Jewelry production is an important driver of overall silver demand. In 2022, the amount of silver used in jewelry was up around 29% as overall silver demand hit record levels. Silver jewelry production used around 235 million ounces of silver.

And according to a recent survey by the Silver Institute, silver jewelry sales are on the rise.

Peter Schiff appeared on NTD News to talk about the bank bailout and the March Federal Reserve meeting. During the conversation, Peter explained that everybody is going to pay for these bailouts because they will ultimately devalue the dollar as inflation skyrockets.

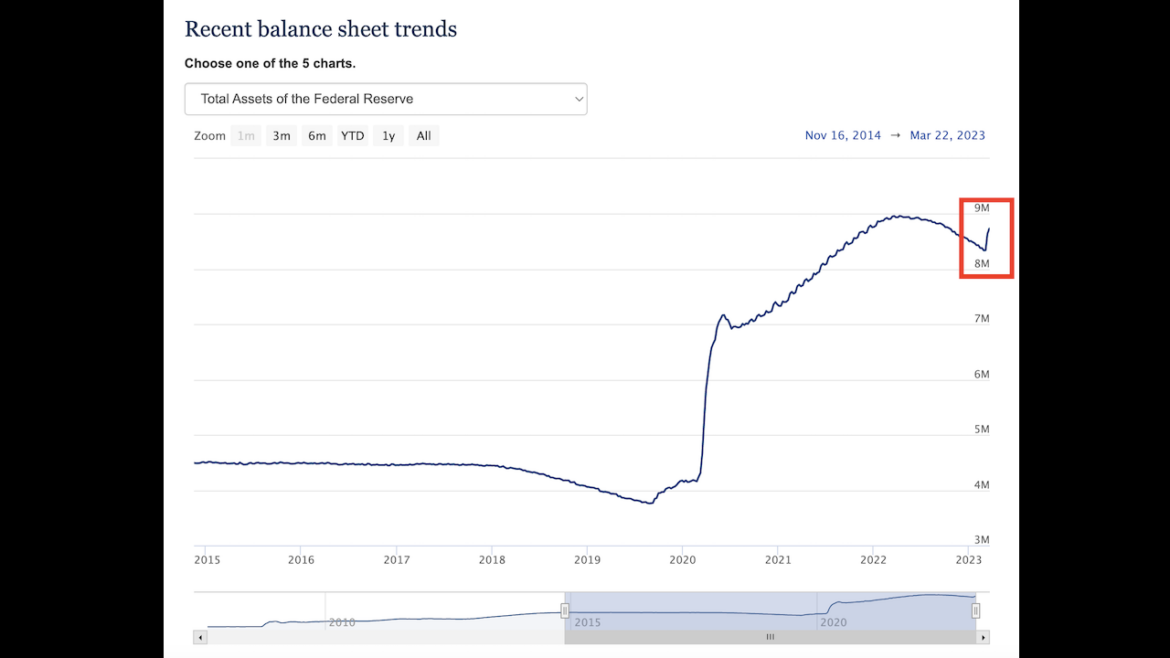

In the week before it raised interest rates another 25 basis points to fight inflation, the Federal Reserve added more than $94 billion to its balance sheet. This was on top of the nearly $300 billion it piled onto the balance sheet in the first week of its bank bailout.

The balance sheet reveals that Fed has loaned banks nearly $400 billion in money created out of thin air in just two weeks.

Peter Schiff appeared on Real America with Dan Ball to talk about the bank bailout, the unfolding financial crisis, the Fed and inflation. He said this is a sequel to 2008 and like all sequels, it’s going to be worse.

Gold is wrapping up March, which is a minor delivery month. While it was a decent delivery month, it was the smallest minor month since November 2021.

On Wednesday, the Federal Reserve raised interest rates again despite the problems in the banking system. In this episode of the Friday Gold Wrap, host Mike Maharrey talks about the Fed’s inflationary efforts to paper over the problems in the financial system while still keeping up the pretense of an inflation fight. He says it’s like trying to thread a needle with rope.

After the Federal Reserve raised interest rates another 25 basis points, Fed Chairman Jerome Powell assured everybody that the collapse of SVB and Signature Bank “are not weaknesses that are at all broadly through the banking system.” That raises a question: if that’s true, why did the Fed bail out the entire banking system?

The fact is Powell’s spin isn’t true. Furthermore, the breakdown in the banking system is a sign of a much bigger problem, as Ron Paul points out.

The Federal Reserve is trying to walk a tightrope — in a hurricane.

After rate hikes resulted in the collapse of Silicon Valley Bank and Signature Bank, the Federal Reserve and the US Treasury stepped in with a bailout. With that hole in the dam seemingly plugged for the time being, the Fed pushed forward and raised interest rates by another 25 basis points at its March meeting.

In the wake of two major bank failures, Federal Deposit Insurance Corporation (FDIC) deposit insurance effectively went to infinity. And there is no reason to believe it will be temporary.

As Silicon Valley Bank and Signature Bank were toppling, the government rushed in to guarantee 100 percent of both banks’ deposits. It was touted as an emergency measure to maintain confidence in the banking system and prevent runs at other banks. In effect, it bailed out wealthy depositors at two failing banks.

The dust continues to settle after the failure of Silicon Valley Bank and Signature Bank, and the ensuing government bailout. Many people in the mainstream seem to think the crisis has passed. But a closer look at the condition of the banking system reveals these two banks were just the tip of the iceberg. Peter Schiff appeared on NewsMax Wake Up America to talk about the financial crisis. He said that there are more bailouts to come.