In the 80s, America confronted two great risks – an evil empire and an out-of-control US dollar. Unfortunately, though we beat the communists, we seem to be losing the battle for sound money.

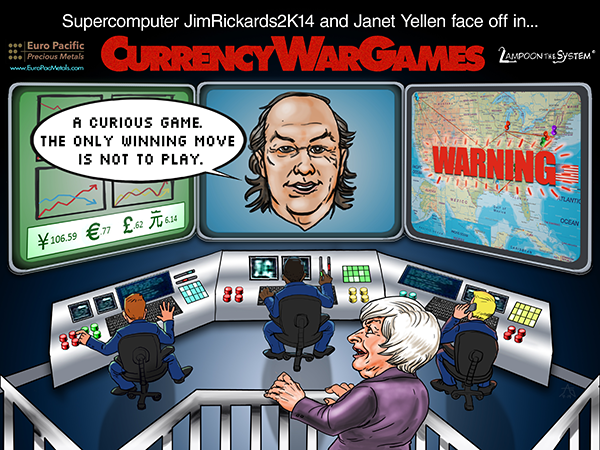

For its latest comic, Lampoon the System reprises War Games, the classic 1983 blockbuster starring Matthew Broderick. The esteemed Jim Rickards plays the role of “Joshua”, the supercomputer in the movie. Peter Schiff interviewed Rickards in August, and they talked extensively about the repercussions of an international “currency war.” If you missed it, check it out here.

Jon Pawelko publishes the web comic Lampoon The System to poke fun at insane economic policies and educate the public on sound economics.

Click here for more cartoons and information on his anthology book, available for only $15.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

This week, Chuck Jeannes announced that either this year or next, miners will have reached “peak gold.” Peak gold means that the amount of gold being pulled out of the earth will begin to shrink every year, rather than increase, which has been the case since the 1970s. Jeannes is the chief executive of the world’s largest gold mining company, Goldcorp, so it’s probably safe to assume he knows a thing or two about mining the yellow metal.

Let’s put this into context. Central banks continue to stockpile gold (even Scotland is wondering how much of the United Kingdom’s gold it will get if it becomes an independent country). Nobody knows how much gold China is hoarding, but pretty much everyone assumes it’s a lot more than the official reports. Smart economists like Peter Schiff and Jim Rickards have been pointing out for a year now that gold buyers throughout Asia are accumulating more and more gold from Western investors, and they have almost no intention of selling it.

For physical precious metals investors, all of this news should hit home. What happens when this robust demand for gold runs up against the hard limits of the mining industry? This is simple supply and demand – prices go up.

As gold production declines, the miner’s job becomes harder, as companies compete for increasingly rare deposits. Discoveries have already tapered off. In 1995, 22 gold deposits with at least two million ounces of gold each were discovered, according to SNL Metals Economics Group. In 2010, there were six such discoveries, and in 2011 there was one. In 2012: nothing.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

The Silver Institute’s August edition of Silver News is now available. This issue explains the fundamentals behind the surging growth in demand for industrial silver, which is expected to exceed global GDP growth through 2016. The constantly evolving industry for silver technology is largely to thank for this increasing demand. August’s Silver News highlights some of the fascinating new applications of silver, including:

- Two forms of 3D printing with silver

- Using heated nanosilver to treat cancer

- Screen-printed silver circuits that cure in UV light

- Antibacterial silver on home hardware products

You’ll also find an explanation of how silver is used as an essential chemical catalyst in the production of ethylene oxide (EO), which in turn is needed to create ethylene glycol. Ethylene glycol is one of the most important substances in our modern world.

Ethylene glycol, in turn, is used to produce many products including polyester fibers for clothes and carpets, plastics, solvents and other chemicals, and even antifreeze formulations. By itself, EO is used to sterilize many health-care products and medical instruments, including delicate electronic or optical tools, which would be harmed by the high heat or radiation sterilization processes. EO is also used to accelerate the aging of tobacco leaves, as a fungicide, and even as a preservative for spices.”

Image: Tanaka’s printed silver circuit board.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

The financial media regularly plays down reports of consumer price inflation that are much higher than the official numbers. Even worse, analysts generally argue that more inflation is needed for the health of the US economy. Pippa Malmgren, author of a new book, Signals: The Breakdown of the Social Contract and the Rise of Geopolitics, has been studying price inflation that is cleverly hidden – she calls it “shrinkflation.”

Shrinkflation occurs when consumer products cost the same, but contain less. For instance, Malmgren points to Cadbury chocolate bars that were reduced in size in 2011, while the price remained the same. Nestle’s Shredded Wheat and Carlsberg beer are two other major companies that are practicing shrinkflation. Haagen-Dazs shrunk its “pint” of ice cream by 20% in 2011. Here’s an entire list of shrinkflation products published by CNN Money three years ago. Peter Schiff has talked about this very phenomenon in his videos and podcasts for years.

The financial media will likely downplay this trend in favor of broader, “official” measures of inflation that show prices are well under control. However, they’d be missing one of Melmgren’s most important insights: “Shrinking the size of goods is exactly what happened in the 1970s just before inflation proper set in.” At a certain point, a company can’t just keep lopping squares off of the chocolate bar – they’re going to have to raise the price.

Remember, if there’s one thing you want to be holding when inflation really hits hard, it’s physical gold and silver bullion.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

The John J. Heldrich Center for Workforce Development at Rutgers University released its latest Work Trends report. The national survey found that Americans are extremely pessimistic about the state of the US economy in spite of the financial media’s claims that a strong economic recovery is underway. The report is titled “Unhappy, Worried and Pessimistic: Americans in the Aftermath of the Great Recession”. Some of its major findings include:

- One-quarter of the public says they’ve experience a major decline in quality of life.

- Only one-sixth of Americans believe the next generation will have better opportunities than the current generation.

- Most Americans don’t think the economy improved last year or will in the next.

- Four in five Americans don’t have any faith that the government will be able to improve conditions in the next year.

The report paints a bleak picture of the American workforce and economy coming from the direct experience of American laborers. Cliff Zukin, co-director of the surveys, said:

“Looking at the aftermath of the recession, it is clear that the American landscape has been significantly rearranged. With the passage of time, the public has become convinced that they are at a new normal of a lower, poorer quality of life. The human cost is truly staggering.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Jim Grant, publisher of Grant’s Interest Rate Observer, was interviewed by Steve Forbes. Jim gives a grim overview of the economy, saying that the Fed’s suppression of interest rates and the creation of “unimaginable amounts of digital money” since 2007 have caused major distortions. Economic intervention leads to more economic intervention and “the patient is over-medicated.”

Jim says that inflation is not simply the CPI (Consumer Price Index). It is the creation of too much money, which manifests itself in many different ways. Among them are the bull market in stocks, which has been intentionally inflated to create the “wealth effect”. Jim repeats the term “wealth effect” with heavy skepticism. He holds up a gold coin and says:

Gold is a universal currency. People recognize it at sight. The derivation of the term ‘sound money’ is: [clang! as he drops the coin on the table]. Isn’t that lovely?”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Michael Franzese, a former mob boss who went straight following a 10-year prison term, thinks stocks are in a bubble. He says he has worked with many of the people on Wall Street and doesn’t feel comfortable letting “shady” characters handle his money. In 1986, Franzese ranked No. 8 on Fortune Magazine’s list of the 50 wealthiest and most powerful mob bosses.

Stocks continue to soar to record highs and the media breathlessly touts the economic recovery. But the Fed-fueled bull market for stocks can’t last forever. Some renowned experts are issuing ominous warnings:

- Nobel Prize-winning economist Robert Shiller says the stock market is looking very expensive. By his metric, stocks have only been at their current level three other times: 1929, 1999, and 2007.

- Hedge fund king Carl Ichan says, “We are in an asset bubble.” He describes a “dangerous financial situation” dependent on the Federal Reserve continuously refilling the punchbowl to stimulate the economy.

- Ex-Treasury Secretary Robert Rubin says that extremely low interest rates have caused major instability and could lead to another financial crisis. When the bubble pops and hedge funds all head for the doors at the same time there is a risk of a “contagion and snowballing effect.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

This is the final installment in a three-part series exploring three key reasons why gold could be the best hedge in the event of a major market correction. For part one, click here. For part two, click here.

As we wrote previously, there are many stories in the news lately exploring the various ways to protect yourself from a major market correction. They talk about hedge funds shorting US municipal debt, junk bonds, and foreign bonds in Asia and the eurozone. However, hardly anyone in the media mentions the use of physical gold bullion to protect your savings from a stock market crash. We believe gold will outperform any of these conventional “safe havens” for three key reasons.

The third promising factor for gold in the event of a major market correction is that there are simply few alternatives. Even the conventional “safe bets” don’t hold up to scrutiny in today’s environment.

Treasury bonds have been one of the most traditional investments for protecting savings and providing cash flow. However, bond yields are currently at record lows and will probably move even lower in the event of a market correction. The return on a 5-year Treasury has fallen by an average of 4.3% in each of the past three recessions. In the likely event that this trend continues in the next market correction, the nominal yield could become negative. In other words, investors would be paying the government to take their money!

Another gold scam has been exposed this month, but only after customers gave more than $2.6 million to precious metals dealer Robert Escobio who lost $600,000 of the invested funds. The US Commodity Futures Trading Commission (CFTC) has filed a civil enforcement claim against Escobio and his company Southern Trust Metals, Inc.

Escobio convinced investors to send him a down payment towards a large purchase of gold, promising to lend them the rest. This sounds exactly like the classic leveraged gold scam, in which the scammer convinces his victims to buy more gold than they can actually afford. He then loans them the remainder at unreasonably high interest rates, promising to deliver all the gold when the debt is paid.

Why would anyone fall for this?