Optimism is driving the markets. Most investors seem to believe the economy is strong. The consumer is resilient. Price inflation is easing. And most people think the Federal Reserve is finished hiking rates. In his podcast, Peter Schiff explained why this investor optimism is at odds with reality.

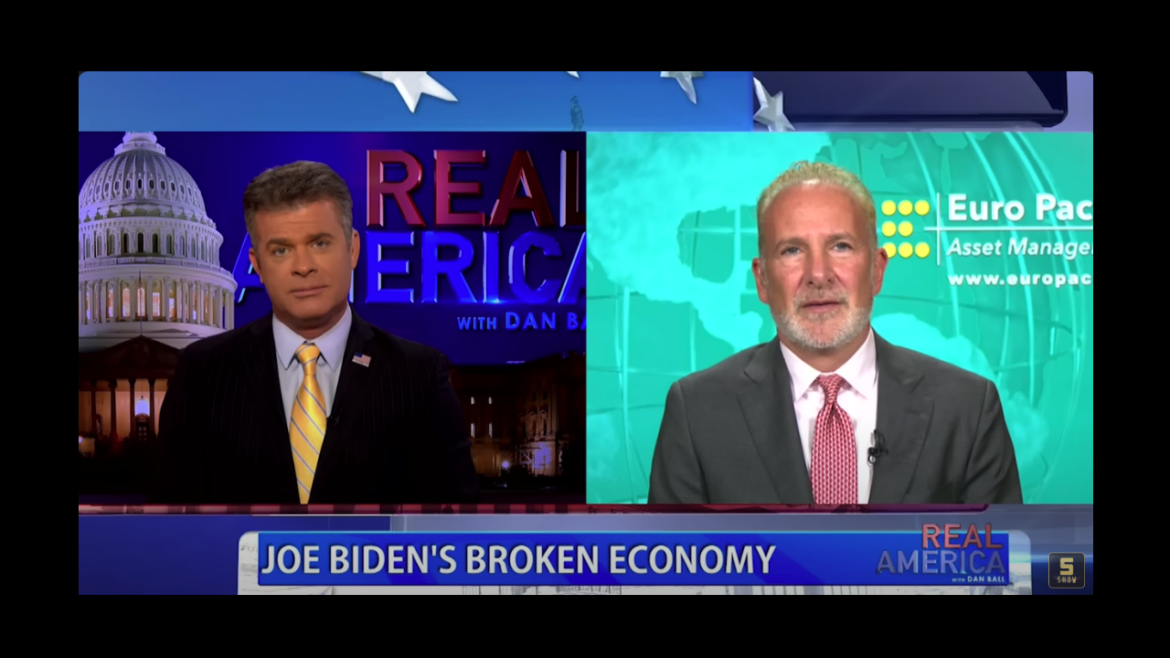

Peter Schiff recently appeared on Real America with Dan Ball to talk about the latest employment data and the state of the real estate market. We know there is a lot of doom and gloom in the headlines, but Peter said the situation is actually doomier and gloomier than the headlines suggest.

The Great Game of Geopolitics faces a new challenge. The new hotspot is Israel and the Muslim Middle East. Ukraine is all but over, and the US is likely to abandon her to her fate — like Afghanistan.

We shall have to see how both will play out. Meanwhile, energy prices are set to keep inflation and interest rates high, undermining governments, banking systems, and businesses dependent on cheap credit.

Mainstream pundits and government officials keep talking about the strong economy and resilient consumers while ignoring what’s driving them – borrowing. To listen to them, you would think the road to prosperity is paved with credit cards. In this episode of the Friday Gold Wrap host Mike Maharrey breaks down the recent household debt data and explains why this isn’t the sign of a strong economy. He also highlights some interesting silver demand news.

Mainstream financial network pundits and government officials keep telling us that the economy is chugging along because Americans continue to spend money. But it’s clear that borrowing is the only thing sustaining this spending spree.

Meanwhile, the “resilient” American consumer is drowning under a surging tidal wave of debt.

The Federal Reserve operates under a dual mandate from Congress — to achieve maximum employment and stable prices. In a recent podcast, Peter Schiff explained why the Fed won’t achieve either.

President Biden keeps saying the economy is great. Fed officials say the economy is expanding at a “strong pace.”

Peter Schiff isn’t buying the narrative.

He says we may already be in a recession and he made a strong case in his podcast.

There is a $33.7 trillion elephant in the living room.

I’m referring to the massive national debt.

It’s pretty amazing that we have this massive animal sitting right in the middle of everything and most people are just walking around it as if it isn’t there.

Federal Reserve Chairman Jerome Powell said he’s not confident interest rates are high enough to slay price inflation. He also said he’s not confident they aren’t. In this episode of the Friday Gold Wrap podcast, host Mike Maharrey wonders out loud why we should have any confidence if Powell doesn’t. Along the way, he breaks down the November Fed meeting and talks about the “colossal” year for central bank gold buying.

Chalk one up for the status quo.

As expected, the Federal Reserve held interest rates steady in a range between 5.25 and 5.5% for the second straight FOMV meeting, and chairman Jerome Powell was intentionally noncommital about future Fed moves.