As the old saying goes, if it looks like a duck, walks like a duck, and quacks like a duck, it’s probably a duck.

Well, if it looks like a bailout, walks like a bailout, and talks like a bailout, it’s probably a bailout.

The annual rise in the Consumer Price Index (CPI) for February came in at 6%. This was down from the 6.4% annual increase charted in January. The eighth straight monthly decline in CPI seems to have restored faith that the Federal Reserve is winning the inflation fight. But everybody should probably stop and remember that the target is 2%.

Six percent is a lot bigger than 2%.

On June 14, 2022, Peter Schiff appeared on Ingraham Angle, and he said, “Thanks to the Federal Reserve, everybody has so much debt that we can’t afford to pay an interest rate high enough to fight inflation. But it is going to be high enough to cause a massive recession and another financial crisis that’s worse than the one we had in 2008.”

On March 13, 2023, Peter was on Ingraham Angle again, this time to talk about the beginning of that financial crisis.

The CPI came in at 0.37% for the month of February. While this was in line with expectations, it is still a 4.5% annualized increase in prices.

And falling energy prices made the CPI look cooler than it actually was.

February has historically been a big budget deficit month, but the Biden administration still managed to overachieve and run the second-largest February deficit ever. The only time the US government has run a February deficit bigger than the $262.4 billion shortfall last month was in February 2021 in the midst of the COVID stimulus.

This raises an important question: between a budding financial crisis and a US government spending problem, how is the Federal Reserve ever going to get price inflation back to its mythical 2% target?

As we start to sort through the fallout of the failure of Silicon Valley Bank and Signature Bank and the government’s reaction to it, the next question is: what’s next?

Government officials and mainstream pundits insist everything is fine now. They say quick government action averted a crisis. But in his podcast, Peter Schiff said this is really just the beginning of the next financial crisis.

Over the past several months, Mike Maharrey and I have posted numerous articles that conclude the same way… the Fed is bluffing and when something breaks, they will fold. On every podcast, Mike has walked through exactly why this is inevitable. Back in September, I laid out the math that showed why the Fed would fold and laid out a series of risks that may cause such an event. One of those risks was “What if the financial markets freeze because there is a credit event somewhere?”.

The Federal Government ran a deficit of -$262B in February. Ignoring the Student Loan forgiveness allocation in September last year, this is the largest monthly budget deficit since July 2021. And it’s the second-largest February deficit ever.

The failure of Silicon Valley Bank and Signature Bank reminds us of a very important truth — if you can’t hold it in your hand, you don’t really own it.

That’s why it’s wise to hold at least some of your wealth in hard assets like gold and silver that are in your direct possession or at least stored in a secure, allocated, segregated, and insured storage facility.

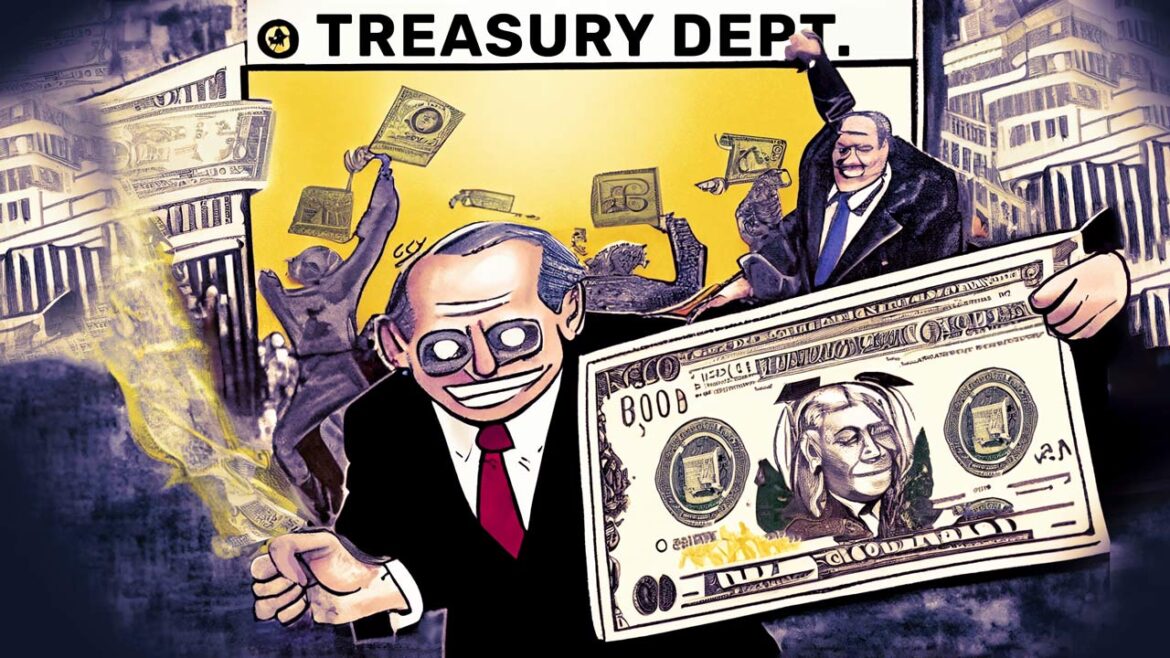

In the wake of two bank failures, the Federal Reserve and the US Treasury announced a bank bailout program.

Last week, Silicon Valley Bank was shuttered by federal authorities after the bank suffered significant losses selling bonds in order to raise capital. When that news hit, depositors rushed to pull funds from the bank, making it functionally insolvent. Then over the weekend, federal authorities shut down Signature Bank.