In this episode of Metal Exchange, host Mike Maharrey chats with SchiffGold analyst Tony about the recent bank failures, the bailouts, the reaction of the markets and what might happen next. They conclude that if you’re betting that the Federal Reserve has everything under control, that’s probably a bad bet!

The demise of Silicon Valley Bank and Signature Bank was just the tip of the iceberg. As it turns out, hundreds of banks are at risk. This explains why the Federal Reserve and US Treasury rushed to provide what is effectively a bailout for the entire banking system.

In the first week, the Federal Reserve handed out more than $300 billion in loans through its newly created Bank Term Funding Program (BTFP).

Peter appeared on Fox Business Claman Countdown to talk about the recent bank failures and the ensuing government bailouts. During the interview, they discussed how to invest in the current environment. Peter said that right now, gold is undervalued, but investors will bid up the price much higher when they come to terms with the reality of inflation.

Peter Schiff recently appeared on Brighteon.com with Mike Adams to talk about the failure of SVB and Signature Bank, the bailouts and the potential ramifications. During the interview, Peter explained the difference between SchiffGold and a lot of the other gold companies out there.

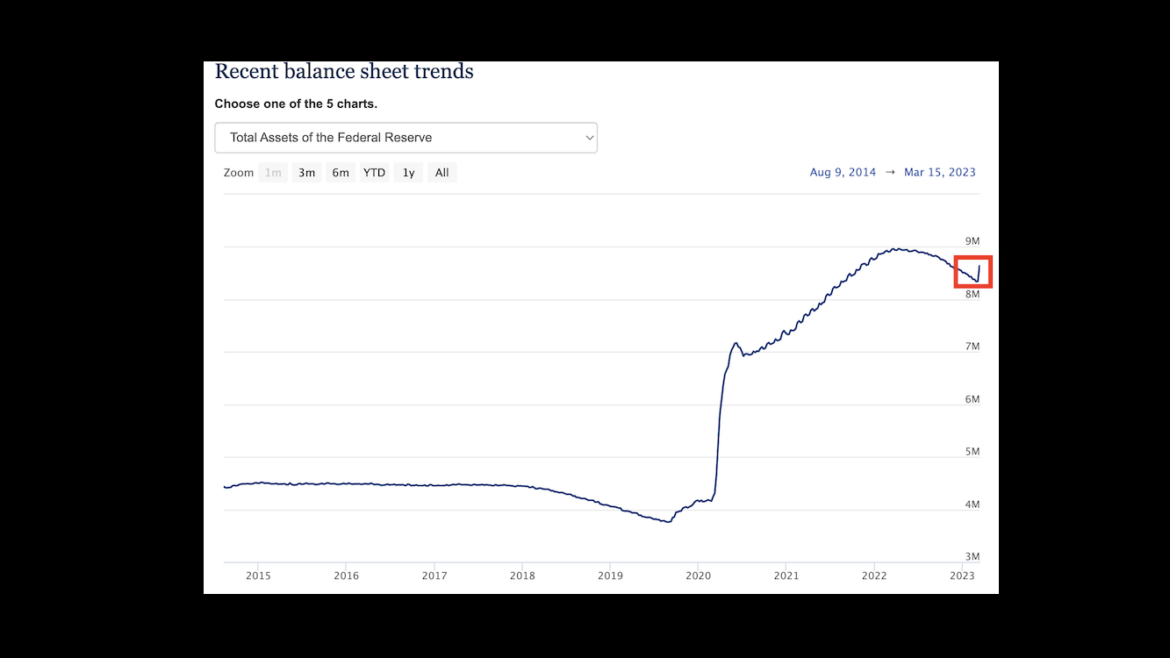

The Federal Reserve added nearly $300 billion to its balance sheet in a single week as it kicked off its loan bailout program for banks.

In effect, the Fed loaned troubled banks $300 billion of new money that was created out of thin air.

In other words, we got $300 billion in inflation in a single week.

Peter Schiff appeared on the Capitol Report on NTD News to talk about the bank bailouts and the possible ramifications. He said that no matter what President Joe Biden and others tell you, Americans are going to pay for this.

The interview started with a clip of Treasury Secretary Janet Yellen assuring Congress that the banking system is safe. So, should we feel confident in our banking system?

Gold had a big rally last week. But is it sustainable? What are the technicals saying?

The data over the last several months continues to give insight into the market. November showed the market was in neutral, but then the December analysis correctly identified an impending move upwards, the January review called for a correction and then February concluded:

Given the potential impacts of the ongoing banking crisis, I will start this article with the conclusion.

The current banking crisis could not have come at a worse time for the Comex system. Inventories have seen massive depletion over the last 2+ years as investors have slowly been pulling physical out of the vaults. I have previously called this a run on the vault but labeled it as a stealthy one. As though certain investors did not want to raise the alarm, but slowly take possession while inventory was still available.

Friday gold wrap host Mike Maharrey has been saying something is going to break in the economy for months due to the Federal Reserve’s monetary tightening to fight price inflation. Last Friday, something broke when Silicon Valley Bank collapsed followed quickly by the demise of Signature Bank. It was the first crack in the dam. The Fed rushed in to plug the leak, but was it enough? In this episode of the podcast, Mike talks about the response to these bank failures and the possible ramifications.

After ending 2022 on an upward trend that continued into January, Chinese gold demand surged again in February as the economy continues to rebound from government-imposed COVID policies.

Gold withdrawals from the Shanghai Gold Exchange (SGE) totaled 169 tons in February. This is a reflection of strong wholesale demand and signals an ongoing rebound in the world’s biggest gold market.