Jim Rickards, author of Currency Wars, appeared on Bloomberg TV yesterday to talk about the fundamental economy of the United States and the weak price of gold. Much like Peter Schiff, Rickards believes that the US economy is already in a depression and that the Federal Reserve will not be able to raise interest rates anytime soon. In fact, Rickards believes another round of quantitative easing will begin in 2015. When asked if he thought interest rates would be raised next year, he responded, “Not in my lifetime.”

Here’s the video:

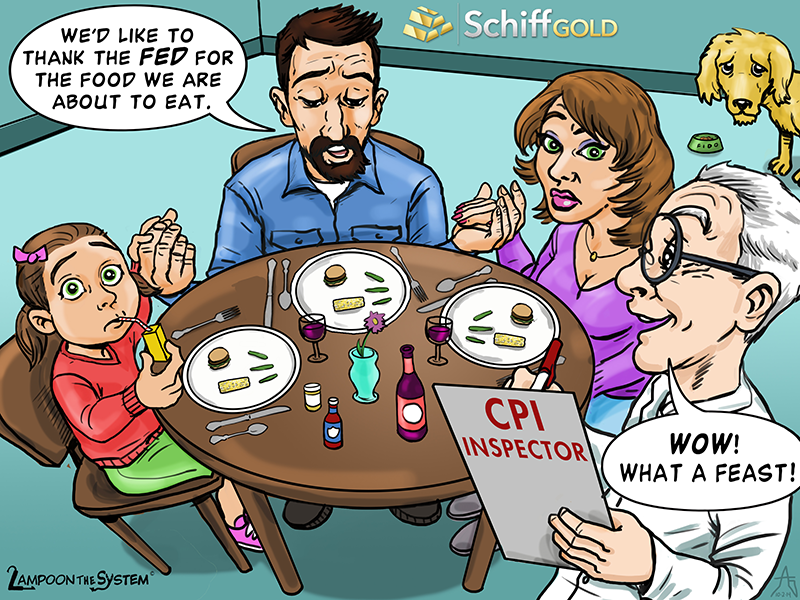

The latest comic from Lampoon the System peeks into the life of an American family grappling with the plight of “shrinkflation.” Let’s be grateful that the entity that bears the most responsibility for this economic trend (the Federal Reserve) is not actually doing our cooking for us.

Shrinkflation has been in the news quite a bit the last couple months. Peter Schiff and other well-respected market analysts have pointed to it as one of the many negative effects of the Fed’s toxic monetary stimulus programs. You can read more about the shrinkflation phenomenon in this post. It’s not just ice cream and chocolate bars that are shrinking before our eyes, though. The fundamental value and purchasing power of the United States dollar itself is slowly crumbling away. Read more here.

SchiffGold’s new website now has a full archive of all past editions of Lampoon the System comics created for our brand. Explore them here.

Jon Pawelko publishes the web comic Lampoon The System to poke fun at insane economic policies and educate the public on sound economics.

Click here for more cartoons and information on his anthology book, available for only $15.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

By Peter Schiff

Yesterday, I launched this new website and announced the rebranding of my gold bullion dealer from Euro Pacific Precious Metals to SchiffGold. I started this company four years ago to provide a trustworthy option for my Euro Pacific Capital brokerage clients, but it has since grown to become a major US gold dealer in its own right. This landmark for my company comes in the midst of a historic time for the precious metals. The past four years have had highs and lows. We have been experiencing the inflation of remarkable new asset bubbles, and gold’s response has been mixed. But I have reason to believe that over the next four years, gold and silver investors will witness shocking macroeconomic events that put to rest any doubts about the importance of having sound money in every portfolio.

Euro Pacific Precious Metals is now SchiffGold. Below you will find a personal message from our Chairman Peter Schiff.

We’re proud to announce this new responsive website and a new brand that is clear and simple, just like our business philosophy. We are committed to bringing you the lowest prices on investment-grade gold and silver, along with the highest quality customer service in the industry. Call and speak with one of our Precious Metals Specialists to learn more: 1-888-GOLD-160 (1-888-465-3160).

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Switzerland is ranked as the freest economy in Europe in the 2014 Index of Economic Freedom, published by the Heritage Foundation in partnership with the Wall Street Journal. In the world rankings, Switzerland is the 4th most economic free country. While the United States Federal Reserve argues that inflation is necessary for economic stability, it should be noted that Switzerland has achieved its economic freedom with a current inflation rate of negative 0.7%. That means consumer goods are getting cheaper for the average Swiss citizen every year. Try to wrap your head around that, Janet Yellen. And while you’re at it, explain why the United States isn’t even in the top 10 freest economies in the world.

Yet in spite of this relative prosperity, the Swiss populace is not satisfied. They want more freedom and are getting ready to demand more economic responsibility from their central bank, the Swiss National Bank (SNB). This fall, the citizens of Switzerland will be voting on a referendum that would dramatically alter the SNB’s gold bullion allocations and holding policy.

Peter Schiff appeared on Fox Business yesterday to debate James Cordier about the state of the United States economy. While their conversation was friendly, Peter posed some tough questions that never got answered.

The precious metals have been having a hard time recently, especially following Janet Yellen’s press conference last week. While Yellen was extremely vague about when the Federal Reserve would raise interest rates, the financial media latched on to her theoretical discussion of how rates would be raised when the time came. This turned out to be the only part of Yellen’s statement the markets seemed to care about. Even unbiased, legitimate new agencies like Reuters reported that “…the Federal Reserve indicated in its policy statement it could raise borrowing costs faster than expected when it starts moving.” This is the explanation for gold and silver’s latest downturn. Talk about not seeing the forest for the trees.

In his latest Schiff Report video, Peter Schiff dissects Yellen’s press conference and the Fed’s statement to explain why the Fed will never raise interest rates. In fact, Peter thinks the United States is overdue for another cyclical recession. Physical gold and silver investors should be focusing on this big picture view instead of the deliberately confusing hypotheticals presented by Yellen and the financial media. The economy is getting worse, and this latest news is just another opportunity to stock up on more gold at discounted prices before the markets wake up to the reality of the Fed’s predicament. Here are some excerpts from the video, which you can watch below.

A recent article on the Wall Street Journal’s blog draws attention to the high cost of producing a single penny – 1.6 cents each, to be exact. They blame this unsustainable price on the high cost of zinc, which makes up 97.5% of every American penny. The online publication Quartz ran with this story, giving it a new headline: “It costs 1.6 cents to make one penny because of the rising price of zinc”. Time for a short economics lesson.

An alternate, more accurate headline for this story would be, “It cost 1.6 cents to make a penny because of currency debasement.” Rather than pondering whether or not the United States should simply stop producing pennies to save money, Americans should really be thinking about the long-term effects of currency debasement that has been going on for generations.

Let’s be honest. No one has the time or patience to actually watch Janet Yellen’s press conferences about the Federal Open Market Committee’s meetings. Besides, the news never seems to change – the US economy is never quite good enough for the Committee to recommend that interest rates actually be raised back to “normal” levels. Even if Yellen did have something interesting to say, her delivery is about as captivating as a pet rock. At most, you might be able to sit through, say… four minutes. Thank goodness Grabien has created a video mash-up of every Janet Yellen press conference ever to fit exactly that time frame. So next time Yellen has something to say about the FOMC, skip it. You can watch this instead.

If you’re seriously wondering when the Fed will actually raise interest rates, read Peter Schiff’s latest commentary explaining what the Fed’s “new normal” is. Find it here.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Once again, the financial world watched the Federal Reserve this week in the hopes of hearing some real news about whether or not interest rates would be raised in the near future. While the Fed continued to taper its quantitative easing, it said that interest rates would remain at zero for a “considerable time.” To economists like Peter Schiff this is more or less an open admission that the United States economy is in terrible condition. If the economy was improving, why would it need the continued intervention from the central bank?

In his latest written commentary, Peter compares historical Fed policies to the central banks’ actions in the past eight years. He explains clearly and succinctly why we’re in a new age of “forward guidance” and how disastrous it will be for the economy. Don’t look for interest rates to be raised at all, Peter argues. Instead, another dose of QE is probably right around the corner.