The Bureau of Labor Statistics (BLS) released the non-farm payroll report for September on Friday. Once again, the headline numbers didn’t reflect reality.

Peter Schiff talked about it in his podcast. He said all of the people like President Biden probably shouldn’t be bragging about creating jobs people wish they didn’t have to have.

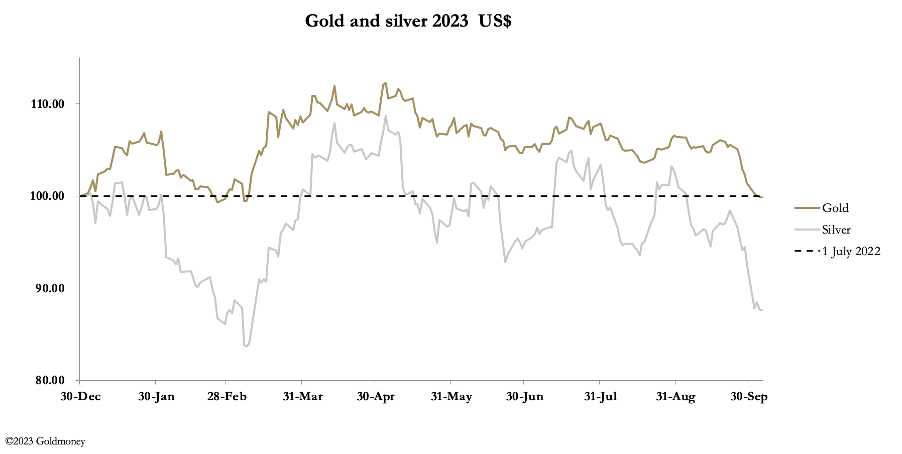

The sell-off in precious metals continued as bond yields continued to rise and a strong dollar persisted. In early trade in Europe this morning, gold was $1822, down another $26, unchanged on the year. Silver traded at $21, down $1.17. Comex volumes in both metals declined from good levels, indicating that selling pressure is declining.

The mainstream wasn’t just wrong about inflation in 2020. It was wildly wrong. In this episode of the Friday Gold Wrap podcast, host Mike Maharrey dissects a 2020 video produced by CNBC to show just how wrong they were. He explains why they were wrong and teaches some economics along the way. He also discusses the carnage in the bond market and tells you who is buying gold.

This article looks at the collateral side of financial transactions and some significant problems that are already emerging.

At a time when there is a veritable tsunami of dollar credit in foreign hands overhanging markets, it is obvious that continually falling bond prices will ensure bear markets in all financial asset values leading to dollar liquidation. This unwinding corrects an accumulation of foreign-owned dollars and dollar-denominated assets since the Second World War both in and outside the US financial system.

I recently ran across a video produced by CNBC back in July 2020. It is titled “Why Printing Trillions of Dollars May Not Cause Inflation.”

That aged poorly, didn’t it?

And people wonder why I keep saying you should be skeptical of mainstream narratives.

Price inflation has been even worse than advertised.

Of course, you know that because you’ve lived it. But it is nice when the data crunchers swerve a little closer to reality.

The Bureau of Economic Analysis did just that, revising its Personal Consumption Expenditure (PCE) data higher for the entirety of this inflation cycle.

We keep hearing about a “soft landing.” According to government officials, central bankers, and mainstream financial media pundits, the US economy has dodged a recession.

So why are recession warning signs still flashing?

Banks are more vulnerable to the housing market now than they were in 2007.

Most people in the mainstream will scoff at that statement. They’ll tell you that the situation is very different today. After all, we don’t have a big problem in the subprime mortgage market. We’re not seeing a big spike in defaults. That’s true. The problem is different this time. And it’s actually worse.

The markets seem to think that everything is fine. They believe the Fed has effectively beat price inflation and it can mop it up without crashing the economy. In his podcast, Peter Schiff said in reality the Fed is at a fork in the road, and there is an imminent disaster waiting no matter which way it goes. He also warned that the biggest crisis is the one nobody sees coming.

The economy is great! Inflation is dead! We’re on our way to a soft landing! We keep hearing messages like this over and over again from Fed officials, the Biden administration, academics, and financial news pundits. But doesn’t the spin seem a little detached from reality? In this episode of the Friday Gold Wrap, host Mike Maharrey exposes the political class’s gaslighting operation. He also talks about the big selloff in gold this week.