days.

That’s how long it took the Biden administration to add another half-trillion dollars to the national debt.

Bidenomics certainly requires a lot of borrowing and spending.

War broke out in the Middle East over the weekend after Hamas attacked Israel. In his podcast, Peter broke down the possible economic ramifications here in the United States. He said the US can’t afford peace, much less war.