Over the past several months, Mike Maharrey and I have posted numerous articles that conclude the same way… the Fed is bluffing and when something breaks, they will fold. On every podcast, Mike has walked through exactly why this is inevitable. Back in September, I laid out the math that showed why the Fed would fold and laid out a series of risks that may cause such an event. One of those risks was “What if the financial markets freeze because there is a credit event somewhere?”.

The Federal Government ran a deficit of -$262B in February. Ignoring the Student Loan forgiveness allocation in September last year, this is the largest monthly budget deficit since July 2021. And it’s the second-largest February deficit ever.

The failure of Silicon Valley Bank and Signature Bank reminds us of a very important truth — if you can’t hold it in your hand, you don’t really own it.

That’s why it’s wise to hold at least some of your wealth in hard assets like gold and silver that are in your direct possession or at least stored in a secure, allocated, segregated, and insured storage facility.

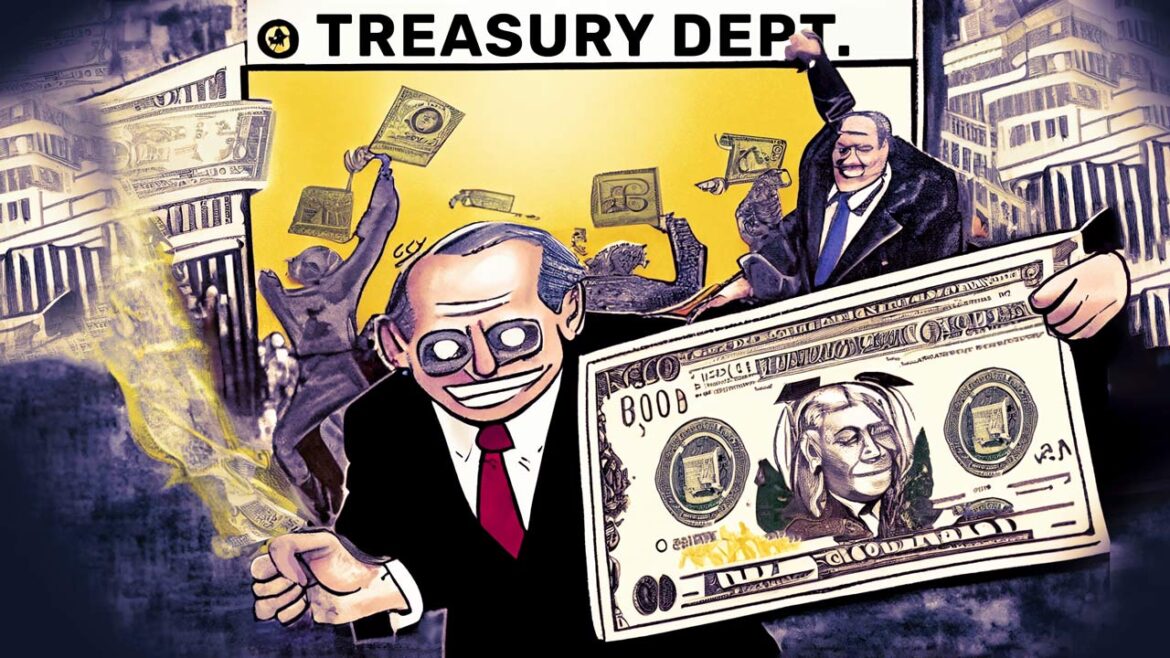

In the wake of two bank failures, the Federal Reserve and the US Treasury announced a bank bailout program.

Last week, Silicon Valley Bank was shuttered by federal authorities after the bank suffered significant losses selling bonds in order to raise capital. When that news hit, depositors rushed to pull funds from the bank, making it functionally insolvent. Then over the weekend, federal authorities shut down Signature Bank.

As discussed last month, it is getting harder to take all the BLS employment data as fact. This month, some of the data is a bit closer in line, but the QECW report seemed to show a big deviation (more below).

There has been a lot of talk about central bank digital currencies (CBDCs) lately. Supporters tell you they will provide a safe, secure, convenient alternative to cash. But in this episode of the Friday Gold Wrap, host Mike Maharrey digs deeper and explains that CBDCs are actually about more government control. He also talks about how Jerome Powell talked and tanked the markets this week.

The January Trade Deficit saw a slight increase compared to December, coming in at -$68.3B vs -$67.2B in the prior month. After peaking at -$106B in March of last year, the Trade Deficit has returned to a more stable range between -$60B and -$80B.

During testimony on Capitol Hill, Federal Reserve Chairman Jerome Powell said the central bank may have to raise interest rates higher than previously expected to bring down price inflation.

Despite the speed of Fed hiking and the enormous amount of debt in the US economy, most people in the mainstream seem convinced the central bank can keep hiking rates without breaking the economy.

Economist Thorsten Polleit disagrees.

Every government policy has consequences – some intended and some unintended.

There is at least one serious unintended consequence of the economic sanctions levied against Russia after its invasion of Ukraine – an erosion of the US dollar dominance.

In January, retail sales came in much hotter than expected. Now we know how consumers paid for the spending spree. They put it on credit cards.

After slowing modestly in December, growth in revolving debt spiked again in January. But a slowdown in non-revolving credit moderated the overall increase in consumer debt.

Overall, this signals a pretty bleak trajectory for the economy.